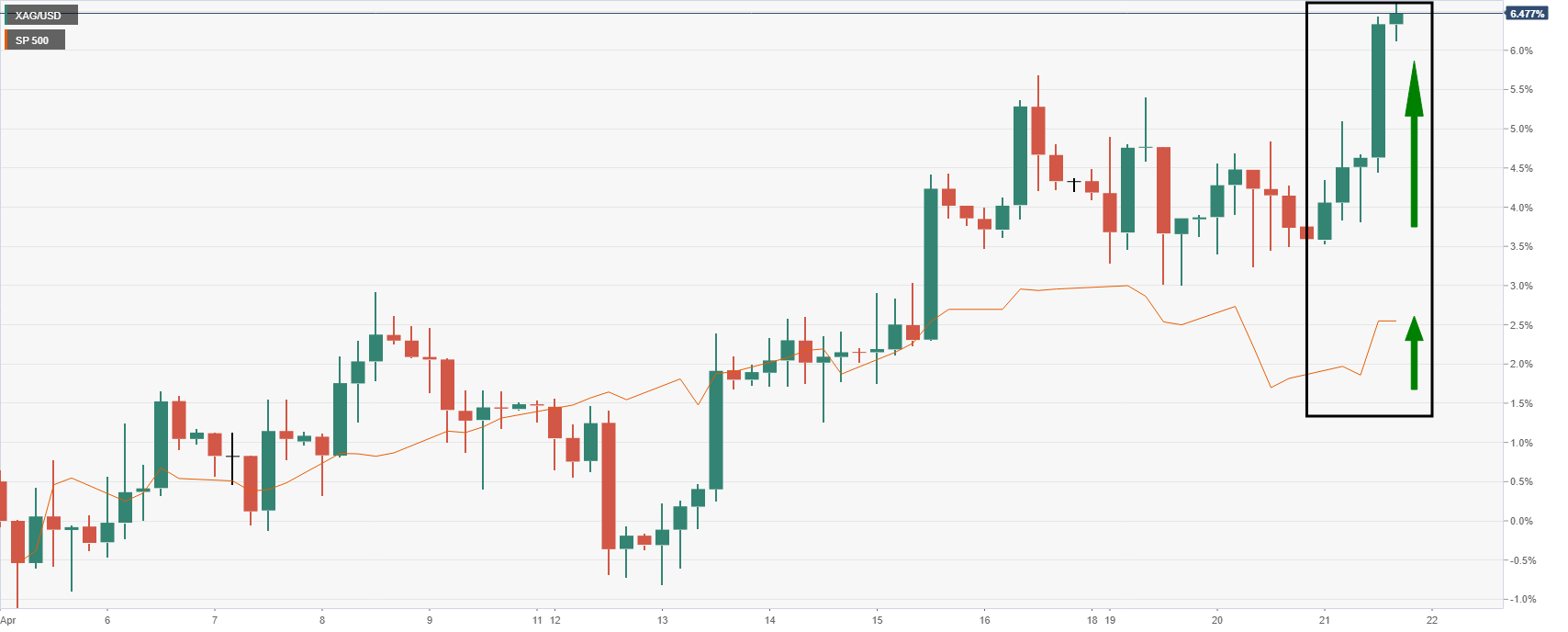

- Silver remains positively correlated to the stock market.

- Bulls are seeking a break of the daily resistance if the S&P 500 can penetrate resistance.

As per the prior analysis, ‘Silver is stalling on the offer, but intermarket correlations are compelling’ the price of silver continues to depend on the stock market.

Wall Street has rebounded following a two-day fall which has weighed on the greenback on Wednesday and lifted the price of the white metal.

