Idea of the Day

With a lack of US data being released due to the government shutdown all eyes will be on the PMIs from Europe and the UK, with particular attention given to the UK services data. As mentioned, the UK PMIs have been surprising to the upside and recent upgrades to UK growth forecasts have given sterling a bout of strength in recent weeks. Today will be a test of that strength as the services PMI number is released, which is due to come in at 60.0 just lower than the previous month’s multi-year high of 60.5. Cable continues to hover around its highs above the 1.6200 level and against the euro sterling has made ground in recent weeks dragging the single currency down to test 0.8330 in EUR/GBP a level not seen since January. It will be impressive for the PMI survey to suggest that the UK services sector still remains in such expansionary mode and if the figure is on or above expectations then the sterling bulls are likely to maintain the upper hand although a figure in the 50s might see some profit taking which we have already been seeing in the EUR/GBP cross.

Data/Event Risks

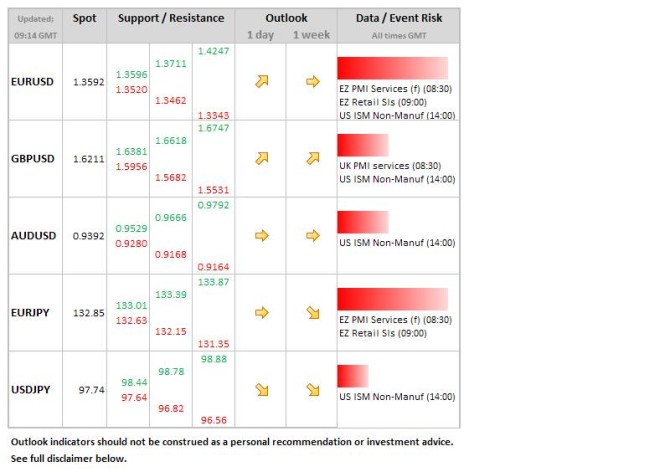

USD: The government shutdown means no data, or at least those released by the government or their agencies. So the weekly claims data is off the agenda, but the ISM is on, with the non-manufacturing composite indicator seen falling from 58.6 to 57.0. The monthly employment report will also not be released tomorrow.

GBP: Services PMI data today. The series has risen for the past 8 months, from 48.9 to 60.5. The market looks for steady outcome today, but would not be surprising to see a softer number given the recent relentless increase and the pull-back seen in the manufacturing data earlier in the week. This would be sterling negative, but as the manufacturing data showed, risk is that we see quick recovery as strong tendency for buyers to emerge on any pull-backs.

EUR: The final services PMI data today brings low risk of revisions, given that manufacturing data earlier in the week was steady on the headline number. Retail sales for the eurozone seen rising 0.2% MoM in August.

Latest FX News

USD: The dollar’s woes continued yesterday as it hit an 8 month low against the euro. Investors seem to be becoming as frustrated as US citizens in respect of the political stalemate as concern over the shutdowns effect on the imminent arrival of the debt ceiling is taking its toll.

NZD: The Kiwi continues to remain well supported as hawkish comments from the RBNZ underpinned its recent strength. With a buoyant housing market the central bank has made it clear that it will remain vigilant and hike rates if required to cool things down.

Further reading:

Forex Analysis: EUR/USD Momentum Establishes New High

Draghi not worried about inflation – EUR/USD rises above 1.36