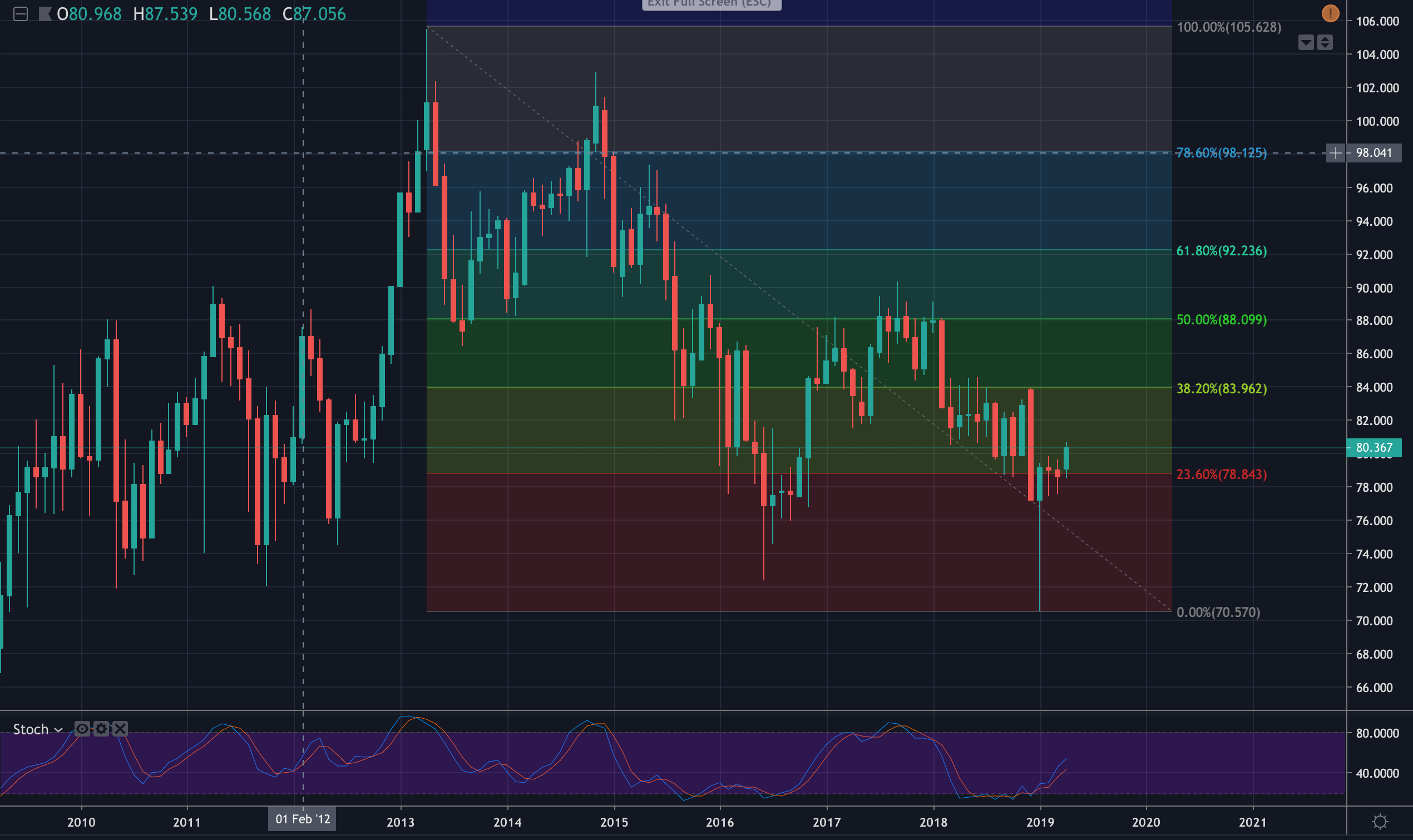

- The weekly outlook is bullish, with stochastics turning higher and the price extending the upside on the 23.6% Fibo.

- A break of the Jan 2018 lows opens prospects for the 84 handle and 38.2% Fibo target.

