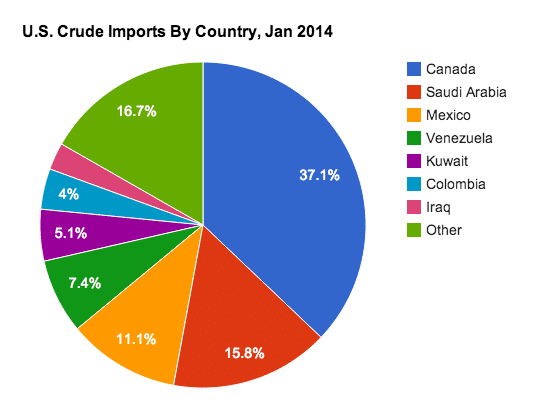

The oil connection of GBP/CAD comes from the quote currency of this pair, which is CAD. The Canadian dollar belongs to the commodity currencies group, which means it is strongly dependent on commodities, in our case it is about oil. It is not clear for what reason, but many people have an impression that the main oil suppliers to the US are Saudi Arabia, Kuwait, and other Middle Eastern countries. This assumption is absolutely wrong, as most of the imported oil comes to the US from Canada.

http://inblackandweitz.com/us-oil-imports-by-country/

Moreover, Canada enters the top 10 largest oil producers in the world and was recently recognized as the most energy-secure country in the world. Oil has the greatest share of the Canadian exports to its southern neighbor, and it goes tens of billions of dollars ahead of the next group of exports – automobiles. At the same time, the United States is not the only permanent Canadian oil buyer. Japan imports almost all of its oil from Canada, being another important buyer.

How does it influence the GBP/CAD pair?

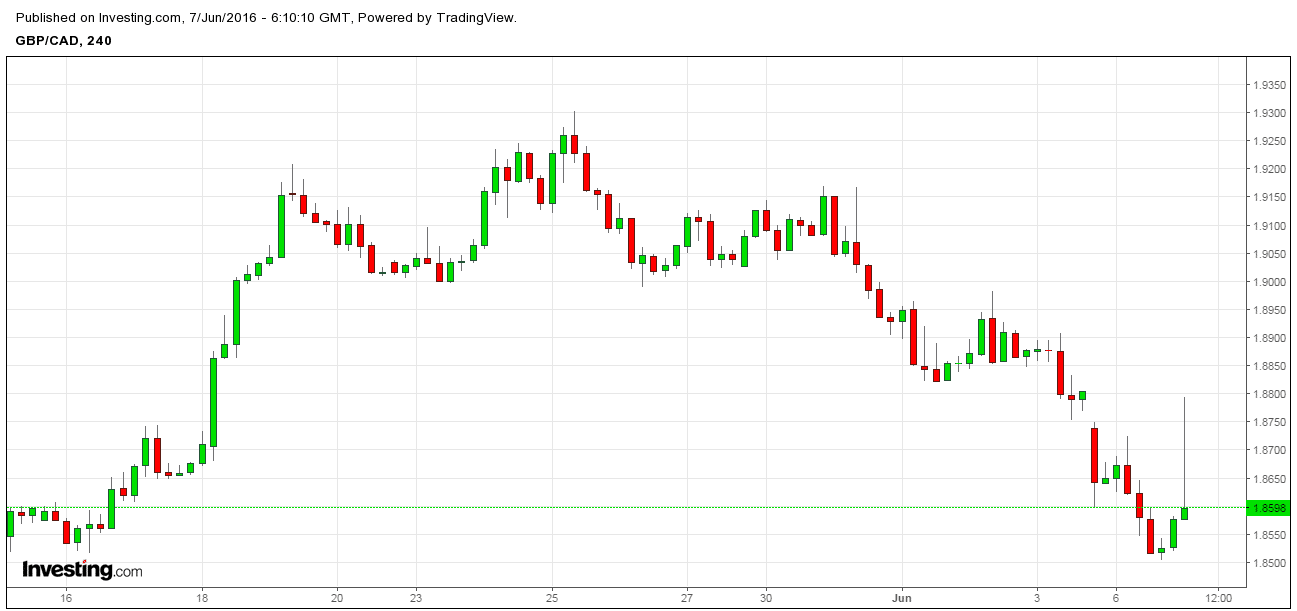

The close relationship of the Canadian economy with oil makes the Canadian dollar a favorite tool of Forex traders who play on oil prices. This is justified, as the historical correlation between the “loonie” and oil is very high, the CAD can be called the “oil currency”. On the other hand, the UK is not related so much to the oil, so whenever oil prices go up, the GBP/CAD pair drops, as the CAD gets support, and when the oil becomes cheaper, GBP/CAD generally has an uptrend, as the CAD loses ground. So, there is an inverse relationship between GBP/CAD and oil quotations.

