- USD/JPY has been on the back foot amid economic weakness and political uncertainty.

- High-level trade talks, the FOMC minutes, and inflation are high on the agenda.

- Early October’s daily chart is pointing to new lows.

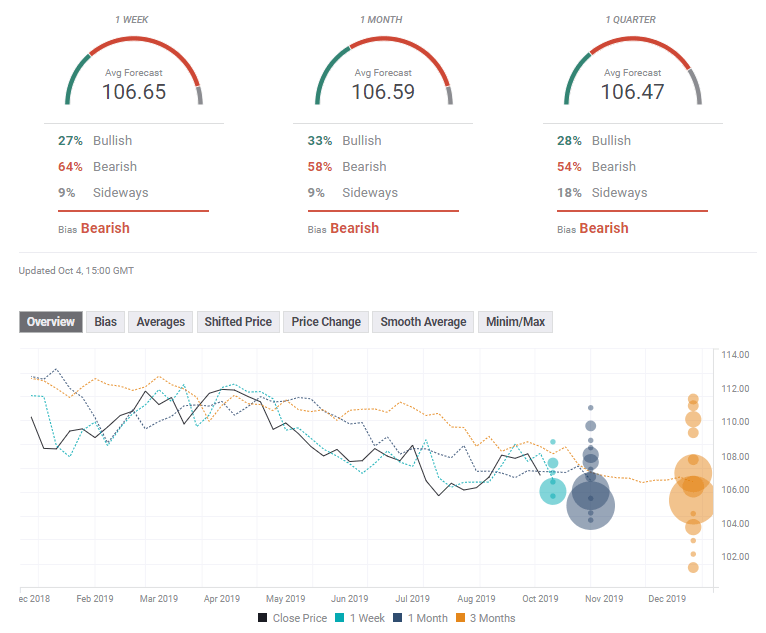

- Experts are bearish on USD/JPY on all timeframes.

USD/JPY has proved that it is data-dependent – and depressing figures sent it down. Concerns about the economy as well as political uncertainty, remain high on the agenda. They will be joined by high-level trade talks and the all-important meeting minutes from the central bank in the first full week of October.

This week in USD/JPY: Recession fears taking their toll

ISM’s Purchasing Managers’ Indexes (PMIs) have painted a bleak picture for the US economy. The Manufacturing PMI dropped to 47.8 – the lowest in over ten years and contraction territory. The Non-Manufacturing PMI has held up above 50, reflecting expansion – but the score of 52.6 is a three-year low.

Those numbers set a low bar for Friday’s Non-Farm Payrolls report. The US gained 136,000 jobs in September, marginally lower than expected, but revisions to previous month’s figures added 45,000 positions. Other details were also upbeat and helped the Dollar stabilize – despite stagnant wage growth.

See NFP Quick Analysis: Four positive points that drive up the dollar and keep hawks happy

Concerns of a recession on the horizon have pushed investors from stocks to the safety of bonds. The consequent fall in bond yields now reflects a high chance that the Federal Reserve will cut interest rates later this month. The US Dollar dropped across the board, and the safe-haven Japanese Yen was one of the primary beneficiaries.

Political uncertainty also weighed on sentiment. Democrats are moving fast with their impeachment inquiry into the “Ukraine-gate” scandal. The opposition is talking with officials and has subpoenaed documents and confidants of President Donald Trump. The president has admitted that he called on Ukranian President Volodymyr Zelensky to dig up dirt on rival Joe Biden and also asked China to look into data related to the former Vice President. Trump raged against Adam Schiff, Chair of the House Intelligence Committee, who leads the investigation and called him a “traitor.” A new whistleblower complaint related to improper dealings with tax returns has also arisen.

Primaries in the Democratic Party have also been on investors’ minds. The scandal embroiling the president has somewhat hurt Biden’s polling numbers, and pundits now see Elisabeth Warren as the frontrunner. Warren’s chances may further increase if like-minded Bernie Sanders quits the race. Sanders has suspended his campaign due to medical issues. Markets are worried that Warren – who championed financial regulation – may enter the White House.

Another source of concern comes from US-Sino relations, even though talks have been on a break due to China’s week-long holiday. Reports that the US is considering financial limitations on investments in China. The administration only said that such measures are not planned “at the moment.” Curbing investment would serve as a significant escalation in the trade war.

Overall, the long-list of worries has pushed USD/JPY lower.

US events: High-level trade talks, FOMC Minutes

Chinese Vice Premier Liu He will lead a delegation to Washington for high-level and high-stakes trade talks. The visit comes ahead of a new round of tariffs that the US plans to impose on China – delayed for China’s National Day. Trump recently said that he would not settle for a limited deal but prefers a comprehensive one. One of the thorniest topics is Intellectual Property (IP). China has been reluctant to give ground on IP while offering to buy agricultural goods.

If the world’s largest economies make progress and agree to postpone new levies, USD/JPY has room to rise. If talks break up and the US moves forward with the new duties, the currency pair has room to the downside.

Politics remain high on the agenda as well. Democrats continue their fast-moving impeachment inquiry. If new revelations continue showing up in evidence that officials provide or in media reports, Trump’s approval rating and support for his ousting could rise. Nevertheless, Republicans are unlikely to abandon the president soon. If Trump continues sliding in polls, USD/JPY could edge lower as well.

