- Nasdaq is in the final stage of Ripple Liquid Index development.

- XRP/USD sits in a tight range amid low market activity.

Nasdaq is about to launch its “Ripple Liquid Index” (RLX) to allow cryptocurrency investors tracking the real-time price of the coin. The second-largest stock exchange with a market capitalization of over $10 trillion has already launched Bitcoin and Ethereum Liquidity Indices (BLX and ELX) in partnership with Brave New Coin (BNC), now its time for Ripple’s XRP.

“This institutional endorsement is what investors have been waiting for as Nasdaq has plans to launch a bitcoin futures market alongside Intercontinental Exchange’s (ICE) Bakktfutures market which was due to launch on its platform on January 23 but has since been pushed back to an undetermined date in Q2 2019,” the statement on BNC’s website says.

The LX indices developed by BNC, are based on a combination of qualitative and quantitative data, they take into account volume, book depth, tick size as well as several other parameters supplied by “qualified market participants.”

The above-said data allows calculating a fair value of Bitcoin, Ethereum and other assets on a global scale. All prices are quoted in USD, while the software updates then every 30 seconds.

Also, the company mentioned its efforts aimed at launching Bitcoin ETF in the US markets.

Now, BNC is in the final stage of developing the RLX (Ripple Liquid Index). It is worth noting that on February 25 XRP was listed on Coinbase Pro. The customers of the exchange can now trade it against USD, EUR, and BTC.

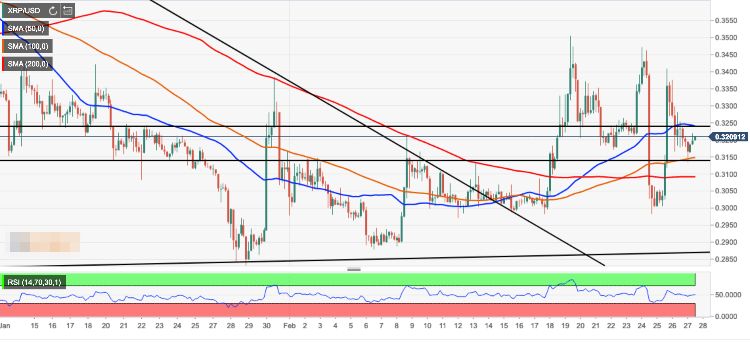

XRP/USD is moving in the range limited by $0.3240-$0.3150. The boundaries of the channel are reinforced by technical indicators (SMA50 (4-hour) on the upside and SMA100 (4-hour) on the downside). A sustainable move in either direction will create a strong momentum with the ultimate bullish goal is seen at $0.3500. The sell-off may be extended towards $0.30.

XRP/USD, 4-hour chart