Hello traders, today’s article is about the KIWI, also known as NZDUSD. Let’s dig in.

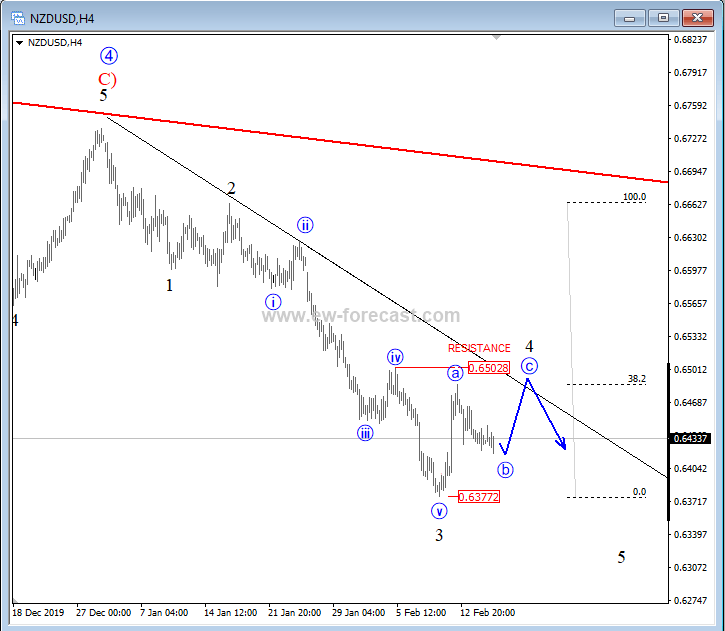

NZDUSD is in a clear, bearish pattern down from 0.674 high, now trading in the middle of an impulse. We labeled waves 1-2 and 3 already completed, so latest recovery from the 0.6377 lows can be only a wave 4 correction within the trend, which can face resistance/bearish reversal at the 0.650 region, also region of ther former wave iv of one lesser degree and region where Fibonacci ratio of 38.2 can react as a turning point.

NZDUSD, 4h

Once wave 4 find resistance, and more leg lower as wave 5 may start unfolding, and targeting the 0.633/0.630 zone.

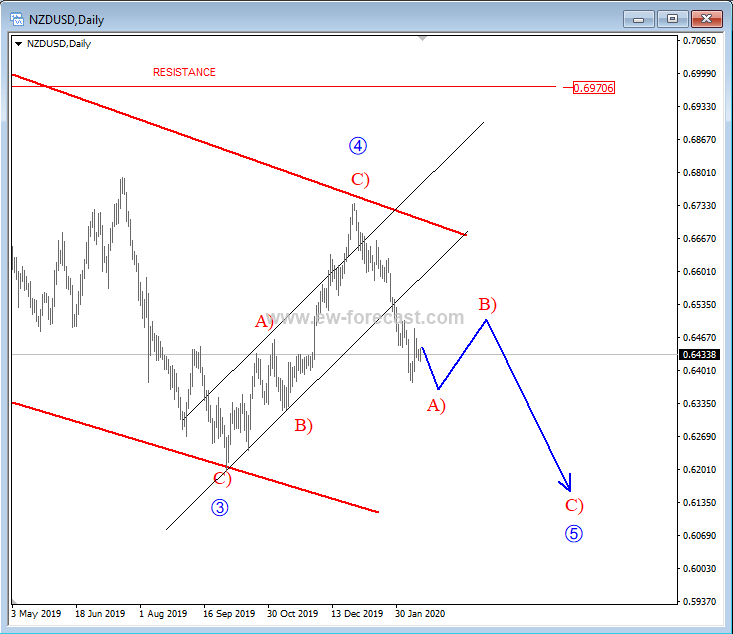

On the daily chart of the same pair, we believe this impulse (down from 0.674 high) can be part of a three-wave, higher degree A)-B)-C) reversal, which can in weeks and months ahead see even lower prices.

That said once wave A) fully develops, the price may experience a corrective wave B) recovery, before wave C,) lower follows.

NZDUSD, daily