- Silver remains depressed around lowest since September 25, flashed on Friday.

- Oversold RSI suggests bounce off short-term bearish chart pattern.

- 200-bar SMA can lure the bulls during the upside break to the channel.

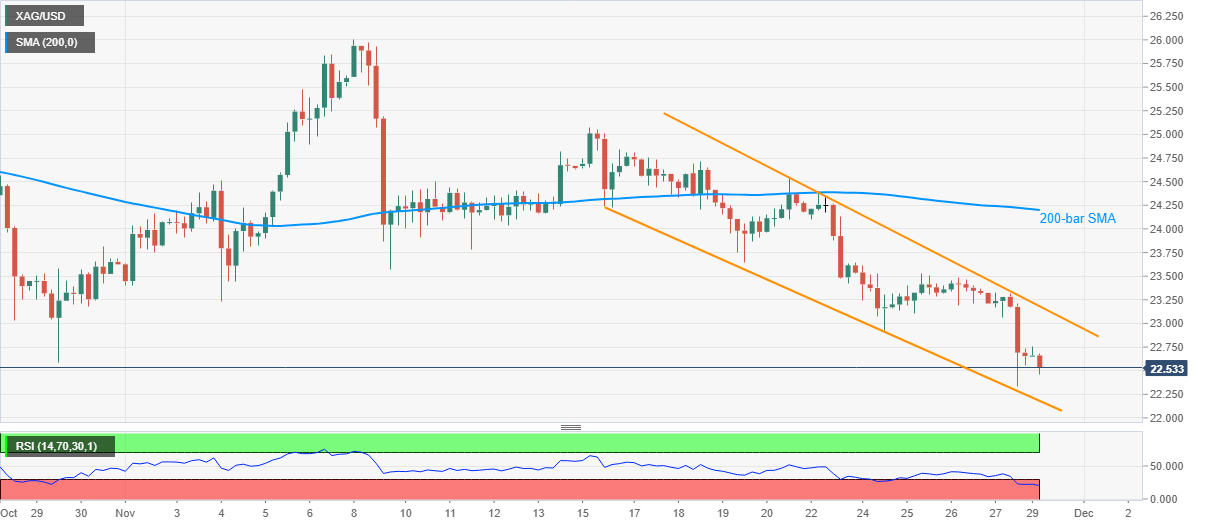

Silver prices decline to $22.50, down 0.60% intraday, during Monday’s Asian session. The while metal dropped to the lowest in five weeks on Friday before bouncing off $22.33. However, failures to cross a downward sloping channel formation since November 16 keeps the sellers hopeful.

It should be noted that the oversold RSI conditions are likely to challenge the silver bears around the stated channel’s support line, at $22.18 now, failure to which can recall the $22.00 round-figure on the chart.

Also acting as the key downside support is September’s low near $21.65.

Alternatively, an upside clearance of the channel resistance, near $23.20, can trigger the run-up towards a 200-bar SMA level of $24.20.

During the quote’s further upside past-$24.20, the mid-month top around $25.10, and the monthly peak close to $26.00 will be in the spotlight.

Silver four-hour chart

Trend: Bearish