- Silver fails to recover, holds lower ground off-late.

- Weekly resistance line directs sellers toward 200-SMA.

- March 18 high adds to the upside barriers beyond the stated channel.

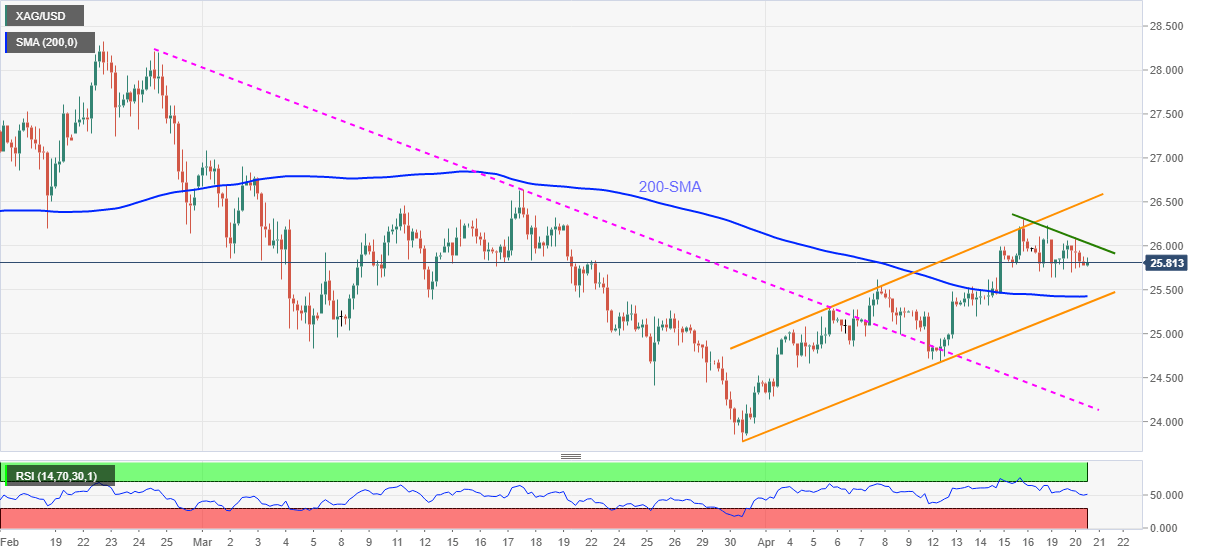

Silver prices cool down the previous day’s recovery moves around $25.80, down 0.05% intraday, during Wednesday’s Asian session.

The yellow metal prints a lower high formation since last Friday, which in turn joins the downward sloping RSI line to back the silver sellers.

However, 200-SMA and support line of an ascending trend channel from March 31, respectively around $25.40 and $25.30, will be tough supports to watch during any further weakness.

It should also be noted that the commodity sellers will have to break the previous resistance line stretched from February 25, near $24.20, to convince the bears.

Alternatively, an upside break of the immediate resistance line, close to $26.05, should trigger the fresh rise targeting the upper line of the stated channel, near $26.50. Though, any further upside will need a clear run-up past March 18 peak surrounding $26.65 to back the silver bulls.

Silver four-hour chart

Trend: Further weakness expected