- Silver bulls are under severe pressure as bears pounce.

- Bears are making a potential final attempt to take over control in an otherwise losing battle.

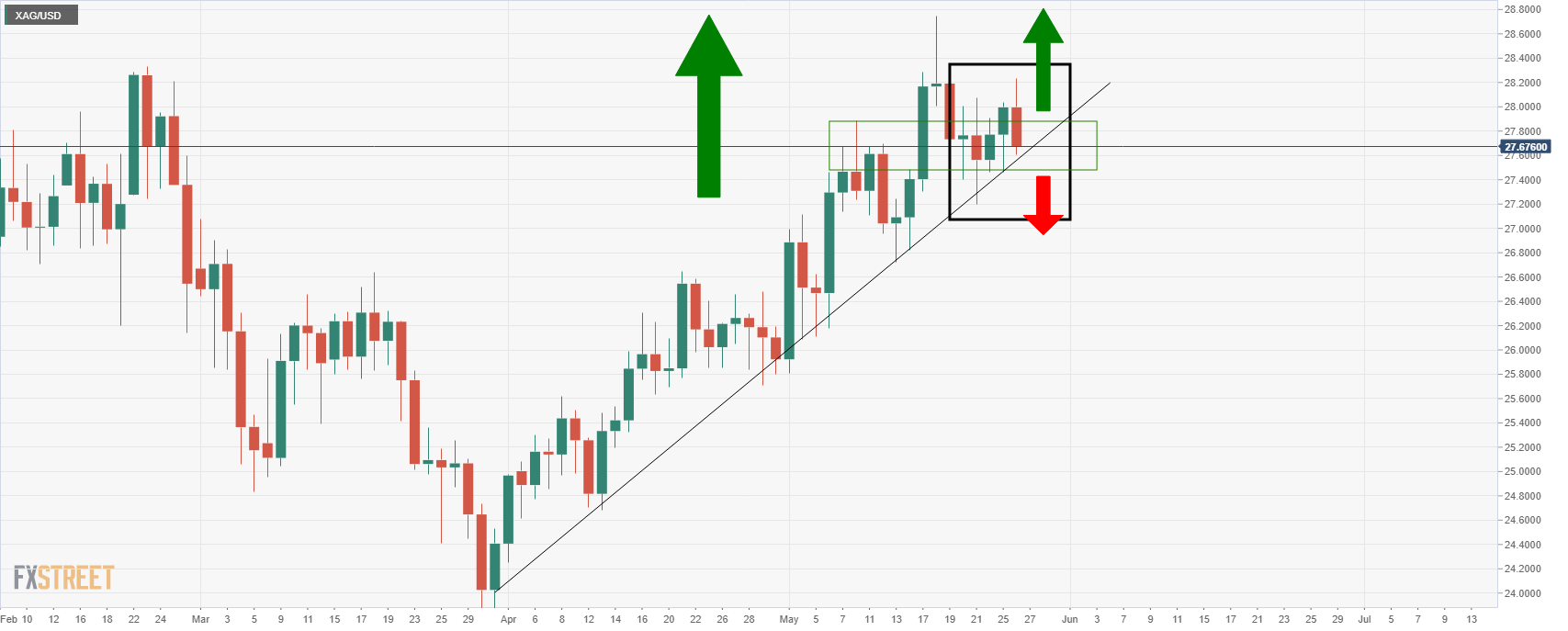

Since 18 May, the price of silver has been developing a bullish case over a series of analysis as follows:

Silver bulls seeking upside continuation from deep correction

Silver bulls seeking a break from daily support

Silver is on track for a daily upside extension

Silver rallies to test bearish commitments

In the latest price development, the bears have potentially come out for their final attempt to squash the bulls.

This has seen a strong rejection into a deep and critical supporting struture.

It is now made or break time for the bulls and the following analysis illustrates this:

Prior analysis, 18 May

”Meanwhile, from a daily perspective, the market is set to close higher and therefore leave a compelling bullish wick on the charts that would be expected to be filled in over forthcoming sessions.”

Live market analysis, 26 May

Since the initial analysis of 18 May, as illustrated in the charts above, the price has since been building a bullish framework across the dynamic support which has come under pressure again in today’s New York session’s trade following an initial upside test of 4-hour resistance overnight.

Prior analysis, 4-hour chart, 25 May

As illustrated, the conditions were apt for bulls to position for a discount on failure so the resistance.

The price, however, has corrected to test a deeper support structure and the 78.6% Fibonacci retracement level which offers a larger discount for committed bulls at the dynamic trendline support:

In doing so, however, there is now a new resistance structure for the final challenge for the bulls to ver come of this breakout sequence.

With that being said, a break of and a close below the current support structure will invalidate the bullish bias for the meanwhile and leave an emphasis on the downside below dynamic support that would be expected to turn into a counter trendline resistance.