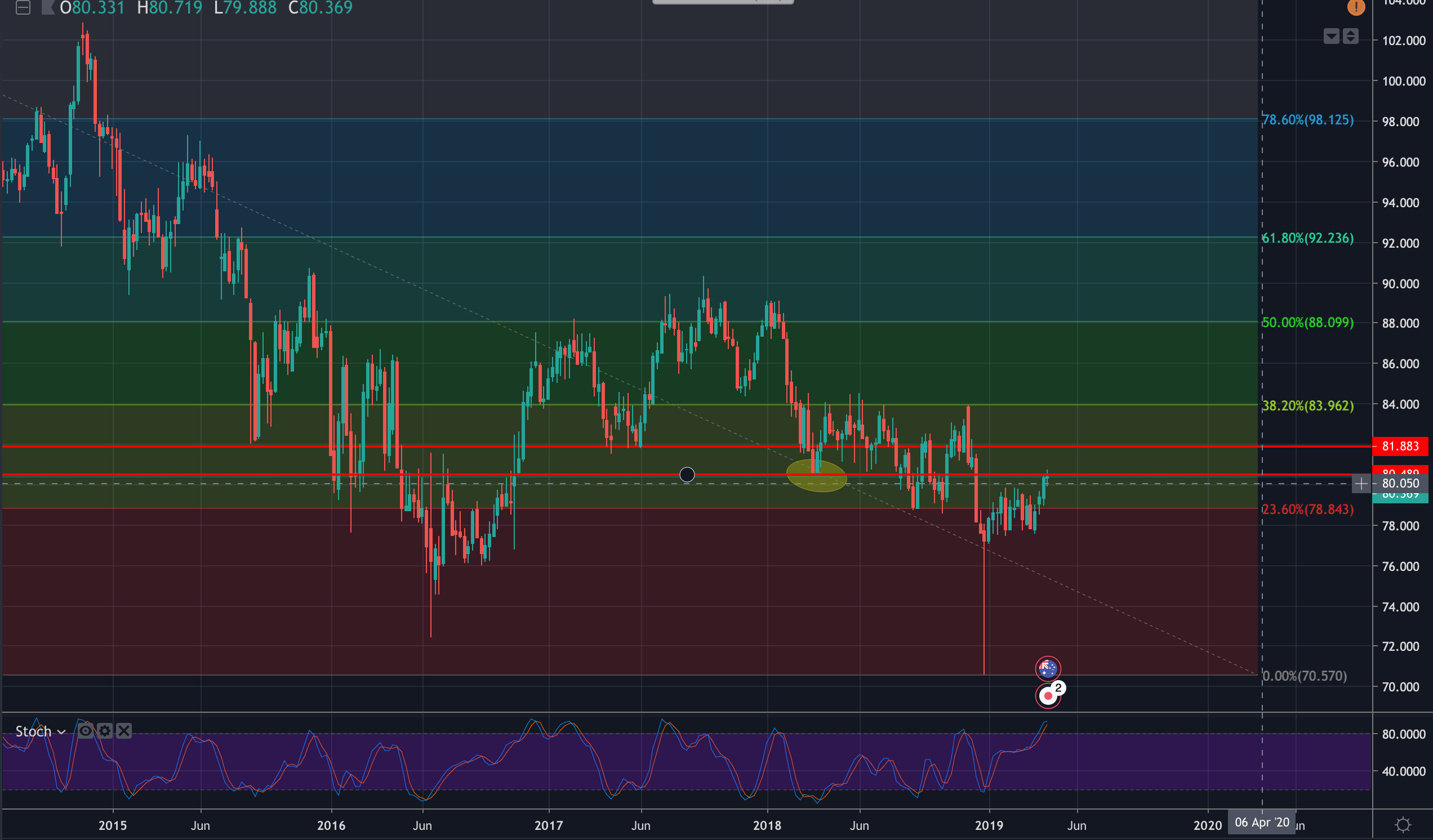

On the weekly outlook, we can see that price is testing that said Jan resistance and the next target will be at the August 2015, May 2017 lows and late August highs located around 81.90.

