- The consolidation from Monday has been instrumental to the ongoing breakout.

- The MACD bullish divergence shows XRP having a positive tune to the trend.

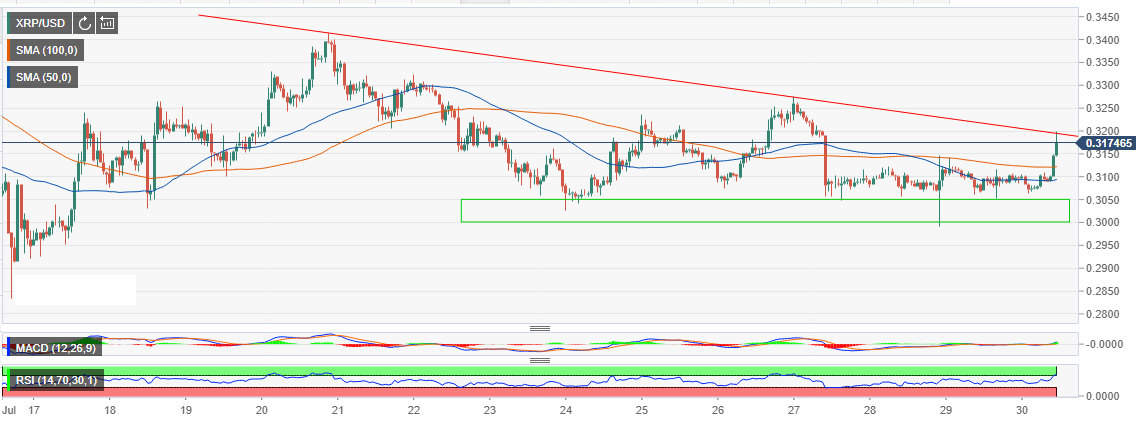

Ripple has been able to hold ground above $0.30 after the declines of last week crippled the bulls. From a high around $0.3276, the sellers smashed through tentative key support levels at $0.32, the 100 Simple Moving Average (SMA) 1-hour, 50 SMA 1-hour as well as $0.3100.

The bearish pressure pushed down on the next support at $0.3050 before meeting an avalanche of buying power at $0.30, which eventually stopped the losses. The consolidation from Monday has been instrumental to the ongoing breakout. XRP/USD made a brilliant move in a couple of engulfing candlesticks.

Read also: Ripple’s Brad Garlinghouse on Facebook’s Libra – “We don’t need a new fiat currency”

After soaring above the moving averages, Ripple is facing resistance at the trendline as well as $0.3200. Trading at $0.3179, technical indicators show XRP having hit oversold levels. The Relative Strength Index (RSI) is settled within the overbought.

Traders need to be on the lookout for a retreat below 70, which will signal a reversal. However, the Moving Average Convergence Divergence (MACD) bullish divergence shows XRP having a positive tune to the trend. Therefore, we can expect Ripple to form a higher low pattern before the next breakout.

XRP/USD 1-hour chart