S&P 500 / XAG/USD 4-hour chart

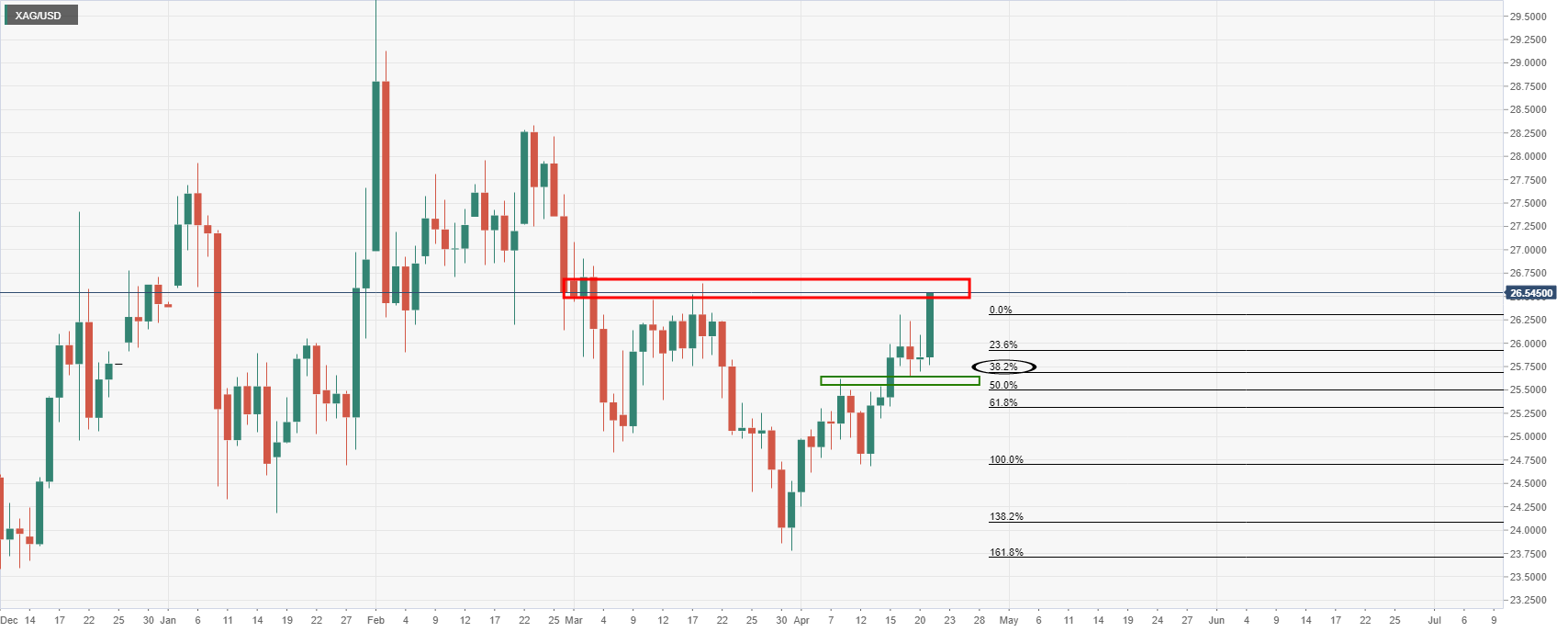

Meanwhile, this has translated into a fresh daily bullish impulse following a correction to the 38.2% Fibonacci retracement area and monthly support:

