Could today be such a day?

I have been monitoring the US indices for quite some time now. I am in no way trying to pick a top, but sometimes it is just great to share your observations. Correct me if I am wrong, but US indices look exhausted.

I have been recently looking at the divergence between US and its European cousin, but now it seems more than striking.

DAX has been dragging lower and lower, while its American counterparts have been rallying. Not until now”¦

Has the time really arrived yet?

Are US indices overbought? Has the time really arrived yet for them to see a minor/major trend reversal? Has the geo-political picture something to do with it.

So many questions with no clear answer. What is clear to me, though is the price action picture.

Since over a month DAX has been going lower, and lower while its American counterparts have been enjoying the bullish fiesta. How do they look today?

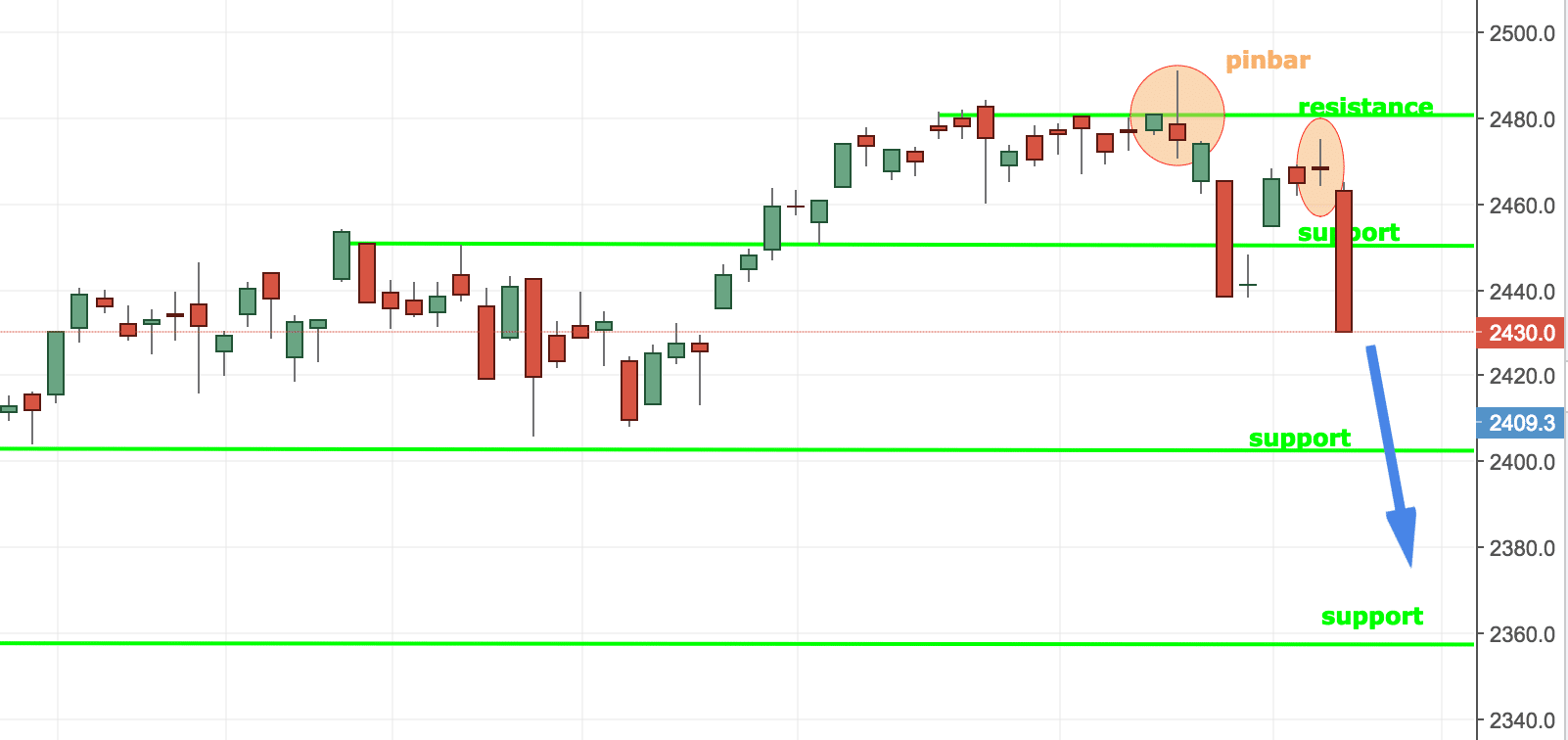

NASDAQ Price Action

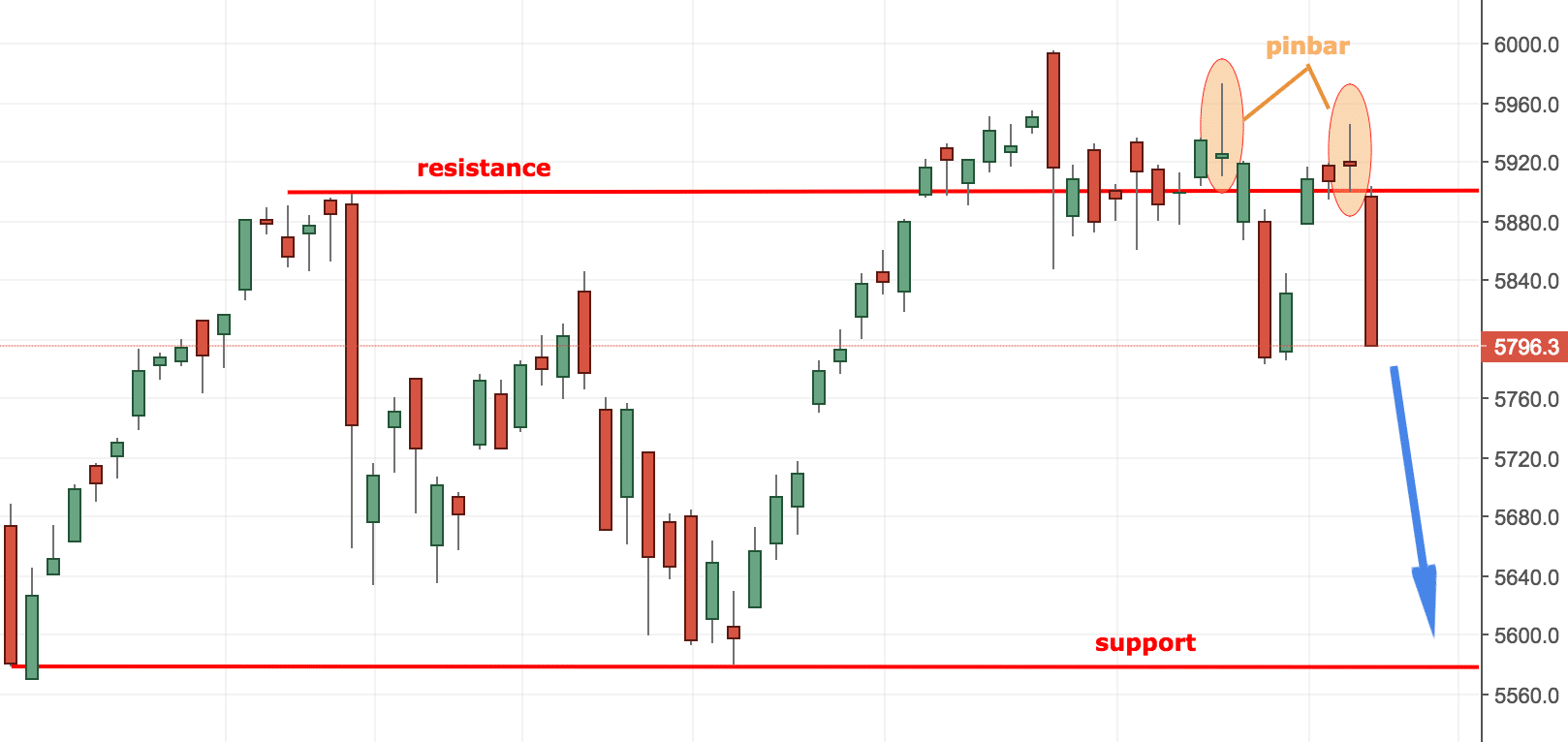

S&P 500 Price Action

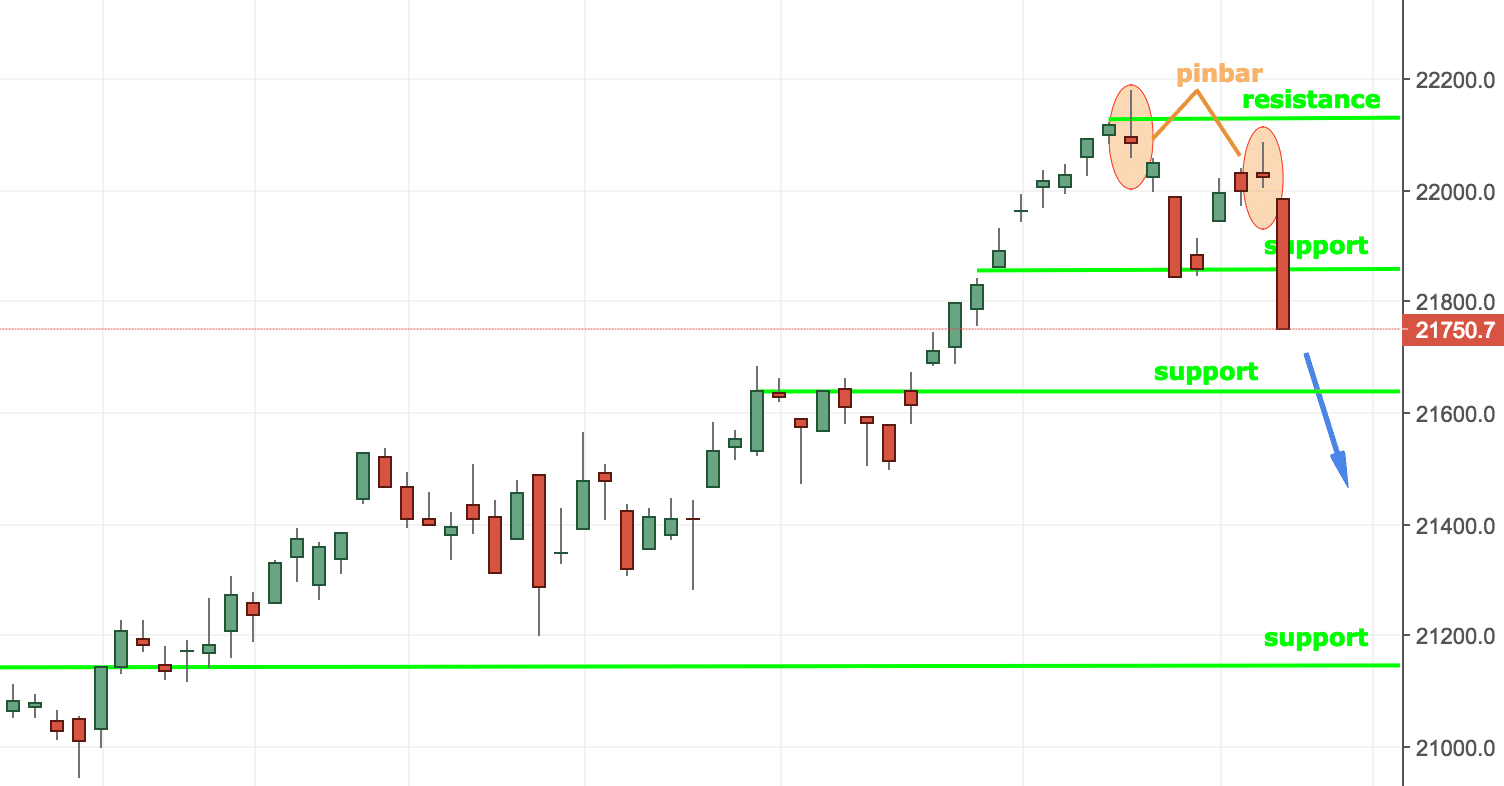

Dow Jones Price Action

What’s next?

Do all of those charts look bullish to you?

I know- they look bearish to me too. The price action is definitely bearish and the European indices have been going lower today. I would not be surprised to all to see a major sell-off today. Seems like all major US indices charts are agreeing at one thing- rejection of the highs. It will be interesting to watch where the price leads us from here.

I am also spotting an interesting formation on Gold. It seems quite bullish, which reminds of an old correlation, which was kind of skewed in the past years:

When Gold goes up, US Stock Market goes down

Let’s see what Friday holds for us. Maybe it won’t be a quiet Friday after all.

Guest post by www.colibritrader.com