The Reserve Bank of Australia has released the Minutes of the May Board meeting where the market’s focus is on commentary around QE and Yield Curve Control.

Note, that the RBA left its key rates at 0.1% for a fifth straight meeting this month and reiterated it would not hike until actual inflation was within its 2-3% target band.

The Minutes state that ”Australia’s central bank wants annual wage growth to more than double to its highest in over a decade to meet its inflation goals, a tough task that underlines how long rates could remain near zero,” Reuters noted.

Key take-aways

”Minutes of its May policy meeting showed the Reserve Bank of Australia (RBA) Board believed wages would likely need to expand by “sustainably above 3%” to generate inflation. Wage growth is currently running at just 1.4%, compared with 2% in Europe and nearly 3% for the United States.”

”First-quarter wage price index data is due on Wednesday and are expected to show growth stuck around 1.4%.”

”The RBA sees that as unlikely to occur before 2024, at the earliest, given core inflation was currently at an all time low of 1.2%.”

“Future policy decisions would be based on close attention to the flow of economic data and conditions in financial markets in Australia,” the minutes showed.

- RBA MINUTES: CONDITIONS FOR RATE RISE CONSIDERED UNLIKELY UNTIL 2024 AT EARLIEST

- 17-May-2021 19:30:01 – RBA: NO RATE RISE UNTIL ACTUAL INFLATION SUSTAINABLY IN 2-3% TARGET BAND

- 17-May-2021 19:30:01 – RBA: BOARD WILLING TO EXTEND BOND BUYING IF NEEDED, NO NEED TO CHANGE YIELD TARGET

- 17-May-2021 19:30:01 – RBA: TO DECIDE IN JULY WHETHER TO ROLL OVER TO NOV 2024 BOND, EXTEND BOND BUYING

- 17-May-2021 19:30:01 – RBA: RETURN TO FULL EMPLOYMENT A HIGH PRIORITY FOR MONETARY POLICY

- 17-May-2021 19:30:01 – RBA: POLICY TO REMAIN HIGHLY ACCOMMODATIVE FOR SOME TIME YET

- 17-May-2021 19:30:01 – RBA: MONETARY POLICY HELPING KEEP A$ IN A NARROW RANGE DESPITE RISING COMMODITY PRICES

- 17-May-2021 19:30:01 – RBA: UNEMPLOYMENT SEEN AT 4.5% BY MID-2023, TO PUT ONLY MODEST UPWARD PRESSURE ON WAGES

- 17-May-2021 19:30:01 – RBA: WAGE GROWTH WOULD NEED TO BE “SUSTAINABLY” ABOVE 3% TO MEET INFLATION TARGET

- 17-May-2021 19:30:01 – RBA: PUBLIC SECTOR WAGE POLICIES TO RESTRAIN OVERALL WAGE GROWTH IN ECONOMY

- 17-May-2021 19:30:01 – RBA: INFLATION PRESSURES SUBDUED IN MOST PARTS OF ECONOMY, TO INCREASE ONLY GRADUALLY

- 17-May-2021 19:30:01 – RBA: IMPORTANT TO MAINTAIN HOME LENDING STANDARDS AMID RISING HOUSE PRICES, STRONG DEMAND

- 17-May-2021 19:30:01 – RBA: FEW SIGNS MAJOR MINERS PLANNING TO EXPAND INVESTMENT IN IRON ORE OUTPUT IN RESPONSE TO PRICE SURGE

- 17-May-2021 19:30:01 – RBA: DISRUPTIONS TO GLOBAL SUPPLY CHAINS TO BE MORE PERSISTENT THAN REALISED, ADDING TO INFLATION

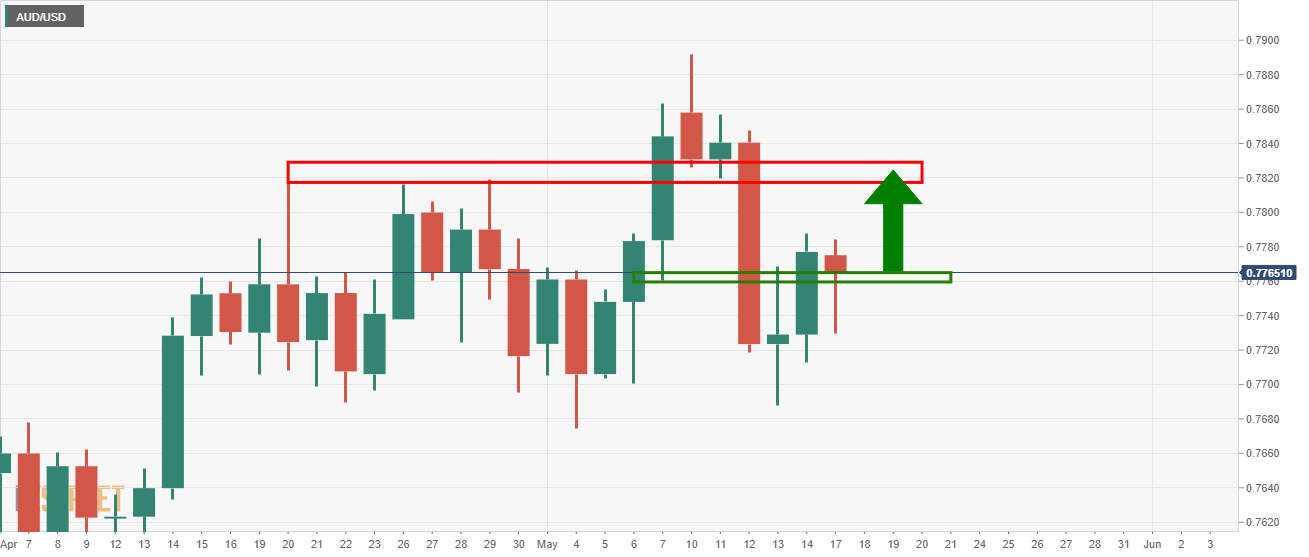

AUD/USD technical analysis

Given that the board will not decide whether to extend current policies until the July meeting, there was little reaction to the Minutes today.

Meanwhile, weaker risk appetite kept the pressure on AUD at the start of this week and offshore equities remain the key driver for the currency.

From a technical standpoint, the focus is on the upside from the daily chart perspective:

About the RBA Minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision.

The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee.

Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.