- Silver remained depressed for the second consecutive session on Monday.

- The set-up seems to have already shifted back in favour of bearish traders.

Silver edged lower for the second consecutive session on Monday, albeit lacked any strong follow-through selling. The white metal, so far, has managed to hold its neck above the key $25.00 psychological mark.

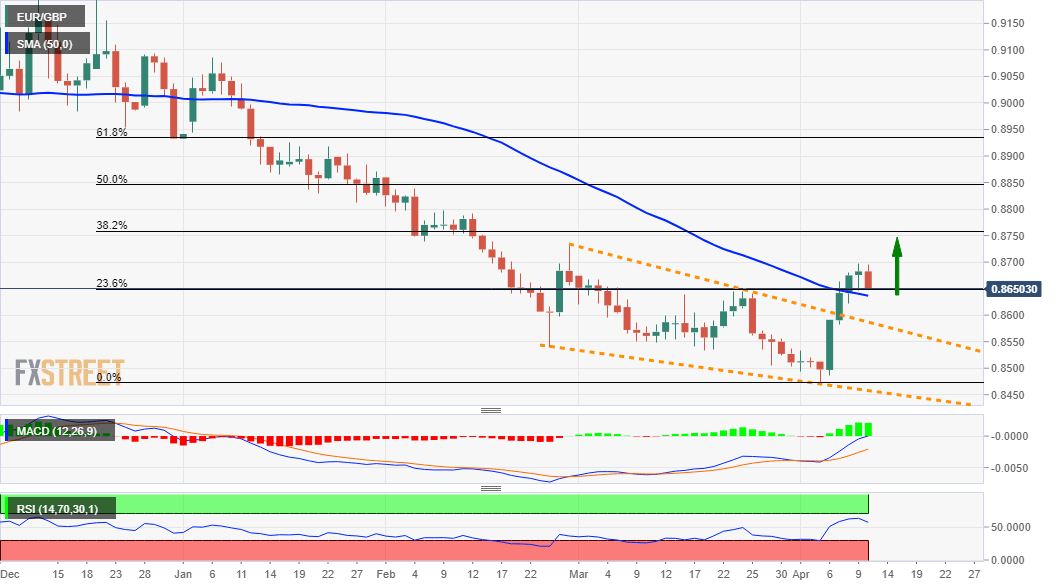

Looking at the technical picture, the recent bounce from YTD lows touched on March 31 stalled near a resistance marked by the 61.8% Fibonacci level of the $26.64-$23.78 decline, around the $25.60 region. A subsequent breakthrough short-term ascending channel support, which coincided with the 50% Fibo. level has shifted the bias back in favour of bearish traders.

The outlook is reinforced by the fact that technical indicators on the daily chart maintained their bearish bias and have again started drifting into the negative territory on hourly charts. This, in turn, supports prospects for the resumption of the commodity’s recent downward trajectory from the $30.00 mark witnessed over the past two months or so.

Hence, some follow-through weakness towards the 38.2% Fibo. level, around the $24.85-80 region, now looks a distinct possibility. The next relevant bearish target is pegged near the $24.45 region, or 23.6% Fibo. level, which if broken will turn the XAG/USD vulnerable to accelerate the fall towards the $24.00 mark en-route YTD lows, around the $23.80-75 region.

On the flip side, the $25.60 region might continue to act as immediate strong resistance and cap the upside for the XAG/USD. That said, a sustained move beyond might prompt a fresh short-covering move and assist the metal to aim back to reclaim the $26.00 mark. Any further move up would allow bulls to challenge the $26.40-50 heavy supply zone.

XAG/USD 1-hour chart

Technical levels to watch