- Silver stays firms, on the bids to refresh weekly top.

- U-turn from yearly support line, break of two-week-old resistance favor bulls.

- Descending trend line from February 01 adds to the upside barriers.

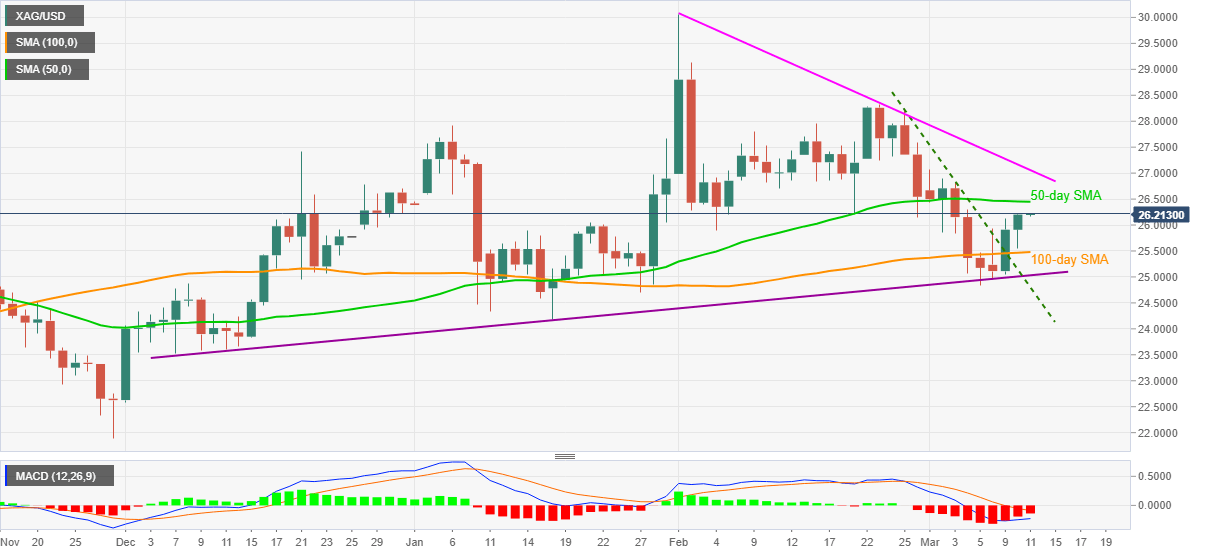

Silver rises to $26.20, up for the third consecutive day, while refreshing the weekly high during Thursday’s Asian session. In doing so, the white metal extends the early week’s bounce off an ascending trend line from December 11, 2020, while cheering sustained trading above 100-day SMA and a falling resistance line, now support, from February 25.

Given the receding strength of the bearish MACD also pushing the silver sellers back, the metal is up for confronting 50-day SMA resistance near $26.50.

However, the quote’s further upside will be challenged by a five-week-long downward sloping resistance line, at $27.05 now, a break of which will not hesitate to challenge the late February tops near $28.35.

Meanwhile, a 100-day SMA level of $25.50 and the yearly support line, currently around $25.00, should restrict the commodity’s short-term pullback ahead of the previous resistance line and the monthly bottom surrounding $24.80.

If at all the white metal remains weak below $24.80, odds of its further weakness towards the yearly low near $24.20 can’t be ruled out.

Silver daily chart

Trend: Further upside expected