- Polkadot price seems to be facing some short-term selling pressure.

- Bulls need to defend a critical support level to prevent DOT from falling further.

Polkadot has rebounded strongly from its low at $4.43 established on November 26 and managed to reach $5.53, aiming to set a new 2020-high. Unfortunately, an important indicator suggests DOT is poised for a pullback in the short-term.

Polkadot price facing strong selling pressure

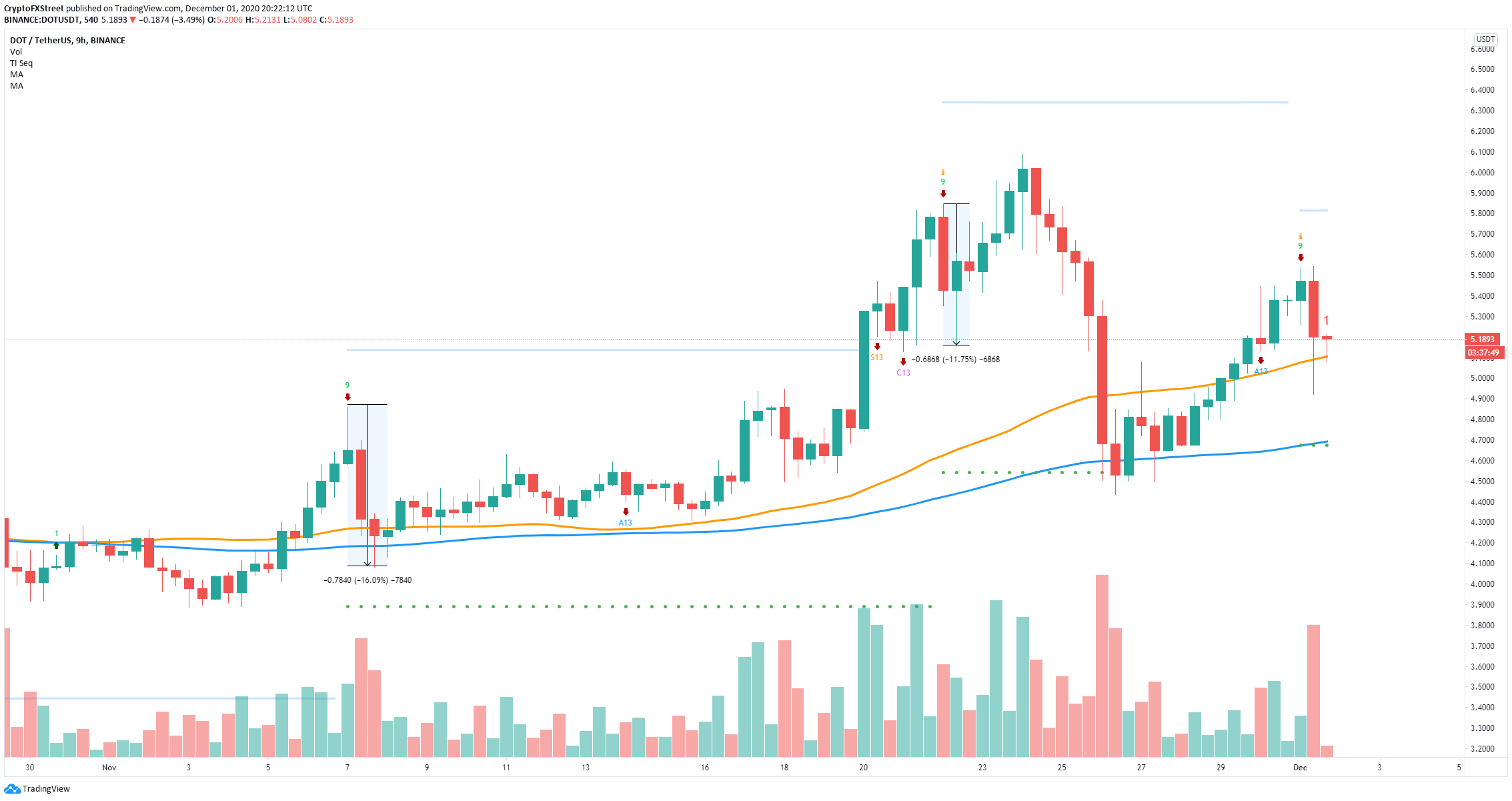

On the 9-hour chart, the TD Sequential indicator has presented a sell signal that seems to be getting a lot of follow-through bearish action. The 50-SMA is acting as a strong support level at $5.10.

