The New Zealand dollar had a positive reality check from the economy and managed to bounce back, just. Is it settling in a new range? Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The good news poured from New Zealand and changed the fate of the kiwi: employment grew by 1.2% in Q4 2015, significantly better than expected. And while the unemployment rate disappointed with a rise to 5.7%, this came on the back of a higher participation rate. Also New Zealand’s main exports, dairy products, enjoyed a jump of 9.4% in the bi-weekly auction. In the US, things were not looking too good at first, and the dollar was sold off. However, the excellent jobs report in the US showed strong job gains, superb revisions and also a bounce in wages. Which jobs report has the upper hand?

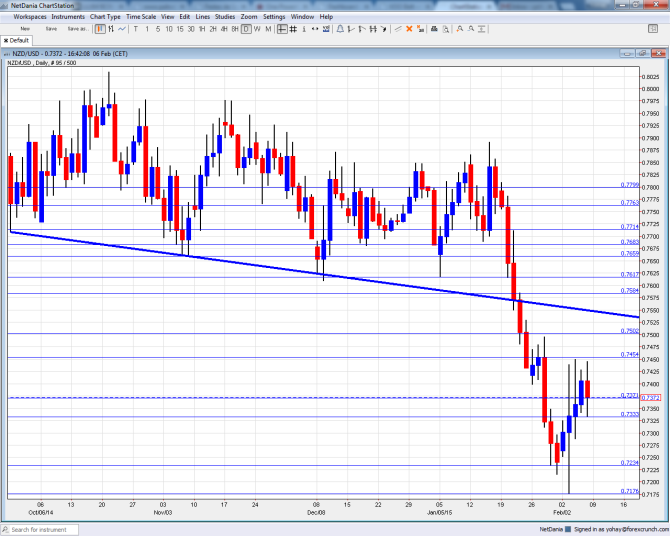

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- REINZ HPI: Publication time unknown at the moment. House prices dropped in December by 1%, after 4 consecutive months of rises. The could continue consolidating once again.

- Business NZ Manufacturing Index: Wednesday, 21:30. This PMI like indicator has been in positive ground (above 50 points) for long months. It hit a strong 57.7 points in December and a small drop could be seen now.

- FPI: Thursday, 21:45. The Food Price Index is important for New Zealand’s food exports. After a rise of 0.3% in December after a drop in the previous month. Another rise is on the cards now.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started off the week with a drop to 0.7180 (mentioned last week) matching the 2010 low. From there it bounced back up and found resistance at 0.7450. From there the pair slid but manages to close higher.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

We start from lower ground once again. 0.7715 was stronger support after serving holding the pair in December. 0.7680 worked as support in December and that is where the pair stopped in early January 2015.

Below this point, we are back to levels last seen in 2012: 0.7615 now works as resistance after providing support during January 2015. It is followed closely by 0.7585 which capped the pair on an initial recovery attempt.

The very round number of 0.75 capped the pair just before the big fall and serves as strong resistance. It is followed by 0.7450 that had a role in the past.

The next line is 0.7370, which was a low point in 2011. It is followed by 0.7325, which capped the pair in the middle of 2010.

The recent 2015 low of 0.7235 is now the next support line. It is followed by 0.7180 that served as resistance back in 2010.

The swing low of 0.71 in 2011 provides further support before the very round number of 0.70.

Below this round number, we have 0.6950 and 0.6810.

I am neutral on NZD/USD

The kiwi is coming back with higher milk prices and a reminder of a stronger economy. However, things are also looking good in the US. The kiwi has better chances to rise against other currencies, such as its neighbor, the Aussie dollar.

In our latest podcast, we do an Aussie Analysis, Greek Grindings and Oil Optimism.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.