The New Zealand dollar reached out to new highs but also had a painful fall and fell to support. The highlight of the upcoming week is the rate decision. Here is an outlook for the events moving the kiwi, and an updated technical analysis for NZD/USD.

New Zealand’s trade deficit significantly narrowed in September and dropped to around 200 million NZD. This shows that money is still flowing into the economy. In the US, the disappointing Non-Farm Payrolls report weakened the USD and pushed to new highs, but fears about Chinese banks eventually triggered a risk off sentiment that hurt the kiwi. Let’s start.

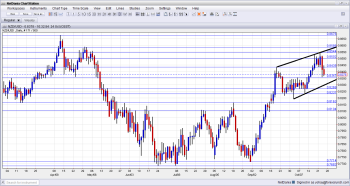

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Rate decision: Wednesday, 20:00. The RBNZ is considering taking measures to curb the rise in house prices, including interest rate hikes later on. However, it would prefer a lower exchange rate, as it expressed repeatedly. The efforts to talk down the value of the local currency usually only enjoyed only temporary success. The interest rate is expected to remain unchanged at 2.50% (where it stands since early 2011, and the accompanying statement will be closely watched.

- Building Consents: Wednesday, 21:45. This gauge of the housing sector has risen by 1.54% last month. A small drop is likely now. A big surprise, either to the upside or to the downside, is needed to stir the kiwi in this case, due to the proximity to the rate decision.

- ANZ Business Confidence: Thursday, 00:00. This 1500 strong survey by the ANZ bank jumped from 48.1 to 54.1 points in September. The fresh report for October will likely show a similar number, indicating strong growth.

- Labor Cost Index: Thursday, 21:45. Statistics New Zealand has reported a gain of 0.4% in labor costs for the second quarter. Another small rise is expected now. This number is critical for the central bank: higher wages usually end in higher inflation and price rises. Year on year, a rise of 1.7% was reported last time.

- ANZ Commodity Prices: Friday, 00:00. New Zealand relies on agricultural exports for its economy. After a significant rise of 0.9% in September, a smaller gain is likely now.

* All times are GMT.

NZD/USD Technical Analysis

NZD/$ began the week by trading above the 0.8435 line. It then shot up and hit a new cycle high of 0.8544. However, the downfall was quick as well, and the pair fell all the way to the 0.8360 level before rising only gradually.

Technical lines, from top to bottom:

The year-to-date high of 0.8676 is the top line. It stands in the distance. Below, the peak in April, at 0.8585 is the next line of resistance.

October’s high of 0.8544 is close by. At the moment, it is only weak resistance. The round number of 0.85 is also watched.

0.8435 was the peak in September – a peak that triggered a big downfall. After it was broken again, the line switched to support. It is a clear separator.

0.8360 worked in both directions at the beginning of the year: in March as resistance and in April as support. Also more recently, it worked as yet another clear separating line. Below, 0.8270 provided some support during October, and it also worked as resistance in March.

0.8230 was an important line in previous years, and also worked as support recently. 0.8160 capped the pair in August and worked as support in March. The round number of 0.81 worked as resistance in July.

Uptrend channel

Since September, NZD/USD traded in an upwards channel, with uptrend resistance having a clearer role than support. The pair is now in the middle of the range (marked with black lines on the chart).

I am bearish on NZD/USD

There are quite a few reasons to be bullish on the kiwi: a strong economy that is less dependent on global trends (it exports food, which is always needed), a strong housing market and an improved immigration situation.

However, the central bank doesn’t like it, and it now has a chance to step up to the microphone and weaken the currency. The statements and speeches that accompany the rate decisions carry more weigh than normal speeches.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.