DOT/USD 9-hour chart

A breakdown below the 50-SMA would be a clear bearish sign capable of driving Polkadot price down to the 100-SMA at $4.7. Additionally, it seems that the TD Sequential is also on the verge of presenting a sell signal on the 3-day chart.

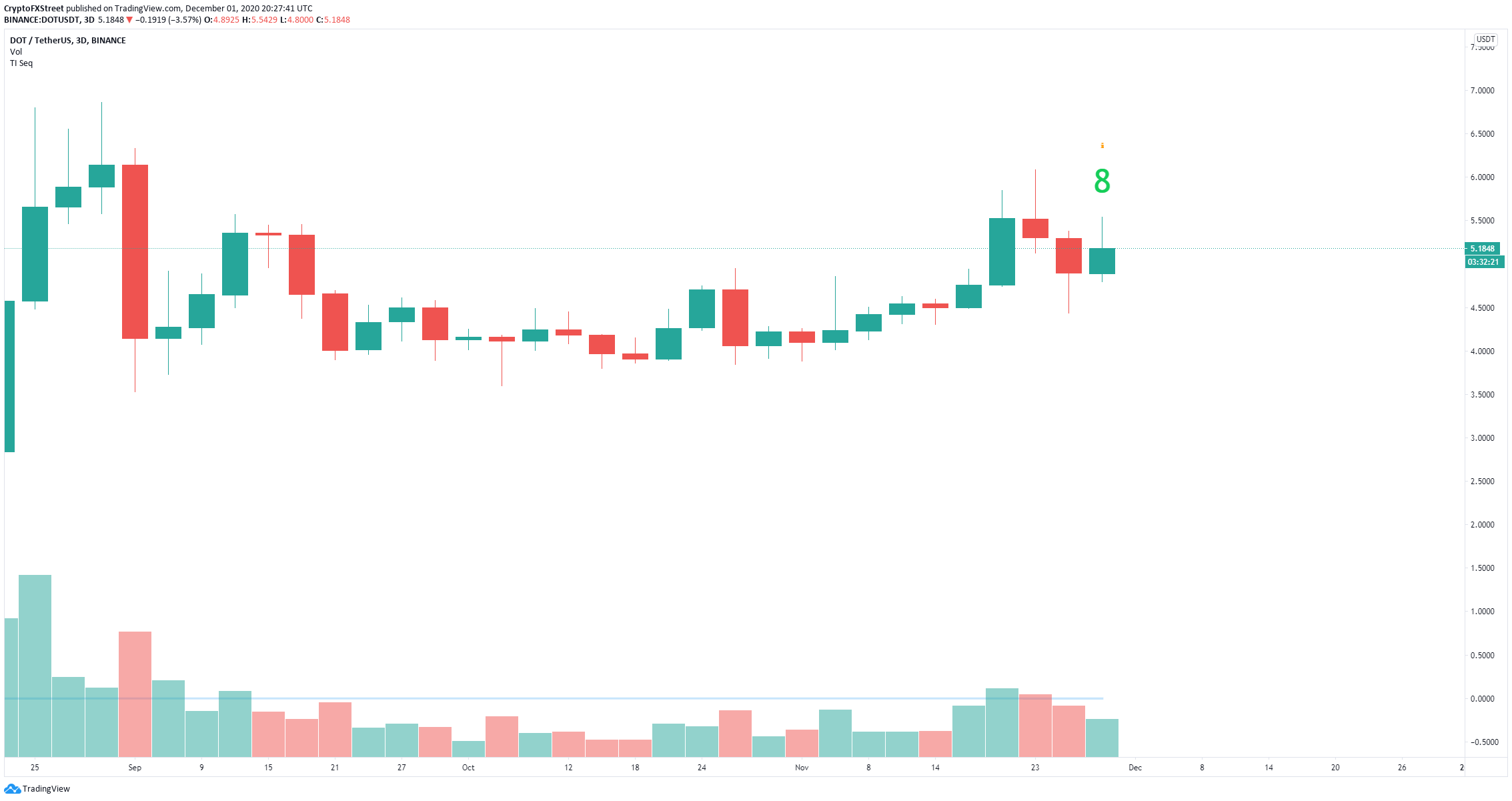

DOT/USD 3-day chart

The current green ‘8’ is a strong indication of a potential incoming green ‘9’ sell signal like the one in the 4-hour chart. This increase in selling pressure gives bears the upper hand in the short-term.

However, if the bulls can decisively defend the 50-SMA support level on the 9-hour chart and push Polkadot price above $5.5, the digital asset could quickly rise to new highs above the 2020-high at $6.08.