- Support at $0.24 was tested twice in the month of August and remains vulnerable as long as XRP stays below $0.28.

- Ripple’s technical picture is strongly bearish especially with the RSI having a negative gradient.

Ripple is facing growing pressure from the selling corner. Since the drop under $0.30 and $0.28 critical levels, the third-largest cryptocurrency has had a difficult time holding onto the accrued gains. The support at $0.24 was tested twice in the month of August and remains vulnerable as long as XRP stays below $0.28.

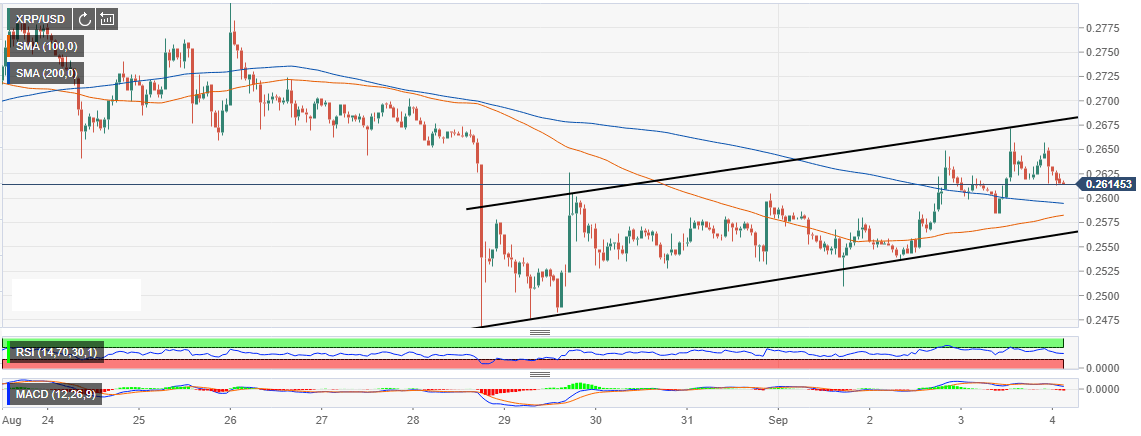

Following the catastrophic fall last week, XRP bulls have in the past few days managed to gain some ground against the bears. However, we cannot say they have full control over the price. The shallow recovery stepped above both the 100 Simple Moving Average and the 50 SMA in the hourly timeframe but failed to clear $0.27 resistance.

A weekly high formed at $0.2675, left the door wide open for the ongoing selling action. If XRP extends the losses below the bearish flag pattern support, a further breakdown could retest $0.24.

At press time, XRP is trading at $0.26 after a subtle 0.63% drop on the day. Initial support is observed at $0.26 slightly below the 50 SMA. Other key support areas include the former pivotal level at $0.2550, $0.2500 and $0.2400.

Ripple’s technical picture is strongly bearish especially with the Relative Strength Index having a negative gradient. Also, the Moving Average Convergence Divergence (MACD) is moving south, in turn, painting a growing bearish picture. The MACD’s negative divergence could encourage the sellers to increase their positions as well, further spelling doom for XRP.