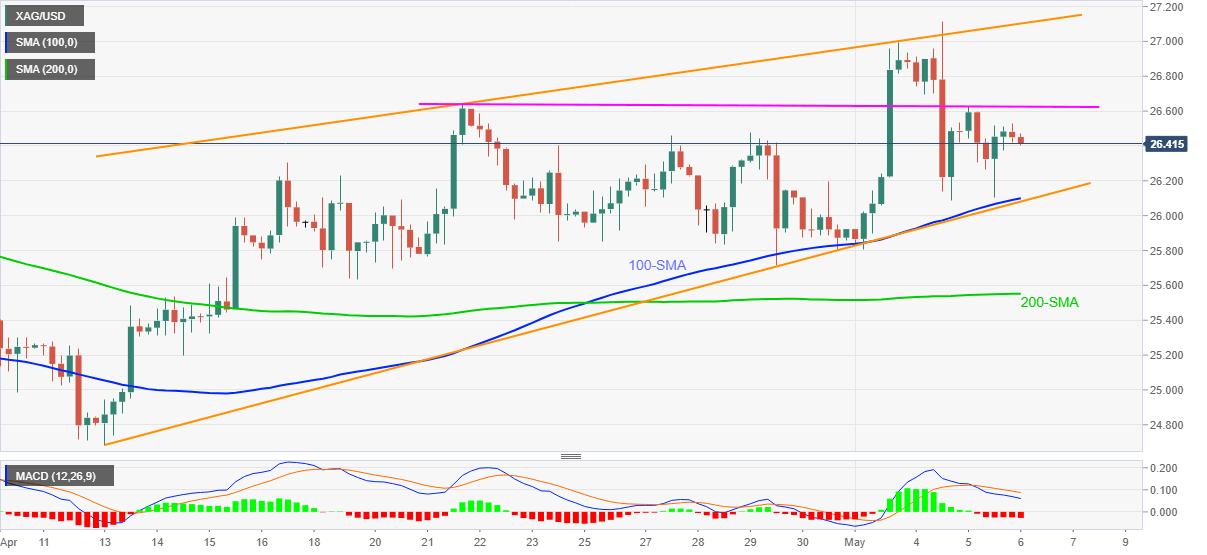

- Silver bounces off intraday low, stays offered for third consecutive day.

- Bearish chart formation, MACD signals keep sellers hopeful.

- 100-SMA adds strength to the wedge’s support line.

Silver drops 0.12% intraday despite taking a U-turn from the day’s low of $26.40 during early Thursday. Even so, the white metal prints a three-day downtrend inside a bearish chart pattern.

With the MACD signals also supporting silver sellers, the latest weakness in prices could extend towards confirming the rising wedge bearish formation. However, 100-SMA offers extra strength to the $26.10 key support.

Also, the downside moves past $26.10 will be need validation from the $26.00 before directing the bears toward the sub-$24.00 theoretical target. Additionally, 200-SMA near $25.55 is an extra filter to the south.

Meanwhile, recovery moves need to cross $26.60-65 horizontal resistance before targeting the $27.00 round figure.

However, any further upside beyond $27.00 will be tested by the said wedge’s upper line near $27.10.

Overall, silver bulls are tiring and a bearish chart pattern keeps traders look for fresh clues to increase sell positions.

Silver four-hour chart

Trend: Further weakness expected