The New Zealand dollar retreated against the greenback after 4 weeks of gains. It is now at the bottom border of the range, after already dipping lower. NZIER Business Confidence is the main event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

The kiwi sided with the Aussie and not with the euro and slid lower, especially after the US published a good Non-Farm Payrolls report. Another thing to watch for is the Food Price Index, that impacts New Zealand’s food exports.

Updates: REINZ HPI fell to 0.6%, down from 1.6% in the September reading. NZIER Business Confidence, released quarterly, rebounded strongly, climbing to 8 points. The kiwi is steady, as NZD/USD was trading at 0.8213.

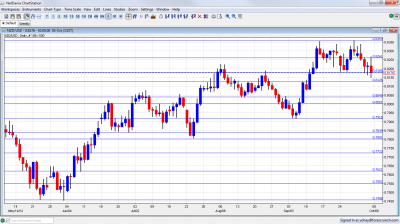

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- NZIER Business Confidence: Monday, 21:00.New Zealand business confidence flipped to-4 in the second quarter, following 13 in the previous survey. There is a general feeling of disappointment from NZ’s sluggish economic recovery.Canterbury area is the only region to progress due to reconstruction activity. The NZIER expects the first rate hike in early 2014 in case the global situation stabilizes.

- REINZ HPI: Tuesday. The Reinz Monthly Housing Index, increased 1.3% in August compared with a 0.7% drop in July. The national median home price was 370,000 New Zealand dollars (US$300,400) in August compared with NZ$361,000 in July and was up from NZ$$355,000 in August 2011. NZ housing market as a whole remained subdued despite the growing activity of the Auckland market.

- Business NZ Manufacturing Index: Wednesday, 21:30.New Zealand’s manufacturing contracted in August reaching 47.2 from 49.4 in July amid a slowdown in employment. All five seasonally adjusted diffusion indexes in the PMI contracted in August due to worsening global conditions. The strength of the NZD is another financial hardship for manufacturers struggling to survive amid weakening demand outside NZ.

- FPI: Wednesday, 21:45. Food prices increased 0.1% in August after a 0.2% gain in the previous month. However on a yearly base, prices dropped 0.5% in August reflecting cheaper vegetables, dairy products and lamb.

* All times are GMT.

NZD/USD Technical Analysis

NZD/$ started the week trading above the 0.8260 line (mentioned last week). After yet another attempt to climb higher failed, the pair dropped to the 0.8180 line and yet another move higher ended in a downfall – a dip under 0.8180. The close at 0.8176 means that this line will be closely watched now.

Technical lines, from top to bottom:

0.8680 served as support when the pair traded higher during 2011. 0.8620 had a similar role around the same period of time.

0.8573 capped the pair in September 2011 and is distant resistance. 0.8505 served as support as well.

0.8470 was the swing high seen in February and remains important resistance. 0.84 was resistance back in February 2012.

0.8360 is a double top, after capping the pair twice during September 2012. 0.8260 capped the pair during March, and worked perfectly well as a separator in October 2012.

0.8180 is a double bottom after providing support for the pair in September 2012. The close around this line at the beginning of October should be watched. 0.8125 separated ranges in August 2012 and has renewed strength now after capping the pair in September 2012.

0.8040 capped the pair in August 2012 and also served as support during the same month. It is weak support after temporarily holding the pair down. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. It was hit by the recent moves and somewhat weaker now.

0.7915 served as an important cushion when the pair was falling in September 2012. 0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

The round number of 0.78 is significant support after working as such in July 2012. 0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks.

I remain bearish on NZD/USD

The kiwi is on the verge of losing important support. In addition, concerns regarding China are likely to continue weighing on the pair for some time. After the better than expected jobs report in the US, expectations for more easing in the US have eased.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.