- The stability in the market culminated in declines not only for Ripple but also for other assets like Bitcoin.

- Ripple must reclaim its position above $0.30 for a correction toward $0.3147 critical resistance.

XRP/USD has not recovered from the slide that commenced on Monday 25. As predicted yesterday, the stability in the market culminated in declines not only for Ripple but also for other assets like Bitcoin which is exploring the levels below $3,900. The demand zone between $0.29 and $0.30 has failed to cause a trend reversal paving the way for the price to explore how deep the rabbit hole goes below $0.29.

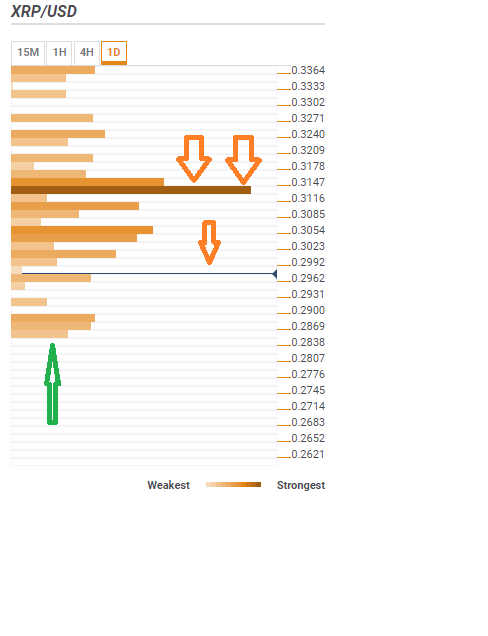

The confluence detector tool shows Ripple steadily increasing the gap between the critical resistance at $0.3147 and the current market value. The region between the two levels consists of several resistance zones with the initial at $0.2992. The confluence of indicators at this level consists of the previous high 15-minutes, Bollinger Band 15′ upper, Bollinger Band 1-hour lower, 5 SMA 15′ and the pivot point daily S1.

Consequently, Ripple must reclaim its position above $0.30 for a correction toward the critical resistance. Other hurdles to look out for in the coming sessions on Tuesday ate $0.3023, $0.3054 and $0.3116. However, a correction above $0.3147 is key for further movement towards $0.33 and $0.35 (ultimate medium-term resistance). $0.3147 is currently highlighted by a confluence of indicators including:

The 100 SMA 4-hour

161.8% Fib level daily

10 SMA daily

Bollinger Band 1-day middle

61.8% Fib level 1-minute

38.2% Fib level weekly,

200 SMA 1-hour

50 SMA 4-hour

50 SMA daily

On the downside, Ripple is also supported although the zones are not very strong. Initial support is seen at 0.2962: Pivot point 1-week S2 and the pivot point daily S2. Another support has been established at 0.2900: previous month low and the pivot point week S3.

Prediction: XRP/USD to test $0.2800 demand zone in order to trigger a reversal above $0.30.