- Ripple recovered from the lows around $0.2982 and stepped above $0.30 (current key support).

- XRP/USD to trend higher towards the week’s breakout pint at $0.3256.

Ripple along with other cryptocurrencies bulls were on steroids throughout last week. The market opened with incredible gains as the marketed turned green. Ripple recovered from the lows around $0.2982 and stepped above $0.30 (current key support). On Tuesday, XRP tested the resistance at $0.35 but formed a high at $0.3478. However, the price corrected lower leading to declines that found support slightly above $0.3150.

The bulls did not stay down for long as XRP/USD started to trend higher toward the end of the week. In fact, the price broke above the hourly 50-day Simple Moving Average (SMA) and the 100-SMA. This ignited further gains on Saturday as Ripple scaled the levels above $0.34. However, the reaction to a completed double-top pattern marginally below $0.35 culminated in a steep drop with Ripple refreshing the lows around $0.2982.

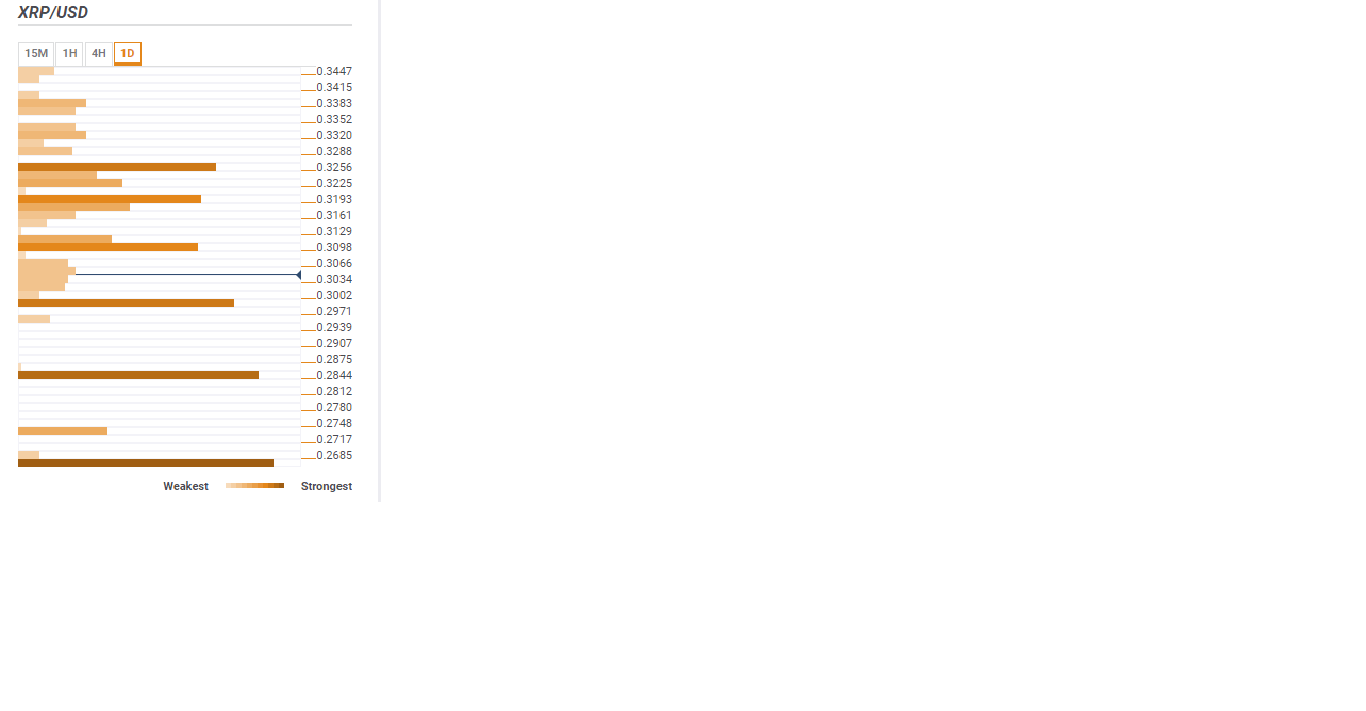

Technical Confluence Detector Levels

Ripple is immediately supported by a confluence of indicators at $0.3002; which happens to be the last week’s low as well as yesterday’s low and the Pivot Point 1 month S1. A second support at $0.2844 is highlighted by the January low, the Bollinger Band lower on the daily chart and the Pivot Point daily S1. Primary support is observed at $0.2685.

Although Ripple is likely to continue with the current sideways trading through the remaining sessions on Monday, further correction to the upwards is imminent in the coming one or two days. The momentum will encounter resistance at $0.3066; the 23.6% Fib retracement level and the 4-hour 100-day SMA. The second significant resistance lies at $0.3093; the 4-hour 10-day SMA and the weekly 61.8% Fib level. I expect XRP/USD to trend above this level before the end this week towards the breakout point at $0.3256; the 1-minute 38.2% Fib retracement level.