The New Zealand dollar continued struggling under the weight of the events in China. The upcoming week is much busier, with the milk auction standing out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Building consents in New Zealand advanced again, and this kept the kiwi bid, weathering a small part of yet another slide in the Chinese stock market.

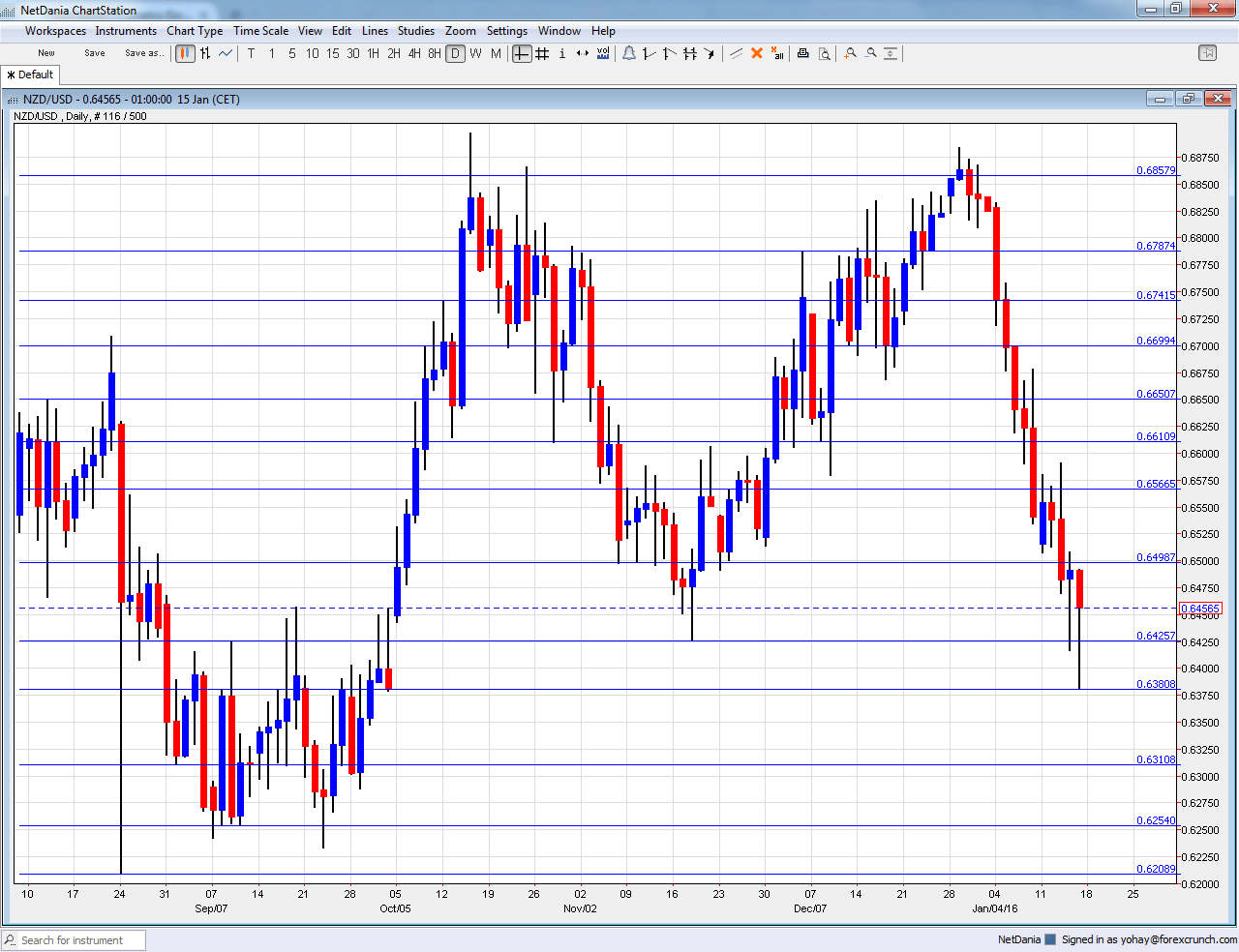

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NZIER Business Confidence: Monday, 21:00. This quarterly survey of around 2500 businesses tends to have a significant impact. After many quarters of positive numbers, a negative score reflecting pessimism with -14 points was seen in Q3: -14 points. A similar number is on the cards now. Actual:

- GDT Price Index: Tuesday, in the European afternoon. The Global Dairy Trade, or price of milk, always rocks the kiwi. It dropped 1.6% in the previous auction and a swing back to the upside could be seen now on lower production.

- CPI: Tuesday, 21:45.Inflation figures are published only once per quarter in New Zealand, making this publication critical for the next decision of the RBNZ. In Q3, the Consumer Price Index advanced 0.3%, slightly better than expected, but certainly not showing any real threat of inflation. Expectations stand on a drop of 0.2%.

- Business NZ Manufacturing Index: Wednesday, 21:30. Yet another business survey wraps the week in terms of NZD events. This PMI like figure ticked up to 54.7 in November, showing slightly more solid growth. A similar number, above 50 (separating growth from contraction) is on the cards now.

NZD/USD Technical Analysis

Kiwi/dollar started off the week pressured to the downside, getting close to support at 0.65 (mentioned last week)

Technical lines, from top to bottom:

We begin from lower ground this time. The low of 0.6940 allowed for a temporary bounce. The round 0.69 level has switched positions to resistance.

0.6860 was a low point as the pair dropped in June 2015. It is followed by 0.6790 that capped the pair in recent months.

It is followed by the round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6425, whcih was the low point in November, as support. The last line for now is 0.63, which had a role in the past.

I am neutral on NZD/USD

While milk prices can recover, it seems like an uphill struggle against the weakness in China.

In our latest podcast we explain how to become a forex pro and avoid forex scams