- Ripple’s XRP jumped to $1.23 as market sees win in latest round of case

- SEC in weak position on whether Ripple knew XRP was a security

- Judge Netburn to rule on document disclosure after 28 September

The Ripple vs SEC lawsuit’s latest twist is being seen as a big win for defendant Ripple. The US Securities and Exchange Commission (SEC) accuses Ripple of knowingly engaging in an unregistered securities offering when it sold its XRP token, thereby breaching the Securities Act 1933.

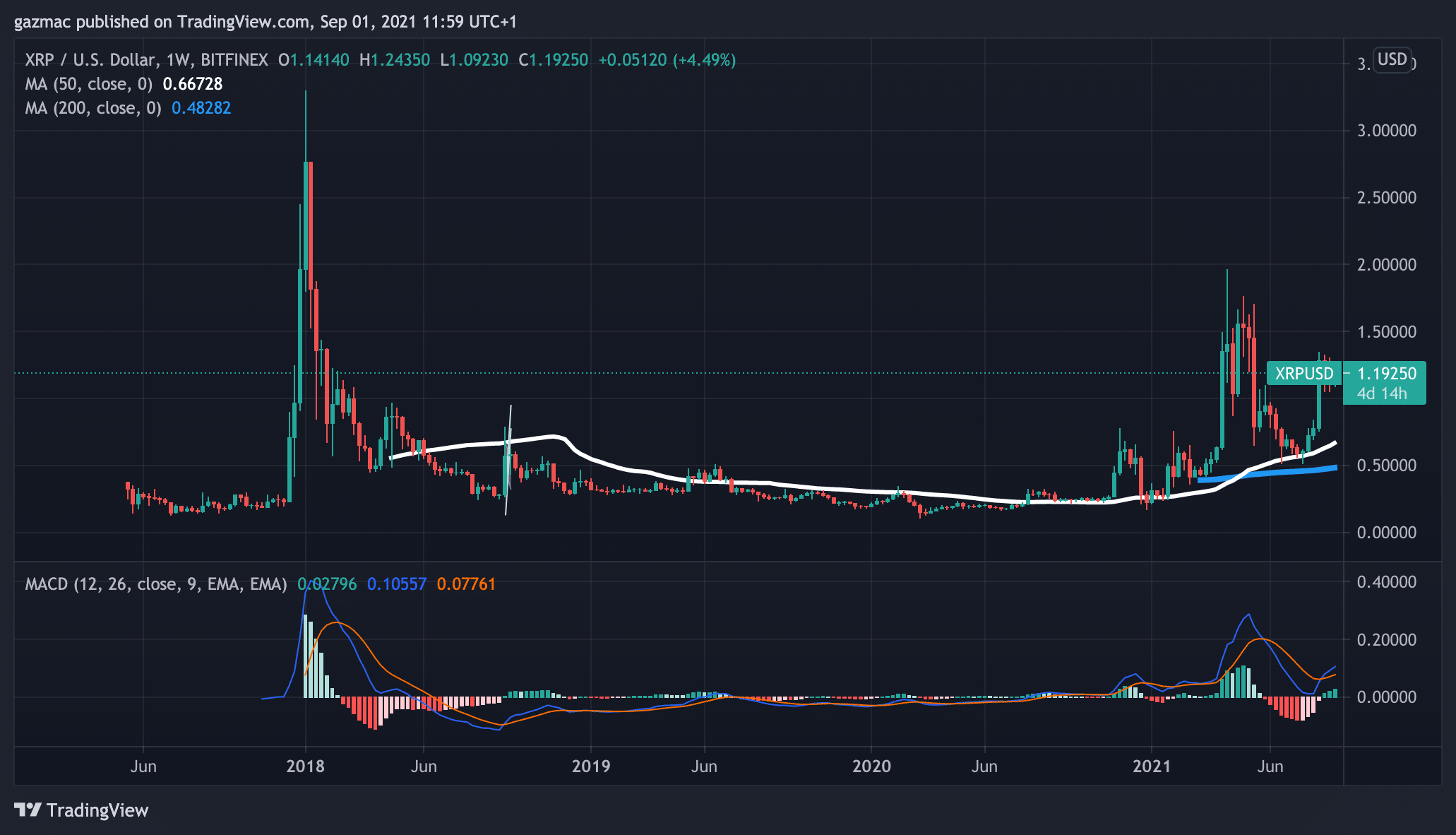

However, developments yesterday saw the price spike as high as $1.23 after the judge in the case seemed to side with Ripple in what could be a positive development for holders of the cryptocurrency.

XRP to test $3.40 all-time high soon?

If the company and its accused executives go on to successfully defend the case, our XRP price prediction is that the token will surpass its all-time high of $3.40, reached at the height of the last crypto bull market in January 2018.

XRP has lagged other crypto because of the uncertainty surrounding the court case, so XRP is being closely followed as a contender for the next cryptocurrency to explode higher.

Get Free Crypto Signals – 82% Win Rate!

Such has been the level of uncertainty around XRP, a number of leading exchanges delisted the token, Coinbase among them.