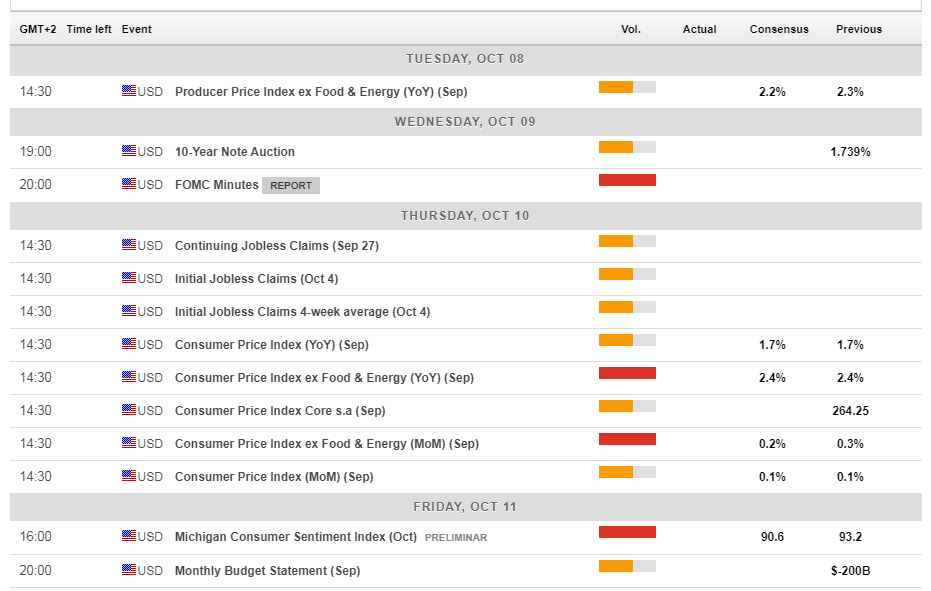

The economic calendar features several significant releases. The Producer Price Index (PPI) serves as a warm-up to consumer prices and may be of interest on Tuesday.

The Federal Reserve’s meeting minutes from the September meeting are scheduled for release on Wednesday. The Fed cut rates for the second consecutive time but refrained from committing to further rate reductions. Three members wanted a different outcome. The minutes may shed light on the split within the ranks of the central bank and could also reveal where the wind is blowing – cutting rates again or taking keeping calm.

While the minutes document an event that took place three weeks ago, it is important to remember that the Fed edits the document until the last minute and knows that markets react to it. Investors may respond to any hint toward the upcoming rate decision.

Inflation figures for September stand out on Thursday. While the Consumer Price Index (CPI) remains relatively low at 1.7% yearly, Core CPI has accelerated to 2.4% in August. Any further advance may lower the chances that the Fed cuts rates in October.

The last word of the week belongs to the University of Michigan’s Consumer Sentiment Index. After confidence bounced in September with 93.2 points, a drop is on the cards in the preliminary release for October. Worse sentiment implies a lower volume of retail sales.

Here are the top US events as they appear on the forex calendar:

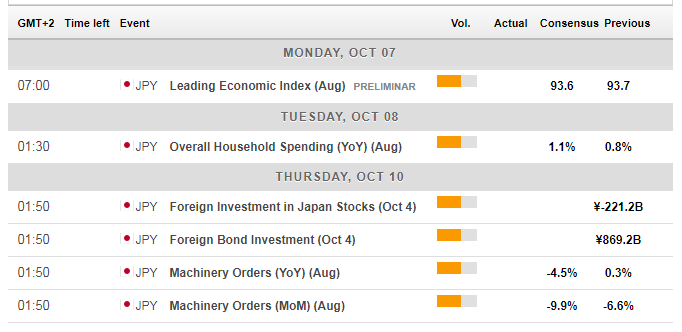

Japan: Watch North Korea

The Japanese Yen is the go-to currency when it comes to safe-havens, and it has played this role successfully once again. Apart from concerns about the global slowdown, trade wars, and politics, the currency may be moved by developments around North Korea. Kim Jong-un’s regime has been recently experimenting with missiles – one of them potentially sent from a submarine – which can move around the world and threaten the US. Any further escalation may boost flows into Japan.

The Japanese economic calendar includes the Leading Economic Index, and Machinery Orders follow overall Household Spending. The latter is expected to show a significant downfall – in line with the global slump in industrial activity.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

While momentum on the daily chart remains positive, USD/JPY is losing the support of the 50-day Simple Moving Average and has also been rejected at 108.50 – both bearish signs. USD/JPY was cushioned at the downtrend support line but leans to the downside after falling below uptrend support in September.

All in all, the bias is leaning in favor of the bears.

Support awaits at 106.50, which was the low point in early October. Further down, 105.75 was a stepping stone on the way up in September and works as support. The next line to watch is 105.05, which provided support in mid-August. The 2019 low of 105.45 is next down the line.

Some resistance awaits at 107, which held USD/JPY up in late September. 107.50 worked as support around the same time and also beforehand. It is followed by 108.25 that held the currency pair down in mid-September. The stubborn double-top at 108.50 is strong resistance. Further up, 109.35 and 1.0995 are noteworthy.

USD/JPY Sentiment

The US economy is suffering a slowdown with growing chances of a recession. The safe-haven yen has room for more falls.

The FXStreet Poll is showing a bearish bias on all timeframes. Average targets have fallen in comparison to the previous week, but are not far from each other. Experts may share the pessimism about the global economy but see only limited falls.

-637057981730860580.png)