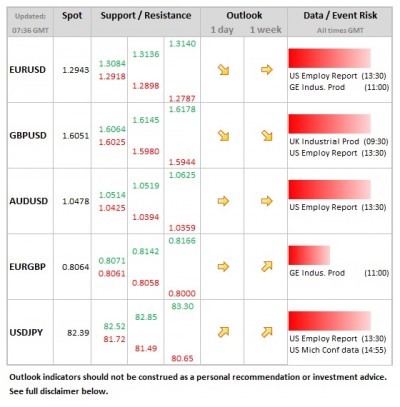

- EUR: Just German industrial production data released today, with stronger data having the potential to give the single currency a lift and encourage some short-covering into the weekend.

- GBP: Industrial production data released today, but should only push sterling a little higher if stronger than expected. Signs that sterling has become less sensitive to data of late as Bank of England seen on hold.

- USD: The big one. US payrolls invariably creates end of week volatility. Last month was stronger than expected, which actually strengthened the dollar. But often with FX the initial reaction does not hold, with the Aug. release seeing the stronger dollar sold within the 1st 30 mins. See how to trade the NFP with EUR/USD.

Idea of the Day

It’s all about the dollar today as the monthly employment report returns. Last month’s release was strong (headline jobs rising 171k) and the market expects a fair proportion of the strength to be given back today (a more modest 85k increase). There are distortions from Hurricane Sandy and also the election, with the more cynical commentators seeing last month’s release being a little too good ahead of the election. The overall picture of better than expected data leading to a stronger dollar holds, but often the initial reaction is not sustained as larger players adjust positions. Also, given the distortions to the November data, there are stronger reasons than normal not to read too much into today’s release as an indication of the underlying picture of the labour market.

Latest FX News

- USD: Up by around 0.5% into the close yesterday, largely on the back of the weaker tone to the euro.

- EUR: The downgrade of growth and inflation forecasts, together with discussion of further easing measures, knocked the single currency euro towards 1.2950 area. Big cut in growth forecast from German central bank for ’13 (from 1.6% to 0.4%) denting euro a little in early European trade.

- GOLD: Seeing some consolidation around the $1,700 level after what has been a fairly soft past 2 weeks.

- AUD: Holding comparatively steady in Asia trade, with brief push above 1.05 late yesterday not sustained. FX reserves data fell for first time in 3 months. Trade data at -2088m was in line with expectations.