- Ripple extended bullish trend turns bearish recording massive losses.

- The support established at $0.430 must continue to hold otherwise XRP/USD could breakdown towards $0.30.

Ripple towered the cryptocurrency skyline last week with gains amounting to 80 percent. The crypto was shining on its way to the moon giving investors a breather from the selling pressure that had held them hostage in lower levels for quite a while. However, the rise was too high that it has resulted in the hardest fall among the major cryptocurrencies this week.

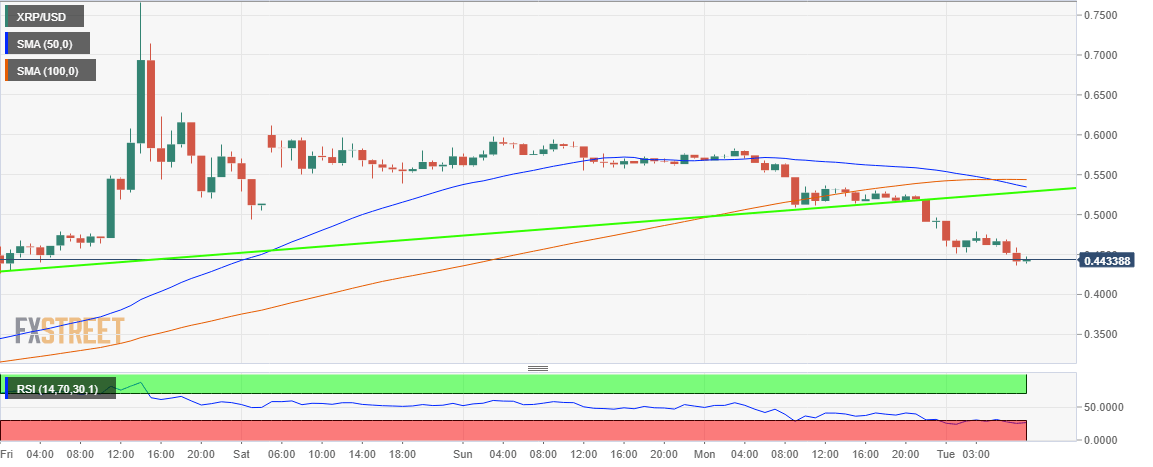

Ripple is trading at $0.44 at the time of press after recording declines of over 10% on the day. The slide is but a continuation of the declines that commenced after the weekend consolidation. The investors appear to have moved quickly to cash out the profits in the aftermath of the surge. XRP/USD has broken below several vital support areas; $0.575, $0.525 as well as the trend line support at $0.5192.

Although Ripple is among the world hit in the current bearish correction, the price movement is reflected across the board. Assets like Ethereum is down at least 8% while EOS is recording losses of over 9% on the day.

A support is currently being established at $0.43. Ripple price is also making a weak upside correction but the resistance at $0.45 is hindering movement towards $0.50. The price trend at the moment is negative; which could also mean that the sellers are exhausted and buyers can therefore push for entry. It is vital that the support at $0.43 and $0.40 holds to ensure that no dives towards $0.30 occur.