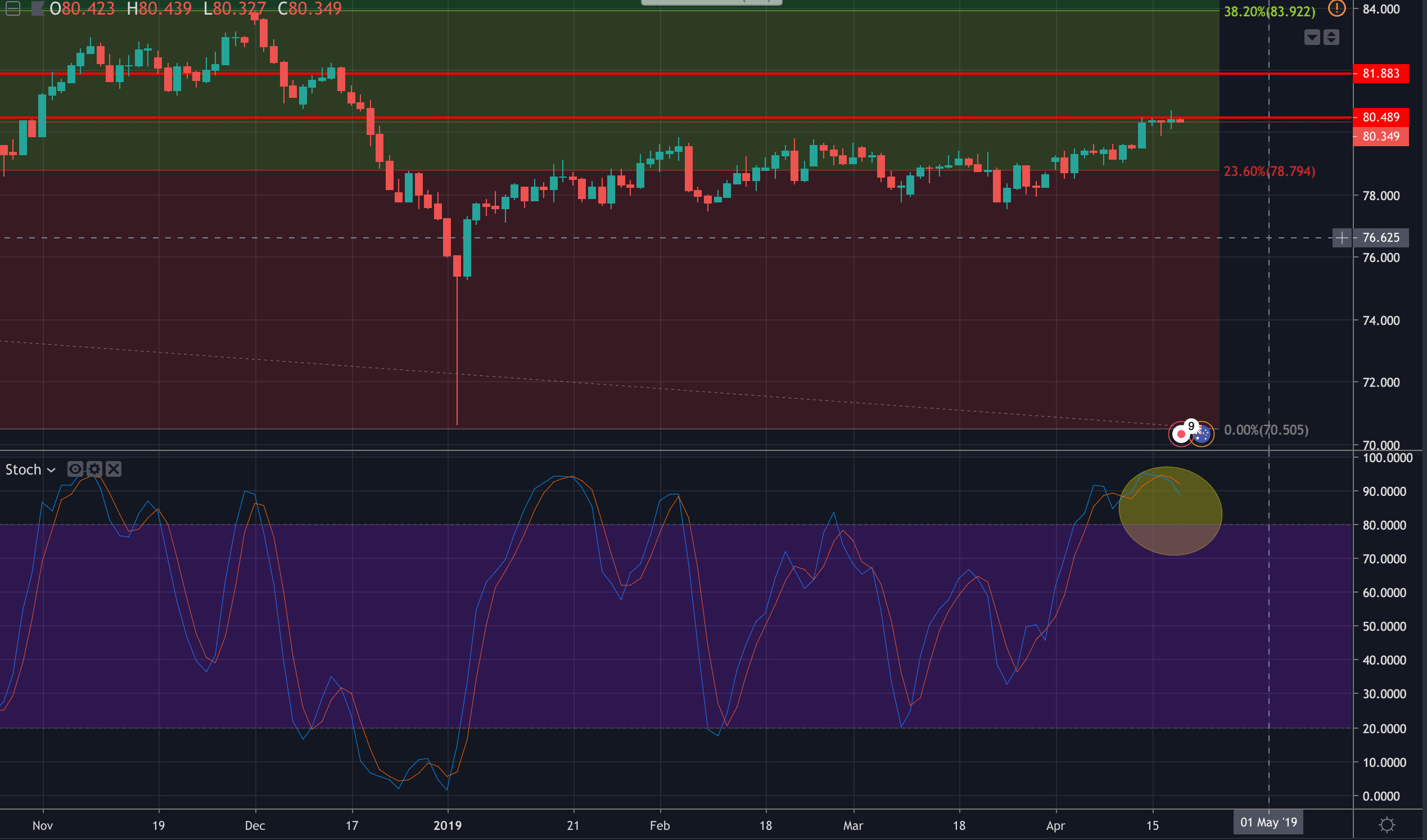

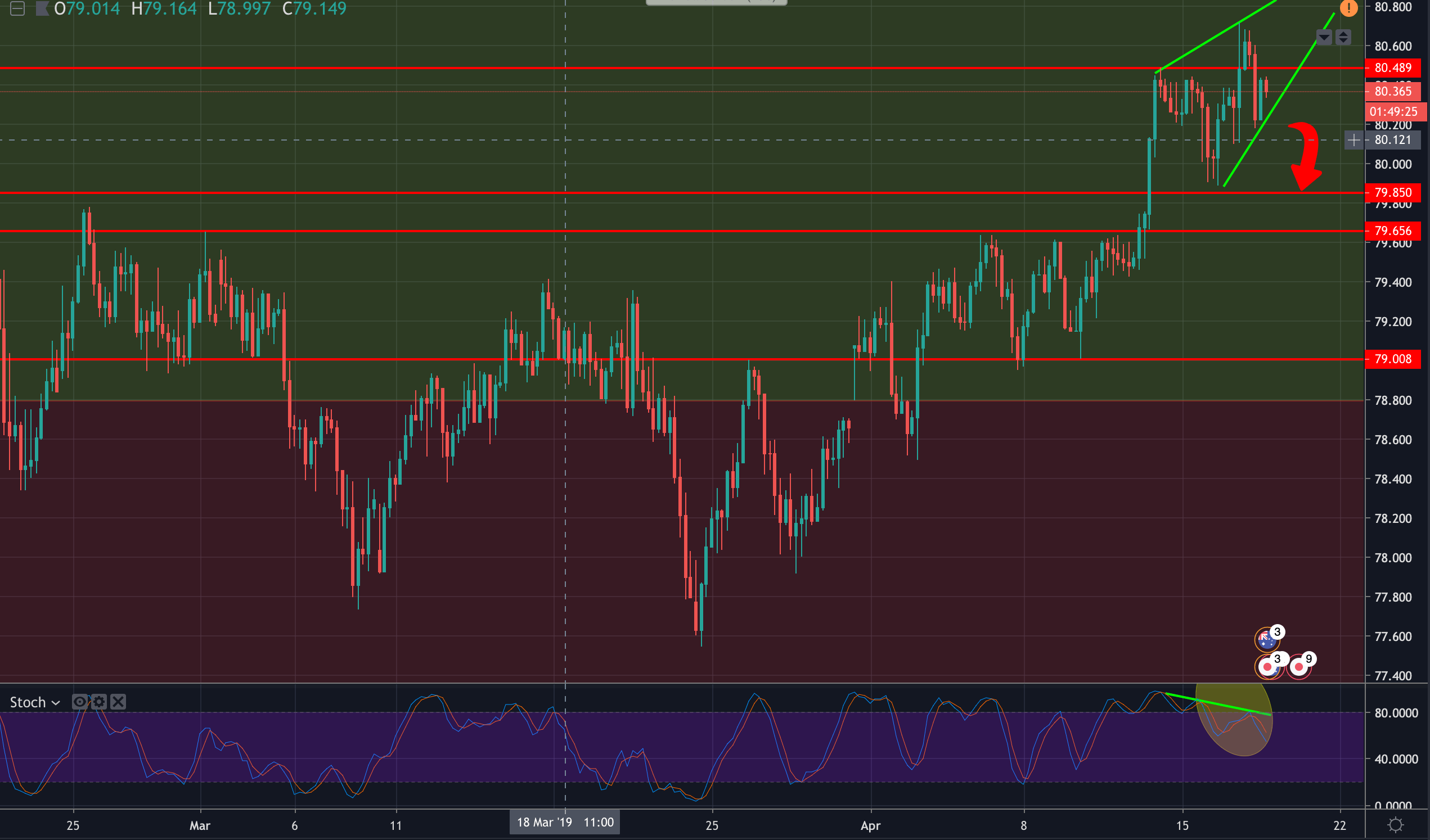

On the daily chart and more so sen on the 4hr time frame, we are seeing some bearish divergence in the stochastics accompanied by the daily doji, so, for the meantime at least, some bearish consolidation should be expected.

