- Silver stays heavy near recently flashed three-day low.

- 100-bar SMA, multiple levels marked since late-December probe the bulls.

- 200-bar SMA, weekly support lure the silver sellers.

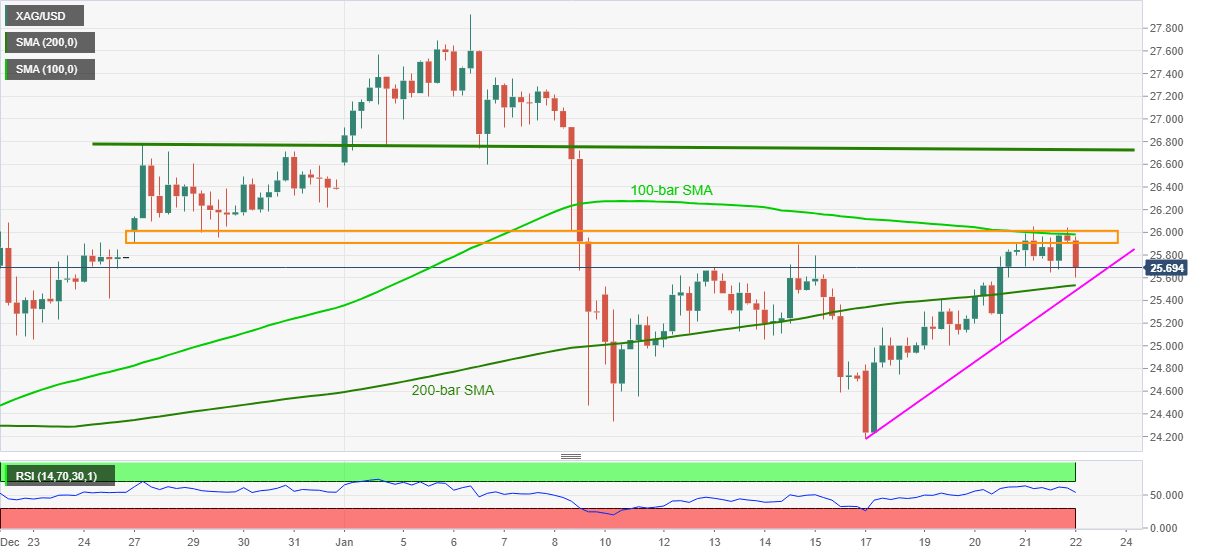

Silver remains offered near the intraday low of $25.60, currently down 1.1% near $25.70, during Friday’s Asian session. In doing so, the white metal justifies its pullback from the key $25.90-$26.00 resistance area while probing Wednesday’s low.

Considering the quote’s sustained reversal from multiple highs and lows marked since December 27, as well as 100-bar SMA, coupled with the downward sloping RSI, silver prices are likely to remain pressured.

However, a confluence of 200-bar SMA and an upward sloping trend line from Monday, near $25.53-48, will offer a tough fight to the commodity sellers.

If at all the bullion bears dominate past-$25.48, the monthly low of $24.18 will should return to the charts. During the fall, the $25.00 can offer an intermediate halt.

On the flip side, a clear run-up past-$26.00 will direct silver buyers toward a one-month-old horizontal resistance near $26.75.

It should, however, be noted that the silver bull’s ability to conquer the $26.75 hurdle enables them to refresh the monthly peak beyond $27.92.

Silver four-hour chart

Trend: Pullback expected