Dairy Prices Weighing on NZD

The New Zealand Dollar has come under fresh pressure across the board over the last week. One contributing factor has been the relative improvement in the outlook for the dairy supply which is expected to keep prices, and thus NZD, under pressure.

Instead of being a function of weaker demand, the weakness in the weakness in dairy prices is down to a relative improvement in the supply outlook in response to signs that EU production cuts are abating, alongside more favourable growing conditions in New Zealand. Specifically, the decline in full-season New Zealand milk solid collection no longer seems to be as severe. The modest pickup in production trends and rebalancing of the market is expected to continue to weigh on WMP prices over the remainder of the season. Continued declines in dairy prices will put persistent pressure on NZD, limiting the scope of any near term squeezes higher.

RBNZ Strike Cautious Tone

Although the longer-term view Is for the RBNZ to move into a hiking cycle, in the near term, their cautious view is unlikely to change. At their February meeting, the central bank shifted into a “neutral bias” noting positivity in the domestic economic outlook though their view on the external backdrop remains fairly downbeat despite a slew of better global data recently. Governor Wheeler commented, during a subsequent speech, that “the balance of risk in the global economy is on the downside” and considering the impact also noted that “there is an equal probability that the next OCR adjustment could be up or down”.

As the upcoming March 23rd meeting is only an OCR review and won’t include the release of a monetary policy statement, it is unlikely that the economic forecasts and underlying economic assessments will be changed. Even though the NZD TWI has declined recently, the RBNZ is likely to continue to emphasise its message that the exchange rate is “higher than is sustainable” to achieve balanced growth and that further depreciation “is needed”.

Consequently, market pricing for an RBNZ rate hike is likely to remain pushed out. When overlaid with the developments in other economies as well as the changes in market expectations regarding central banks such as the Fed and RBA, New Zealand’s interest rate advantage has been eroded.

The sensitivity between NZD and changes in the New Zealand – US 2yr swap spread has intensified recently. This is likely a function of the reduced commodity price support afforded to NZD. In light of this, an intensification of expectation for a 25bos Fed rate hike in March, a further upward repricing of the 2017 rate path as well as an upward shift in US 2yr swap rates is likely to produce a further, more pronounced downward effect on NZD.

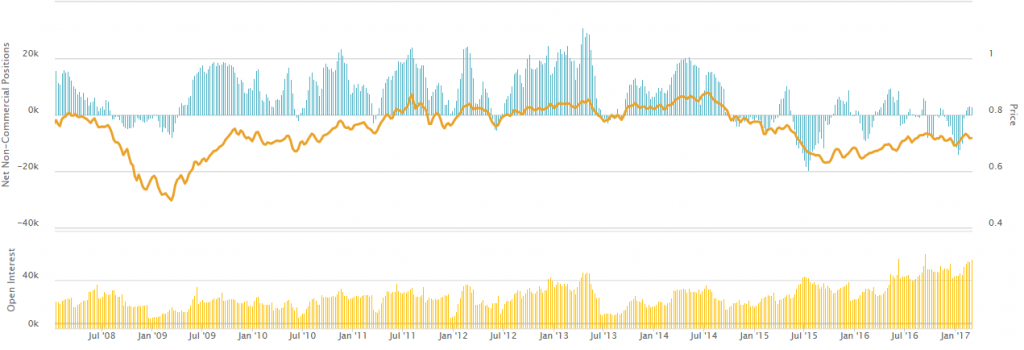

Positioning Data

NZDUSD has now retraced nearly all of its 2017 gains while the trade weighted index has actually fallen into negative territory. Referring to positioning data shows that, while positioning has fluctuated greatly over the last year and a half, there is plenty of room for downside engagement in NZD as institutional investors are currently net long the currency.

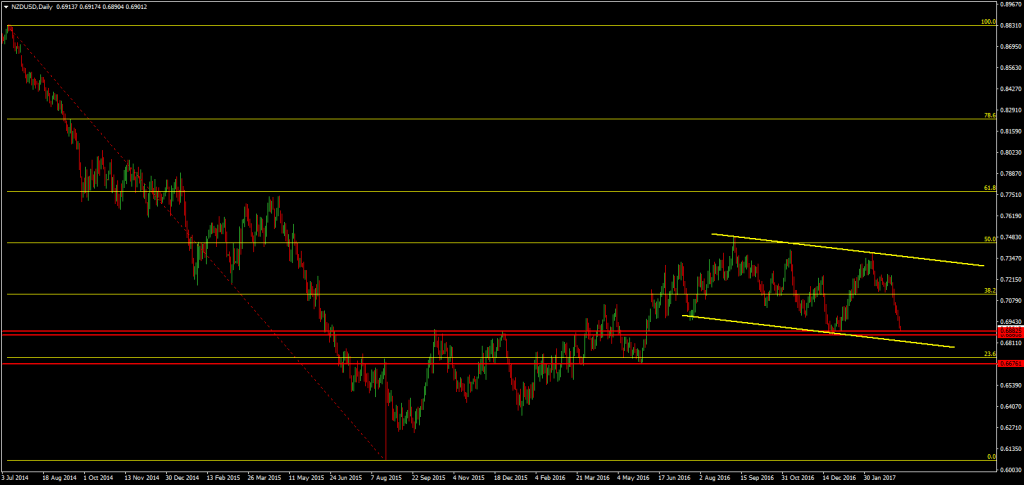

Following the large decline from 2014 highs, NZDUSD spent all of 2015 and a large part of 2016, correcting higher. The correction made it all the way back up to the 50% retracement from 2014 highs before downside resumed and price started to trend lower again. The key local support in NZDUSD is at the .6856 level which is the December 2016 low.

From last year’s high, the price has been moving in a bearish channel. Traders will now be watching as price makes its way down to test bearish channel support which could offer room for a rotation higher. A break below local structural support and the bearish channel support opens up the way.