- USD/JPY one-month risk reversals fell to lowest level since March 7.

- The drop in risk reversals indicates rising demand for JPY calls – bullish bias.

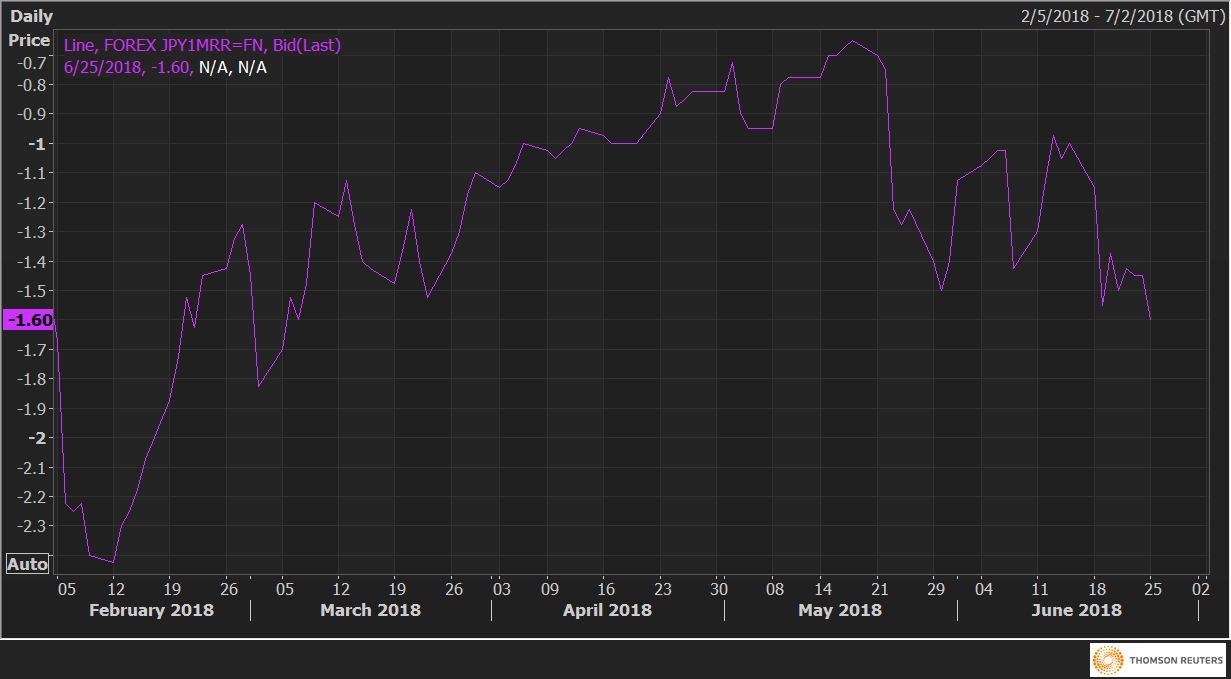

The USD/JPY one-month 25 delta risk reversal (JPY1MRR) fell to -1.60 on Monday – the lowest level since March 7, representing a rising demand or rising implied volatility premium for JPY calls (bullish bets).

The risk reversals stood at -1.38 on June 20 and was at -0.98 on June 13, according to Reuters data.

The strengthened JPY call bias indicates the investors likely expect a deeper drop in USD/JPY amid rising US-China trade war fears and hence seeking downside protection (JPY calls).

JPY1MRR