- Silver prints mild gains after Monday’s bounce off 50-bar SMA.

- Bearish chart pattern needs validation from a downside break of $23.60.

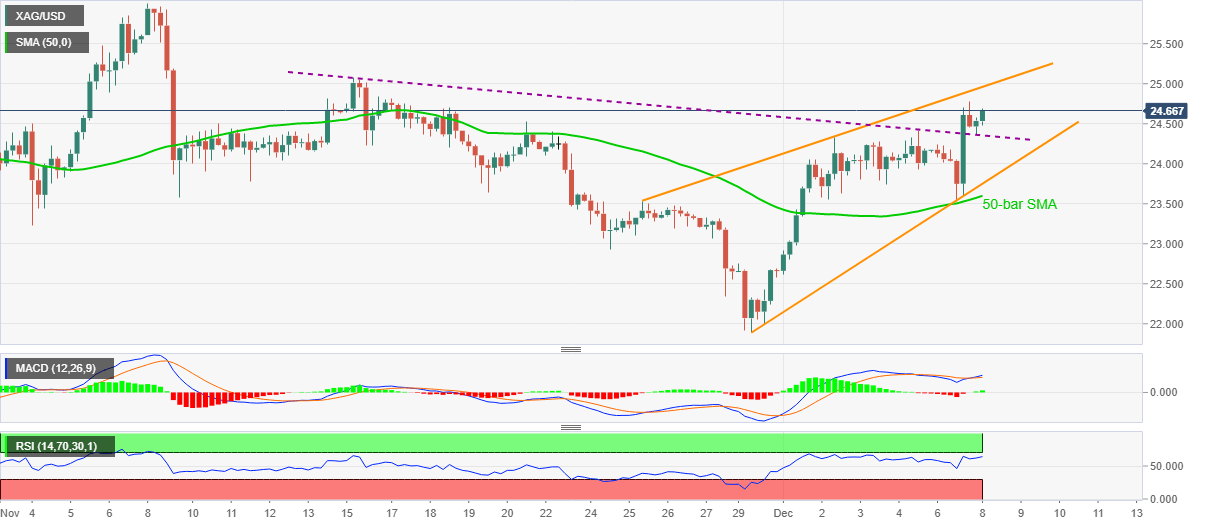

Silver prices pick up bids near $24.62, up 0.32% intraday, during early Tuesday. In doing so, the white metal extends the previous day’s U-turn from 50-bar SMA inside a bearish chart formation on the four-hour (4H) play.

It should, however, be noted that the quote’s sustained break of a three-week-old falling trend line currently propels the bullion towards the upper line of the stated wedge, currently around $25.00.

If at all the bulls manage to cross $25.00, November’s high near $26.00 should return to the charts.

Meanwhile, a downside break below the immediate support, previous resistance, at $24.37 now, will not only have to slip beneath the wedge’s support near $23.75 but also under the 50-bar SMA level of $23.60 to confirm further weakness.

Following that, the monthly bottom of $21.89 will be the key for the silver bears.

Silver four-hour chart

Trend: Pullback expected