- GBP/USD has been edging higher as Brexit moves forward on two fronts.

- Mid-East tensions have been mostly shrugged off by the pound.

- Wednesday’s four-hour chart is pointing to higher chances for gains.

How will the UK and the EU trade after Brexit? That is a question on many investors’ minds and one that the top politicians will begin tackling on Wednesday. Prime Minister Boris Johnson aims to clinch a swift agreement with the bloc – by the end of the transition period, which expires at year-end. Markets have their doubts, but pound bulls seem encouraged.

Johnson will meet European Commission President Ursula von der Leyen and Chief EU negotiator Michel Barnier in London. They will kick off preliminary talks on future relations. Reports and statements from the leaders may have a significant impact on the pound.

Von der Leyen previously expressed doubts that a new deal could be achieved quickly. It took the EU and Canada no fewer than seven years to reach an agreement.

Close by, the House of Commons is projected to advance the passage of the Withdrawal Bill, ratifying the UK’s exit on January 31. The Conservatives’ landslide victory in December’s elections is set to result in a smooth process.

Beyond Brexit

Mid-East tensions remain in the spotlight for broader markets. Iran launched a missile attack on US bases in Iraq and claimed that 80 lives were lost. However, the Pentagon did not report any casualties and President Donald Trump’s tweet that “all is well” provided a dose of calm to nervous markets.

Tehran said it is only a “slap,” and investors seem less fearful of an all-out war that would disrupt the global economy.

The focus later shifts to US data. ADP’s Non-Farm Payrolls report for private-sector employment is forecast to show an increase of 160,000 jobs in December – a healthy gain. The figure serves as a hint toward Friday’s official labor report. On Tuesday, ISM’s Purchasing Managers’ Index for the private sector beat expectations with 55 points.

See US ADP Preview: Labor market expansion is steady

Overall, Brexit news will likely compete with Mid-East developments for attention, with an interlude for economic figures.

GBP/USD Technical Analysis

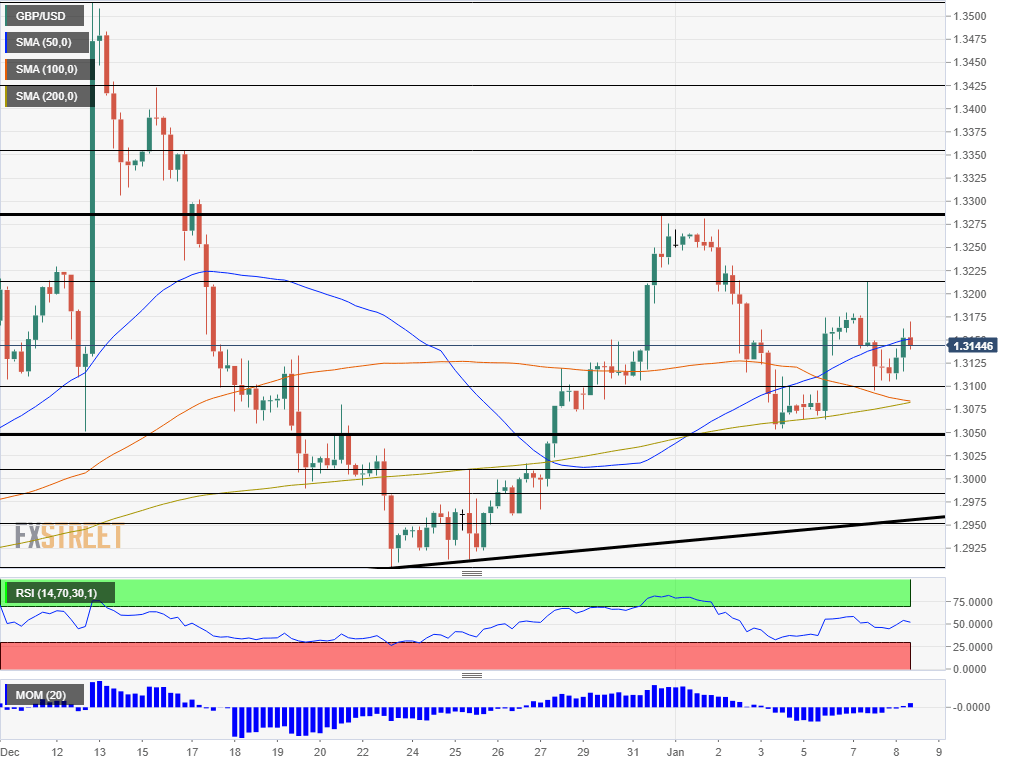

GBP/USD has risen above the 50 Simple Moving Average on the four-hour chart – a bullish sign. Moreover, momentum has turned positive.

Resistance awaits at 1.3215, which is the weekly high. It is followed by 1.3285, which held it down in the dying days of 2019. Next, we find 1.3355, 1.3425, and 1.3510 – levels set around the mid-December elections.

Support awaits at 1.31, a round number which provided support on Tuesday. It is followed by 1.3050, which is the 2020 low. Next, 1.3010 and 1.2985 await the pair.