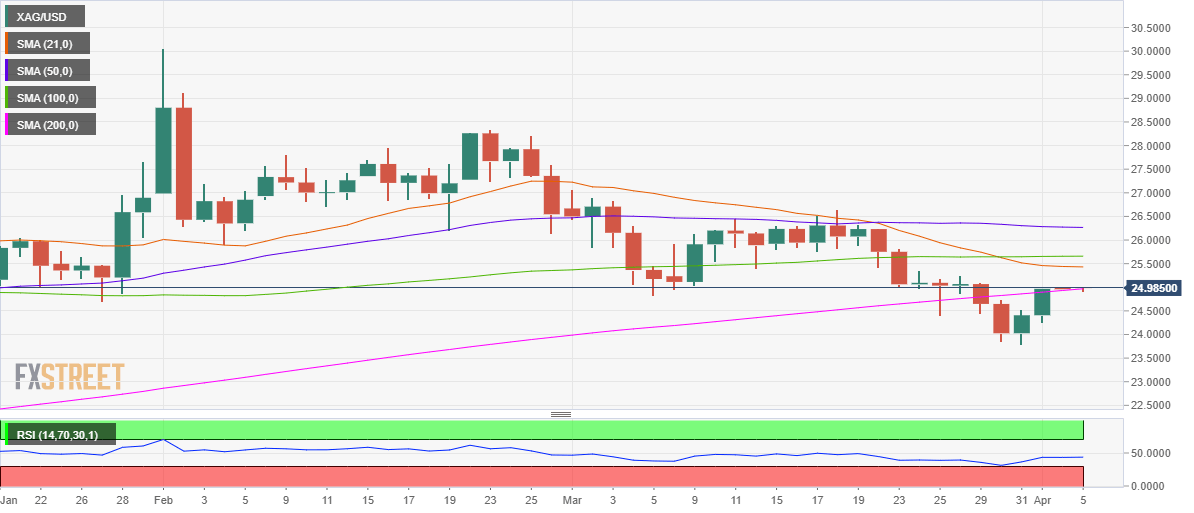

- Silver’s daily closing above 200-DMA on Friday revives the bullish trades.

- But bearish RSI on the daily chart keeps the sellers hopeful.

- 21-DMA at $25.44 could act as a strong resistance for XAG/USD.

Silver (XAG/USD) is clinging onto the critical support while wavering around the $25 mark amid holiday-thinned Easter Monday trading.

That support $24.93 is where the 200-daily moving average (DMA) lies. Note that the price managed to recapture the latter and closed Thursday above it, extending its recovery from over one-month lows.

Although the bulls appear to lack follow-through bias, as the 14-day Relative Strength Index (RSI) continues to trade within the bearish territory, limiting further upside attempts.

Immediate resistance aligns at $25.44, the horizontal 21-DMA, above which the powerful 100-DMA barrier at $25.66 could be retested.

Silver Price Chart: Daily

Alternatively, a breach of the 200-DMA support could once again expose the multi-week troughs at $23.78.

Ahead of that, the bears may need to tackle the $24 psychological mark.

Silver Additional levels