- Silver witnessed a turnaround from the $25.60 confluence resistance, or two-week tops.

- A sustained break below an ascending channel should pave the way for a further decline.

- Bulls might now wait for a move beyond the mentioned barrier before placing fresh bets.

Silver witnessed some selling on the last trading day of the week and erased a major part of the previous day’s gains to over two-week tops. The XAG/USD was last seen trading around the $25.15-20 region, down 1.05% for the day.

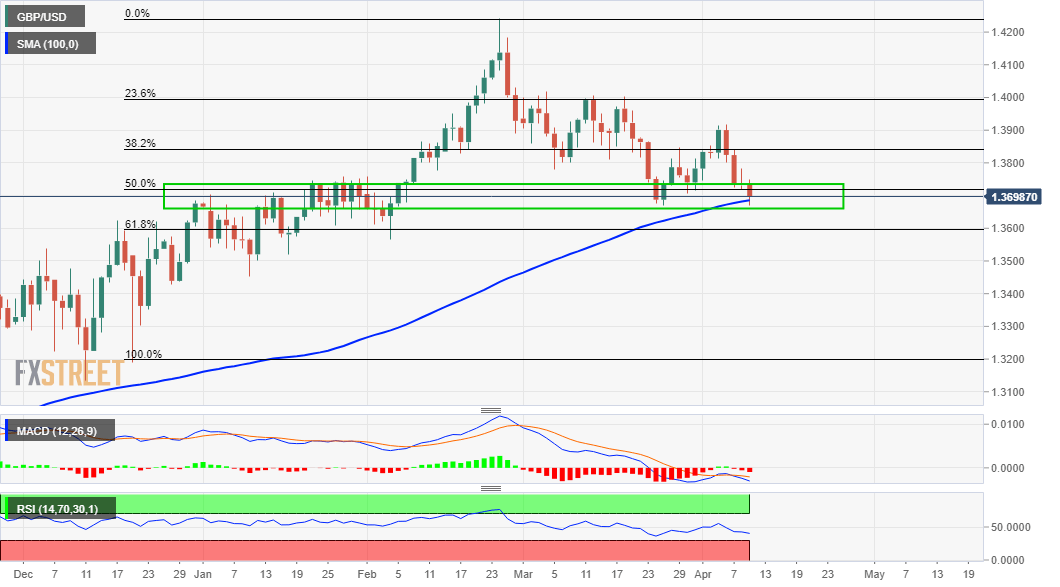

The recent bounce from YTD lows touched on March 31 stalled near the $25.60 confluence region. The mentioned barrier comprised of the 61.8% Fibonacci level of the $26.64-$23.78 decline and the top end of a short-term ascending channel. This should now act as a pivotal point for short-term traders and help determine the next leg of a directional move for the XAG/USD.

The white metal, so far, has shown some resilience below the 50% Fibo. level and managed to hold its neck above the $25.00 psychological mark. The said level coincides with the trend-channel support, which if broken decisively might trigger some technical selling. This, in turn, will set the stage for a slide towards testing 38.2% Fibo. level, around the $24.85 region.

Meanwhile, technical indicators on hourly charts have again started drifting into the negative territory. Moreover, oscillators on the daily chart are yet to recover from the bearish zone. The set-up supports prospects for an eventual break to the downside and resumption of the prior/well-established downward trajectory witnessed over the past two months or so.

The next relevant bearish target is pegged near the $24.45 region, or 23.6% Fibo. level. Some follow-through selling will negate any near-term positive bias and turn the XAG/USD vulnerable to accelerate the fall towards the $24.00 round-figure mark. The momentum could further get extended and drag the commodity back towards YTD lows, around the $23.80-75 region.

On the flip side, the $25.60 region might continue to act as immediate strong resistance and cap the upside for the XAG/USD. That said, a sustained move beyond might prompt a fresh short-covering move and assist the metal to aim back to reclaim the $26.00 mark. Any subsequent move up would allow bulls to challenge the $26.40-50 heavy supply zone.

XAG/USD 1-hour chart

Technical levels to watch