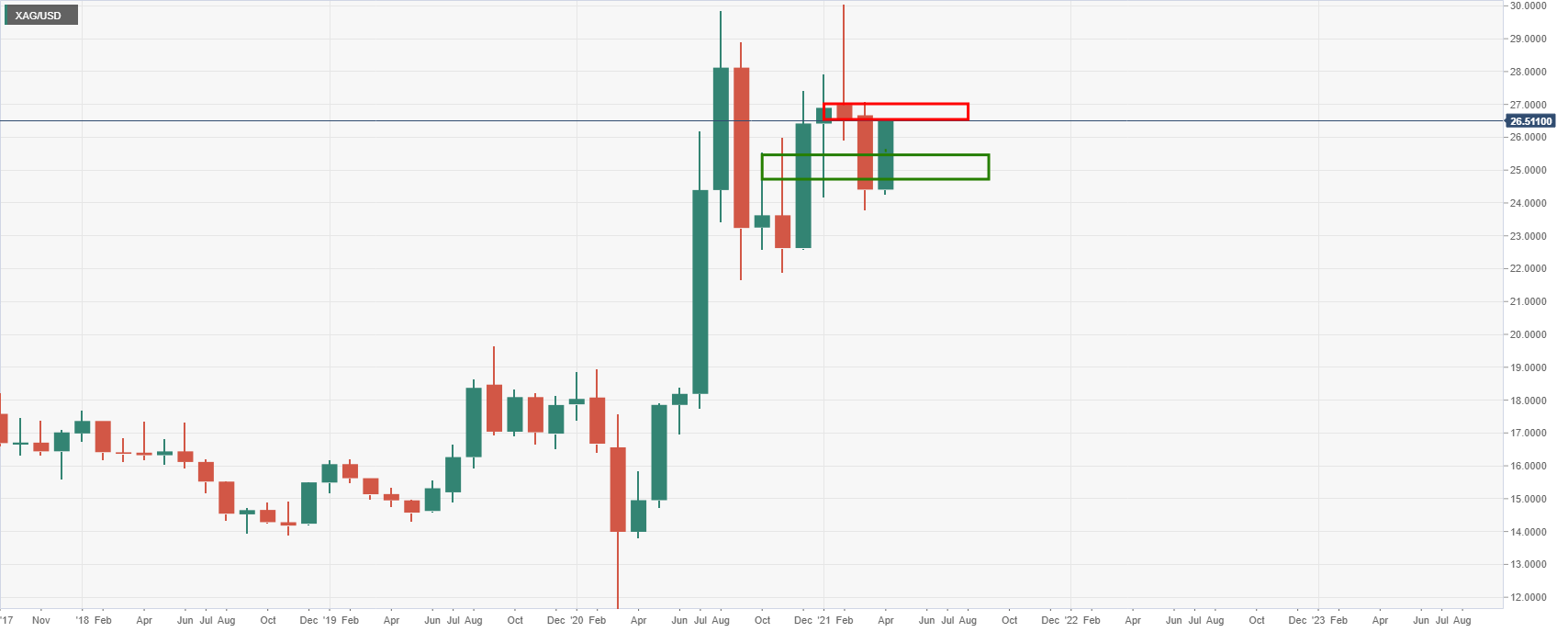

Monthly chart

A break of monthly resistance is now the focus.

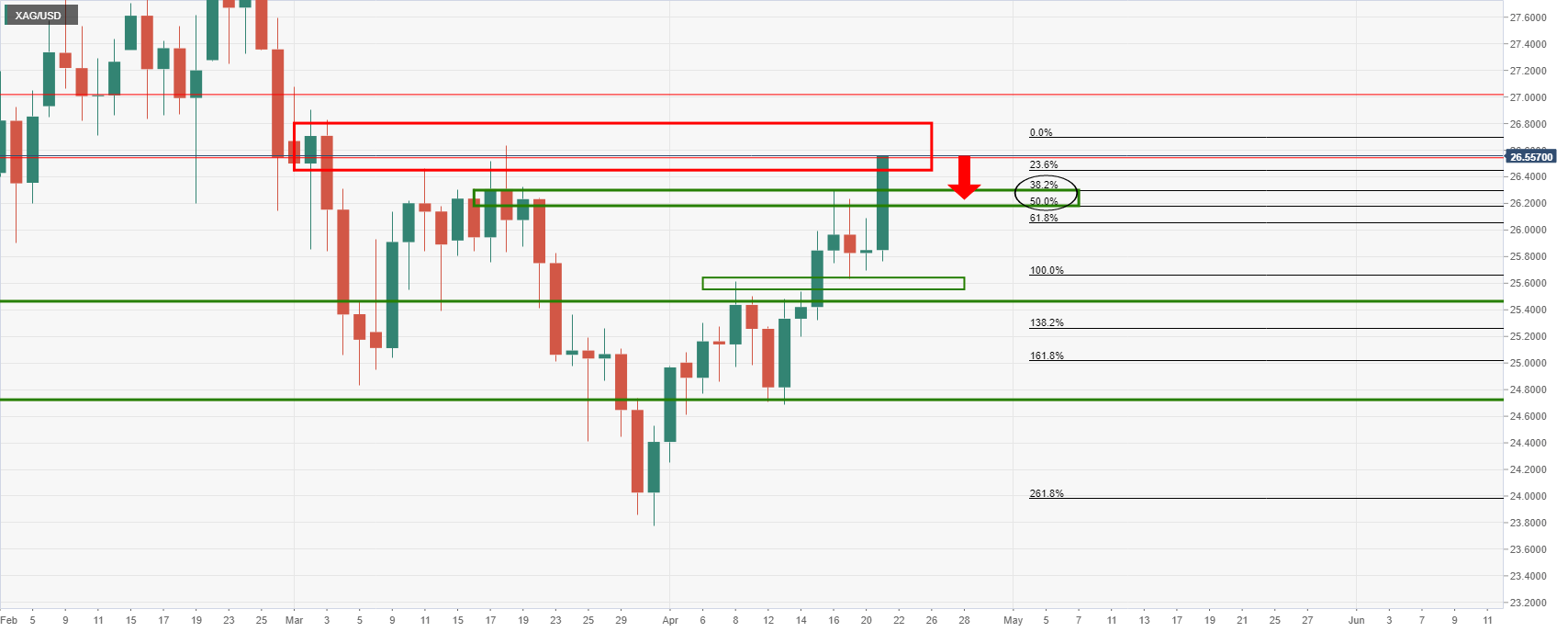

Moving down to the daily chart, however, is where the action will be for the near term noting the daily resistance.

Daily resistance

The price is meeting a daily resistance zone and while there is room for a deeper test of the bear’s commitments, the path of least resistance is likely to the downside.

There is the case for a restest of the prior resistance now expected to turn support.

However, again, the correlation with the stock market is compelling and should the S^P 500 continue to recover and move higher, then silver will likely clear the daily resistance.

This will set the stage for a test of the moth resistance for a fresh bullish impulse towards higher highs.

S&P 500 daily chart

-637546292425846488.png)