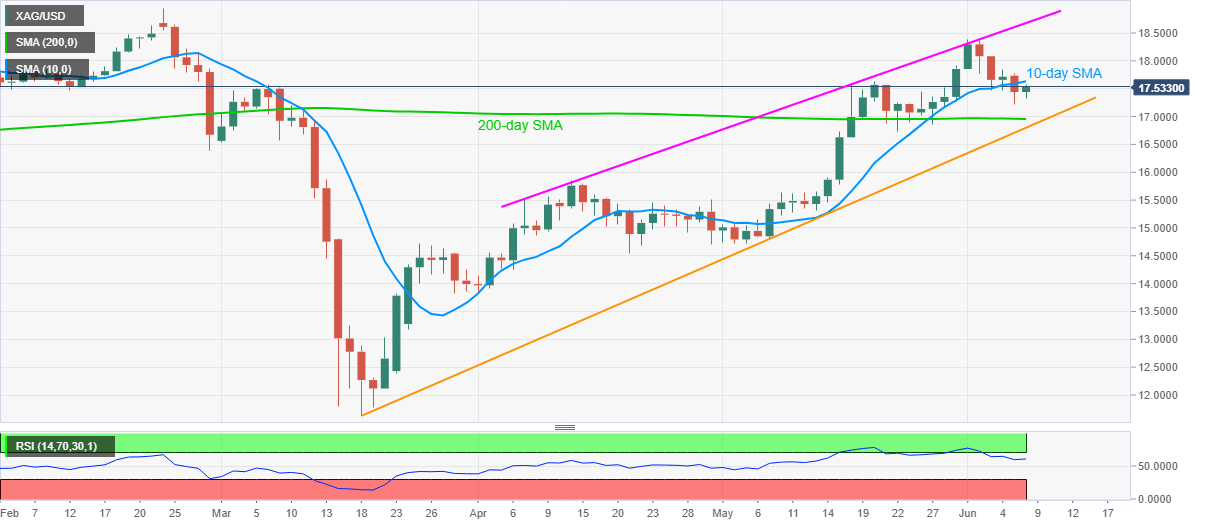

- Silver prices bounce off a one-week low of $17.22 to probe 10-day SMA.

- A two-month-old ascending trend line could restrict the quote’s further advances.

- An upward sloping support line from March 19 limits the short-term downside.

Having taken a U-turn from one-week low, Silver prices take the bids near $17.55, up 0.64% on a day, during Monday’s Asian session.

Even so, the white metal stays below 10-day SMA, not to forget remaining below a rising trend line from April 07.

As a result, the bears keep a 200-day SMA level of $16.96 as an immediate target during the fresh declines.

However, a 12-week-old support line, at $16.80 now, could restrict the bullion’s additional weakness.

Alternatively, an upside clearance of 10-day SMA, currently near $17.63, could push the prices towards the current month high around $18.39/40.

However, bulls are less likely to dominate unless clearing an ascending trend line from April 07, at $18.68 now.

Silver daily chart

Trend: Further weakness expected