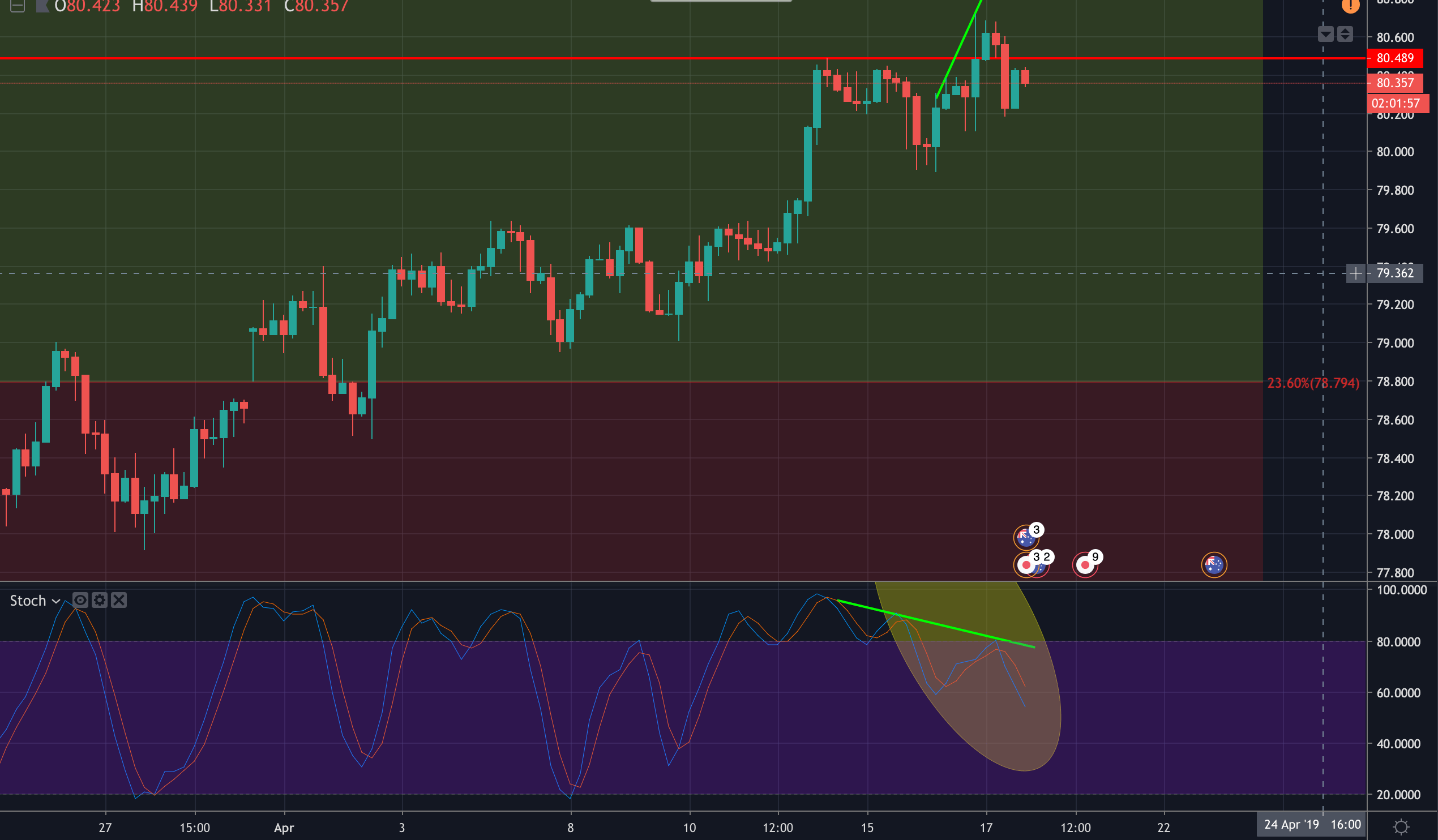

4-HR Chart and clear divergence:

While some of the divergence has already filtered through to the recent correction in the price, a break of the rising wedge’s support-line opens risk to 79.80/60 and 79 the figure: