As economies continue to re-open and climate change takes hold, the oil price outlook remains unclear after the run up seen this year, but near-term prices will likely be impacted by Thursday’s OPEC+ meeting’s decision on production levels. And the uncertainty around the Iran nuclear talks also continues to hang over supply.

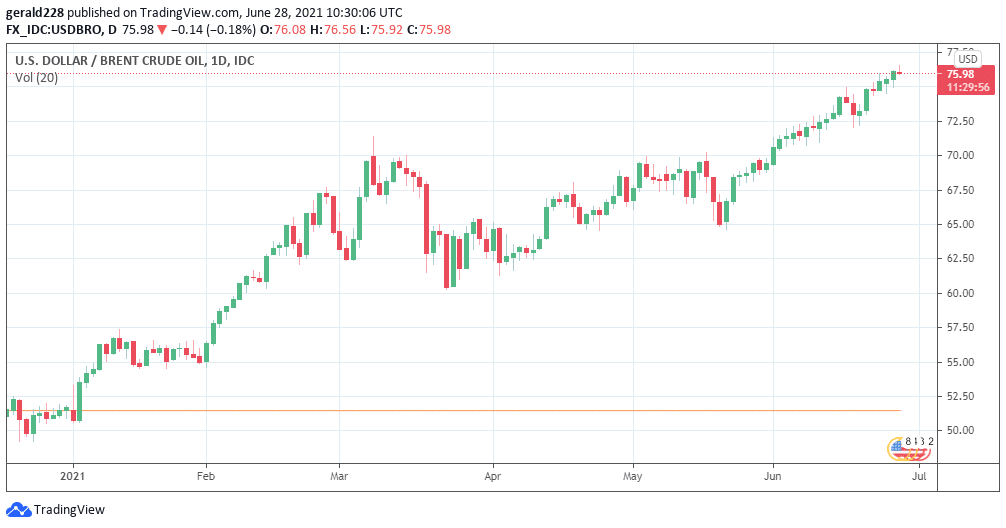

More longer term then, the general expectation is that prices will continue to rise and since January, Brent Crude is up by around 35% from $48 to $73. West Texas Intermediate (WTI) is also up by a similar margin to the $73.4 level. Crude oil is currently trading at its highest price since 2018.

However, supply issues remain a factor and could continue to impact the short to medium term situation. Let’s take a look at the situation in the oil markets. These include spot, futures, supply, inventories and the different types of oil.

Oil Outlook: Brent Spot prices Look To Continue Their Recent Rally

The Short-Term Energy Report by the U.S. Energy Information Administration reveals a raise in its 2021 Brent oil price forecast. It now sees Brent spot prices averaging around the $65.19 price per barrel. This is a jump of around $3 from May where the prediction was at $62.86.

The STEO report also noted that average prices for crude in May jumped by $4 from April. This was largely due to the fact that oil inventories continued to decline. For June, the EIA said that it expects Brent prices to remain near current levels for the third quarter of the year. This would remain at $68 a barrel. However, with the spot price already up to $73, oil could turn even more bullish as supply drops and demand increases. The increase in price is largely due to OPEC’s decision to raise production to meet growing demand.

Thursday sees another OPEC+ (which includes large non-OPEC producers such as Russia) meeting which could have an effect on the price if output is increased. Traders have factored in an increase of 500,000 bpd but if that is increased then a sell-off could be triggered.

However, in 2022, it noted that it expects continuing growth in production from OPEC+ and accelerating growth in US tight oil production, along with other supply growth, will outpace decelerating growth in global oil consumption and contribute to declining oil prices.

“In the coming months, we expect that global oil production will increase to match rising levels of global oil consumption,” the EIA added.

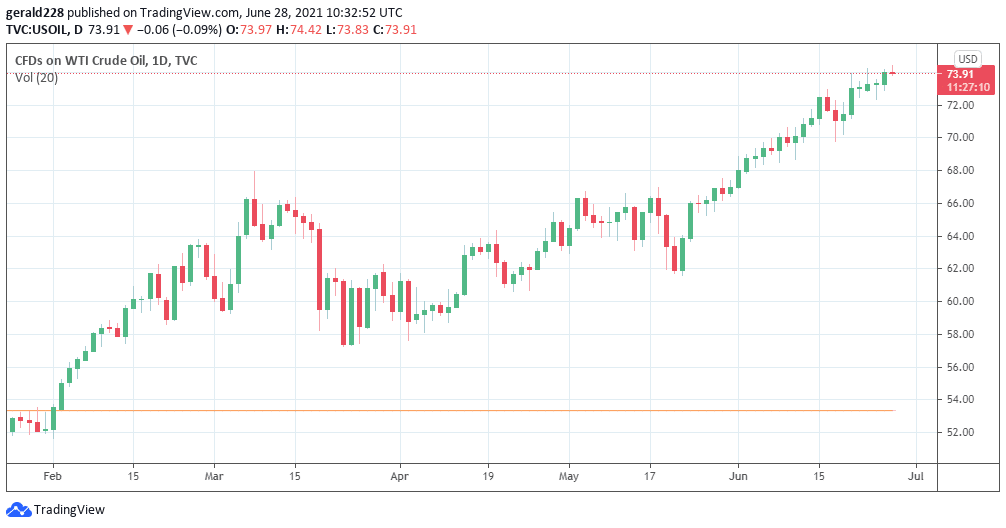

West Texas Intermediate (WTI) Spot Prices

West Texas Intermediate is charting a similar spot comparison to Brent Crude with the price around $73 at present. That is expected to dip in the third quarter of the year to around $68 according to forecasts.

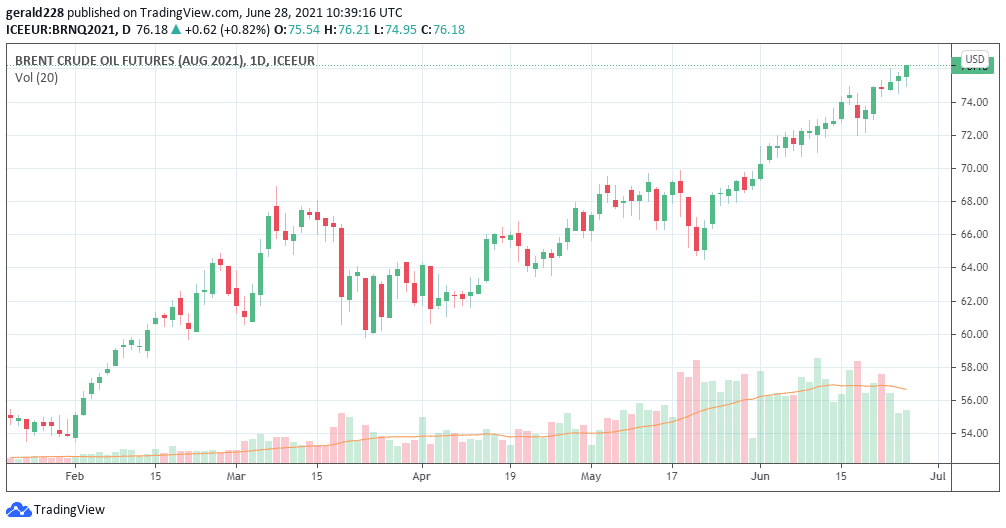

Outlook for Oil: Futures Looking to Decrease in 2022 As More Supply Comes Onstream

According to the EIA, Brent spot prices will average around $60.49 per barrel. This is a slight decrease when compared to the $60.74 which the EIA projected in May’s STEO report.

The EIA is also confident that supply issues should decrease in the second half of 2021 as demand is consistently met by supply.

“The rising oil production in the forecast is largely a result of the OPEC+ decision to raise production. We expect rising production will end the persistent global oil inventory draws that have occurred for much of the past year and lead to relatively balanced global oil markets in the second half of 2021,” the EIA added.

Supply And Consumption Issues – Demand Rising But Production Should Keep Up

According to the EIA, around 96 million barrels per day of fuels were consumed globally in May 2021. This was an increase of 11.9 million barrels from May 2020 but still 3.7million barrels less than May 2019. However, the EIA is forecasting further demand increase for the rest of 2021. In fact, the average for the rest of the year as far as consumption is concerned is expected to be 97.7 million barrels per day. This would be an increase of 5.4 million barrels per day from 2020.

In 2022, consumption is expected to increase further to 101.3 million barrels per day. This would represent an increase of 3.6 million barrels per day.

OPEC crude oil production is expected to average 26.9 million barrels per day in 2021. 2022 is expected to see a jump of around 10% in production to 28.7 million barrels per day. According to the EIA, US crude oil production averaged 11.2 million barrels a day in March. This was an increase of 1.4 million barrels per day from February. US production data typically lags a couple of months behind.

Will Shale Recover This Year?

Shale Oil production had a disastrous year in 2020 as production fell by no less than 20% when compared to 2019. The outlook for 2021 remains tepid as US shale drilling sites remain well below 2019 levels and in some cases even below last year.

However, as demand continues to pick up, the shale industry could see a considerable rebound. This all depends on the situation with Covid19 and if the recovery in the US continues accordingly. Hiccups such as sporadic outbreaks on the way could temper demand but this does not seem to be the case as the vaccination programme gathers pace.

Conclusion: Oil Demand Rises Steadily – Prices Should Remain Steady

It appears that oil demand continues to rise steadily and the outlook for prices remains good although well below 2019 levels. Apart from the now standard pandemic issues, supply forecasts remain generally good as production has increased considerably especially with OPEC’s boost.

Looking to trade forex or commodities now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.