- FX: The Presidents Day holiday in the US will ensure that volumes are on the low side today, together with overall volatility risk.

- EUR: Note that ECB President Draghi speaks in Brussels, so worth having an eye on that for possible further comments on the euro and on the recent weak output data in the Eurozone. Scheduled data releases are of only minor interest for the single currency.

Idea of the Day

For the moment at least, it looks as if world leaders have eased back from an all-out currency war. This was one of the fears surrounding the weekend’s G20 meeting. Deep-down, they know that there are no real winners in a currency war, so instead the message was one of support for Japan for its efforts to revive its economy, so long as it does not openly call for a weaker yen. Still, with the yen 18% lower vs. its strongest level against the US dollar seen in September of last year, Japan won’t be too worried if it has to be a little more discreet, because their currency is now at levels which is a lot more beneficial for their economy. We’ve said before that the traffic in the yen is now likely to be a lot more 2-way and the recent price action on USDJPY continues to bear this out.

Latest FX News

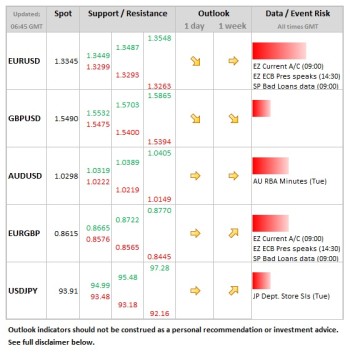

- EUR: Last week saw the euro adjusting to the underlying reality of the economy, given weak GDP data from Germany and elsewhere. The weaker tone is likely to remain for the time being. Key support comes in at 1.3293/99 on EURUSD.

- GBP: Data from Rightmove showed house prices rising 2.8% MoM in February, but this series is just asking (not selling) prices, so can be volatile. Sterling was soft last week and scope for this weakness to reverse looks slim right now, the Bank of England having effectively softened its inflation target in its latest Inflation Report.

- JPY: Weaker in the wake of the G20 meeting, where consensus was that it was OK for Japan to continue with policies to reflate its economy so long as it does not publically advocate a weaker currency. Also, Prime Minister Abe has continued to keep option open of buying foreign bonds as part of this strategy, which also allowed the yen to soften.

Further reading: EUR/JPY Pulls Back and Recovers within Strong Bullish Trend