The New Zealand dollar made nice gains before the holidays. Will this continue now? This holiday week doesn’t feature any events, so the outlook is only technical.

New Zealand enjoyed strong growth in Q3 – 0.8%. But on the other hand, this came on top of significant downwards revisions for many quarters that preceded this one. The uplift came from no eruption of new bad news from Europe.

Updates: The kiwi enjoyed the relative calm in the holiday week and moved up to 77.80, leaving behind the 77.23 line.

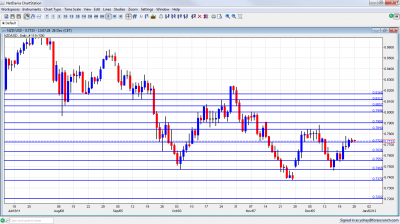

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

NZD/USD Technical Analysis

Kiwi/dollar started the week capped by the 0.7637 line (discussed last week), before breaking higher and eventually conquering the 0.7723 line as well.

Technical lines, from top to bottom:

0.8165 provided support for the pair at several occasions, last seen in October. 81.10 switched positions from support in August to resistance later on and is a minor line on the way up.

0.8060 was resistance in October and support beforehand. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now minor resistance, after being approached in December. 0.7840 capped the pair in October and became much stronger in December, holding the range.

0.7723 proved to be a significant line – very distinct in separating ranges and the bottom border of the range. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January. 0.7470 was the trough in October and worked as perfect support in December.

The fresh low of 0.7370 seen in November is the lowest level since March and will be tested on the way down. 0.7340 was minor support back in February and March and is minor now.

The last line is the veteran 0.72, which worked as support many times in the past.

I am neutral on NZD/USD

The holiday week will likely see stable trading, without any big moves. Risk doesn’t come from Europe this week, but rather from China, which isn’t on holiday. But as no major figures are due, the pair will likely stride in range.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.