Check out our crypto exchanges guide for brokers – such as eToro, depending on jurisdiction – that do offer a market in XRP.

What just happened in SEC vs Ripple?

Ripple had filed a motion to force SEC disclosure of internal documents but the regulator has invoked privilege and refused to do so.

In a telephone conference call yesterday (31 August) the pending motion was discussed and whether the SEC should be able to use something called deliberative process privilege (DPP) to prevent disclosure.

This is just the latest episode in the long-running litigation. In addition to the Ripple company being accused of a securities violation, also in the dock are chief executive Brad Garlinghouse and executive chairman Chris Larsen who are charged with recklessly aiding and abetting Ripple in its unregistered securities offering.

As the disclosure process trundles on, for its part the SEC has demanded that Ripple provides the audio recordings of its company meetings, which one of Ripple’s executive revealed were all routinely recorded, although the SEC had not previously been aware of their existence.

Your capital is at risk.

Yesterday’s conference call was the latest in the back and forth of an increasingly fraught discovery process.

According to Tigue vs US Dept of Justice, “To be protected by the DPP, documents must be pre-decisional and deliberative” – and this is why the SEC says it doesn’t have to provide the documents that Ripple is demanding in the disclosure process that has been holding up the commencement of the trial itself.

But it may be that this does not apply in this case, or at least that may be the conclusion of the judge if yesterday’s deliberations are anything to go by.

Judge Netburn question floors the SEC

Judge Sarah Netburn looked at the SEC’s privilege log (in which documents are listed and reasons provided regarding whether privilege has been invoked and why) and then asked a number of questions of both parties, with arguably the most important one being this:

“Mr Solomon [Ripple attorney Matt Solomon], is the standard for aiding and abetting a violation of law an objective or subjective standard?”

In his answer Solomon referenced an insurance case that reached the Supreme Court in which this question was answered to the effect that it is an objective standard.

The judge then put the same question to SEC attorney Jorge Tenreiro: “Is recklessness a subjective or objective standard”? He initially failed to answer the question but eventually had to admit that it is indeed an objective standard.

Why it matters – SEC Ripple case has wide implications

If the standard is subjective, then what Brad Garlinghouse knew about whether XRP was or was not a security when he sold it is all that matters. And if that’s all that’s relevant then the SEC’s internal deliberations are completely irrelevant.

Jeremy Hogan, a lawyer who has been following the twists and turns of the case, reading from his notes of the conference call, recalls this comment from Judge Netburn: “What if all the SEC commissioners were out having lunch and talking about how they were all confused about XRP and other digital assets’ status as a security or not? That would be relevant.”

This hypothetical from the judge is important, says Hogan, because it could be a succinct description of the situation as described in multiple depositions previously revealing the confusion and debate at the heart of the SEC about digital assets and whether they should be considered securities.

Your capital is at risk.

So if it is an objective test and the SEC is confused, then how can the defendants have acted with “knowledge of wrongness”, as Hogan puts it.

So the judge believes all of the documents that the SEC is withholding under privilege are extremely relevant, and so much so that this outweighs the DPP defence.

Solomon is fully aware of this and in his brief states: “…the SEC bears the burden of proving that each individual either knew that XRP was a security or was reckless in not reaching such a conclusion. If the underlying law was unclear at the time even to the SEC, then the alleged violation could not have been ‘So obvious that the defendant must have been aware of it’ – the part in single quotes is a citation from a 2000 case, Novak v Kasaks.

Suffice to say the outcome of the case will have wide implications regarding which crypto assets are deemed securities and which are not.

XRP vs SEC: What’s next

The judge concluded by saying that she would rule on the DPP issue some time after 28 September. The DPP issue has been a hot potato since April.

The SEC will now have to provide to Ripple all the documents (with redactions), although the judge said they were to be “lightly redacted”. However, Judge Netburn will get to see the un-redacted copies of all the documents in camera (i.e. in private).

Each party will then have to provide reasons for why each individual document is or is not privileged. Then the judge will issue an order on each document as to whether it should be produced to Ripple or not.

The discovery phase of the trial ends in two months (12 November) and it has taken six months of wrangling to get to this stage.

As Hogan puts it, “In the discovery phase that you plant and grow the food that feed you case”. It’s obvious that Ripple has not been lazy in that regard.

SEC vs Ripple: Ripple defence looking stronger by the day

Ripple’s defence is looking stronger by the day, but exactly how strong may ultimately depend on what is revealed in those Ripple town halls and other recorded company meetings, as well as communications of employees on messaging and productivity app Slack, although the latter has been sealed until the merits of the underlying motion have been decided upon.

Another factor operating in Ripple’s favour is the speech made by William Hinman on 14 June 2018 in which he said that Ethereum was not a security.

Hinman was director of the SEC’s Division of Corporation Finance in the three years to December 2020, which was coincidentally when the lawsuit was brought by the SEC against Ripple.

Ripple is arguing that it was not given “fair notice” that it would be treated any differently than Ethereum with regards to the Howey Test as to what constitutes a security.

Looking to buy or trade Ripple XRP now? Invest at eToro!

Your capital is at risk.