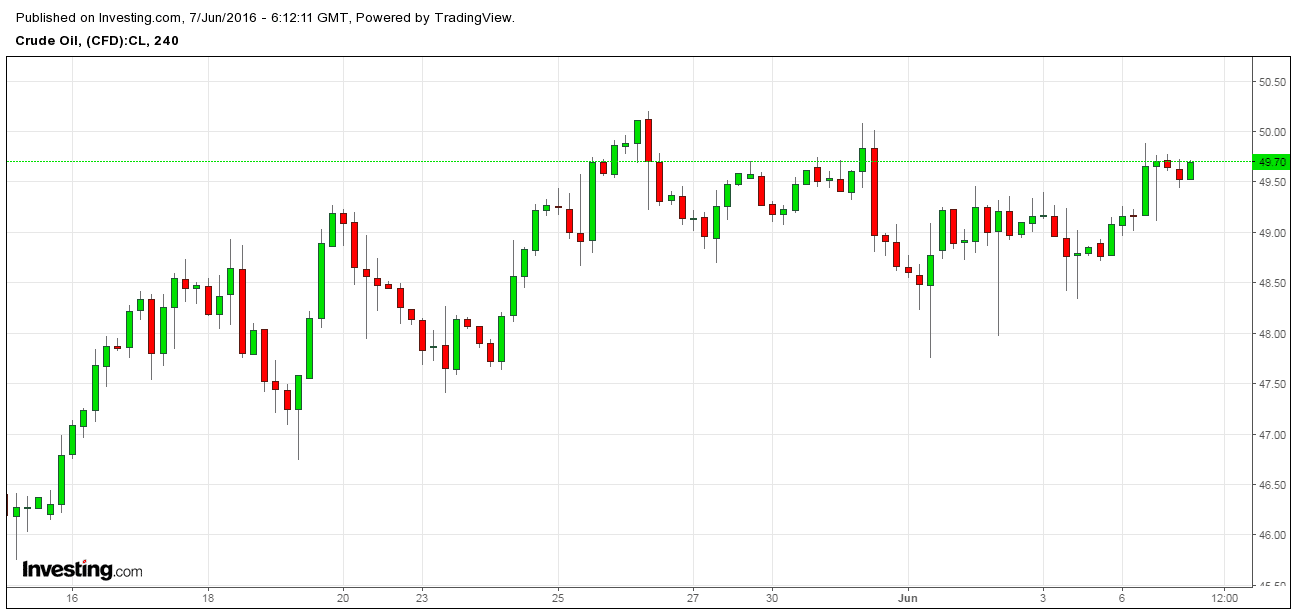

However, you can see on the charts that while the WTI crude oil prices went up and maintain right below the $50 mark, GBP/CAD constantly drops starting with May 25, having a recent correction. Why is this happening?

Brexit as a temporary driver of GBP pairs

The Brexit refers to a scenario in which the UK exits the European Union after the referendum on 23 June 2016. The fears related to Brexit have a strong impact on the GBP pairs, including GBP/CAD, and it can be a sole factor of the pair fluctuations, especially when oil prices go in sideways trend.

For example, a poll organized 10 days ago, showed that nine out of ten leading British economists, working in the City of London – the business and financial center of the city – activating in the small businesses and the scientific field, think that the Brexit may damage the country’s economy.

However, there are also strong pro Brexit voices: “Fifteen years ago, the vast majority of economists supported the British abandonment of the pound… They were wrong then and they are wrong now,” – said, Matthew Elliott, the head of the pro Brexit campaign.

The oil prices outlook

The OPEC countries rejected to adopt a new production ceiling, which was an expected decision.

“The OPEC outcome was expected,” said Gene McGillian, a senior analyst and broker at Tradition Energy in Stamford, Connecticut. “The continuing decline in North American output and the idea that global growth will boost demand have pushed prices higher. Whether they are enough to push us decisively over $50 has yet to be seen.”

The prices may keep above $50 level supported by the dynamics of drilling rigs in the United States. If at the current price level the oil shale companies will actively reopen their facilities, the prices will weaken, and if not, then they will search the $ 55 territory.

How to trade GBP/CAD?

This possible gain in oil prices combined with the Brexit referendum may put pressure on the GBP/CAD. The sentiment is bearish, and considering all these factors, the pair is expected to go down.

The Forex traders may open short positions after getting the reports on US drilling rigs, while the Binary Options traders can rely on PUT options.

Guest post by AnyOption