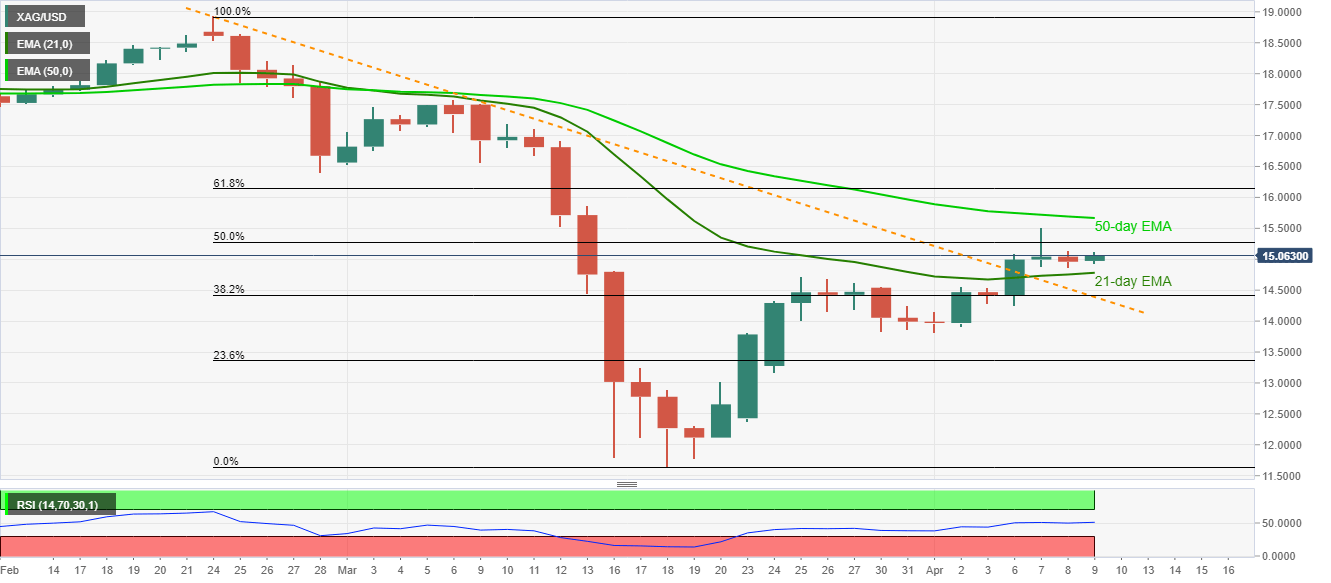

- Silver prices reverse the previous day’s losses with gains.

- Normal RSI conditions keep favoring range-bound trading between short-term key EMAs.

- February’s low can lure the bulls during the upside, the resistance-turned-support line can check the bears alternatively.

Despite reversing the previous day’s losses, with 0.65% gains to $15.06, silver prices remain between short-term key EMAs ahead of Thursday’s European session.

While a sustained break beyond a six-week-old falling trend line favor buyers to confront a 50-day EMA level of $15.67, failures to cross 50% Fibonacci retracement of February-March drop signals pullback to $14.78 support comprising 21-day EMA.

It should also be noted that the industrial metal remains above the multi-day-old falling resistance line, now support, around $14.40, which also nears 38.2% Fibonacci retracement level.

During the bullion’s rise past-$15.67, 61.8% Fibonacci retracement level of $16.14 may offer an intermediate halt to February month low close to $16.40.

Alternatively, the current month’s low near $13.80 can entertain the sellers below $14.40.

Silver daily chart

Trend: Sideways