The Reserve Bank of New Zealand managed to hit the kiwi when it was down. The recent improvement in the employment situation created expectations for a more hawkish central bank, but the RBNZ remained neutral and especially cautious.

The policy is expected to remain accommodative for a considerable period of time. They also have specific projections about the interest rate. It carries expectations for remaining at 1.8% all the way to September 2018. The interest rate is predicted to rise to 2% only in September 2020.

Perhaps the biggest disappointment comes from the dismissal of the recent developments. They see them as neutral. The Wellington-based institution mentions numerous uncertainties and an ongoing moderation in house prices.

What about the kiwi?

The RBNZ is satisfied with the recent fall but wants to see a further drop in the TWI.

Governor Graeme Wheeler said to parliament that he does not expect inflation to move quickly. Also, wages are not on the path to accelerate. The key to raising rates would be a rise in inflation expectations.

Wheeler’s Assistant Governor, McDermott, reiterated the neutral stance. In an interview with Reuters, he added that the RBNZ is “not unhappy” with the recent drop NZD. In other words, they are happy with the drop and want to see more.

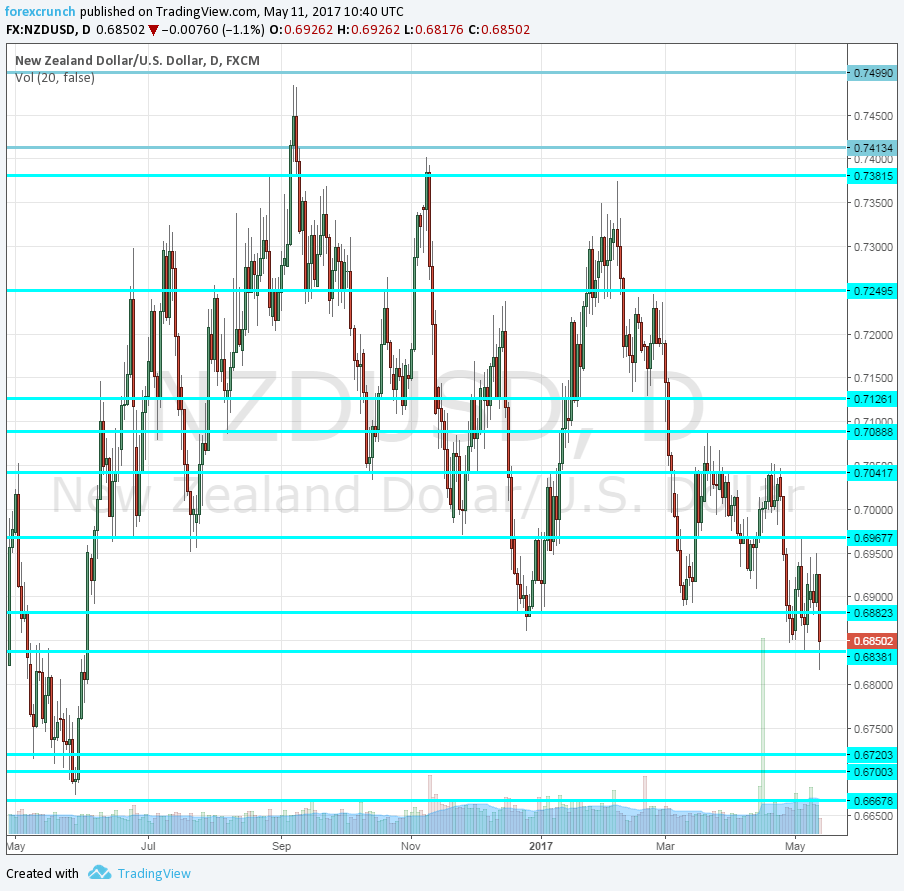

NZD/USD drops

NZD/dollar reached a new cycle low of 0.6817 before bouncing back. This is the lowest since June 2016, nearly a full year. Further support is visible only at 0.6720, followed by 0.6666. Resistance awaits at 0.6880.

More: NZD/USD cannot break out of range despite CPI jump

Here is the NZD/USD daily chart.