- The Securities and Exchange Commission (SEC) has recently sued Ripple.

- The SEC has also just issued a statement on the custody of digital asset securities by broker-dealers.

In a new statement, the Securities and Exchange Commission (SEC) says it will not target broker-dealers of digital asset securities that meet certain requirements in the next five years. This new guidance statement is aimed at obtaining comments which can be submitted to the SEC through various forms.

The Commission recognizes that the market for digital asset securities is still new and rapidly evolving. The technical requirements for transacting and custodying digital asset securities are different from those involving traditional securities. And traditional securities transactions often involve a variety of intermediaries, infrastructure providers, and counterparties for which there may be no analog in the digital asset securities market. The Commission supports innovation in the digital asset securities market to develop its infrastructure.

It seems that the SEC is certainly not against broker-dealers’ custody of securities but it requires them to meet certain compliance requirements with respect to the Customer Protection Rule.

SEC sues Ripple over securities fraud

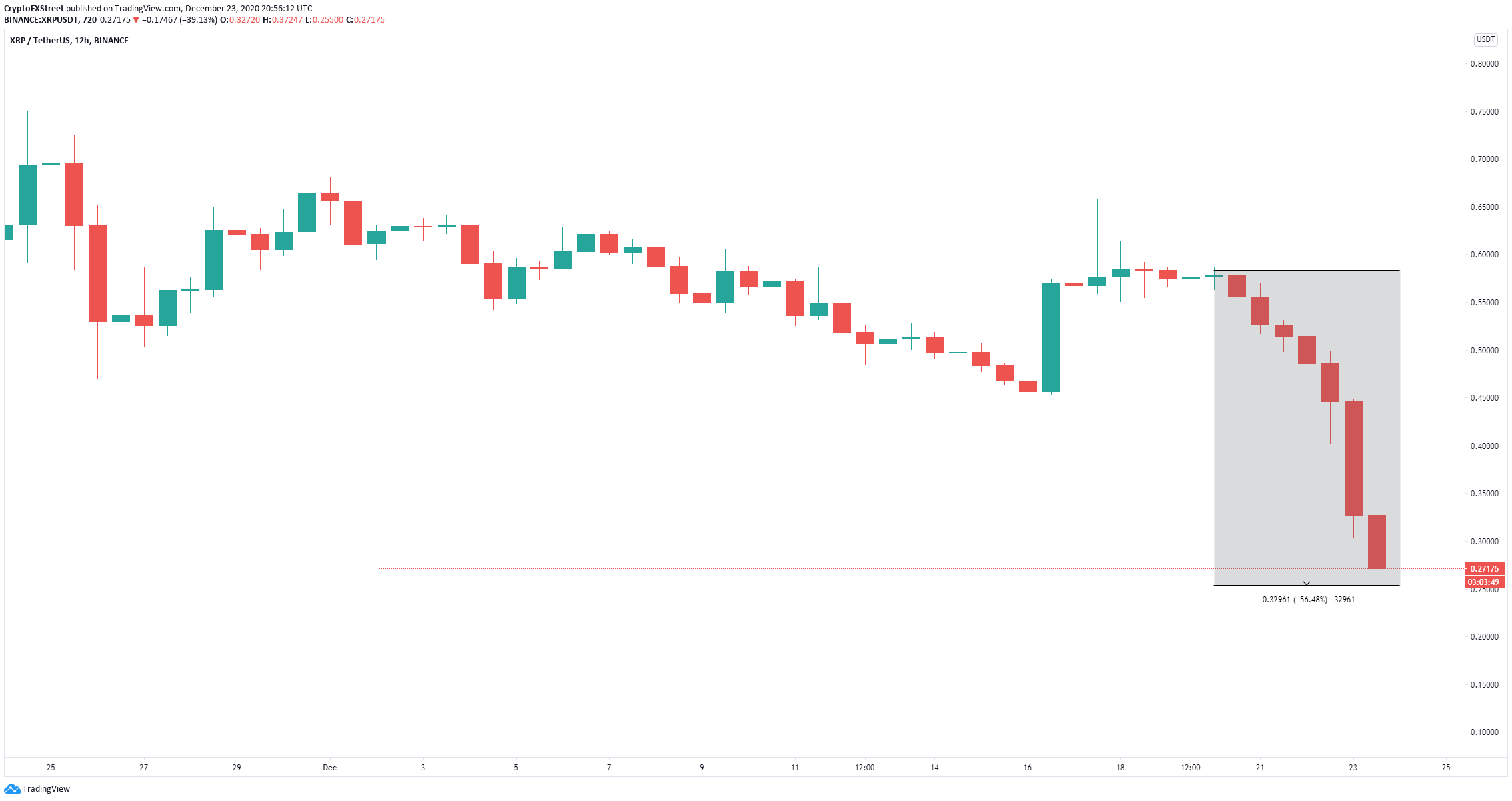

The SEC has also recently sued Ripple stating that XRP is a security and the platform conducted an illegal sale of securities worth around $1.3 billion. XRP price plummeted by more than 50% following the announcement.

XRP/USD 12-hour chart

This lawsuit could have massive detrimental effects on XRP as it implies the digital asset is a security. Many exchanges have already delisted XRP and prominent platforms like Binance and others could follow suit.

Ripple could actually come out victorious of the SEC lawsuit, however, this process will most likely take months, perhaps even more than a year. The price of XRP is already falling extremely fast and if exchanges delist the asset, it could quickly drop towards $0.