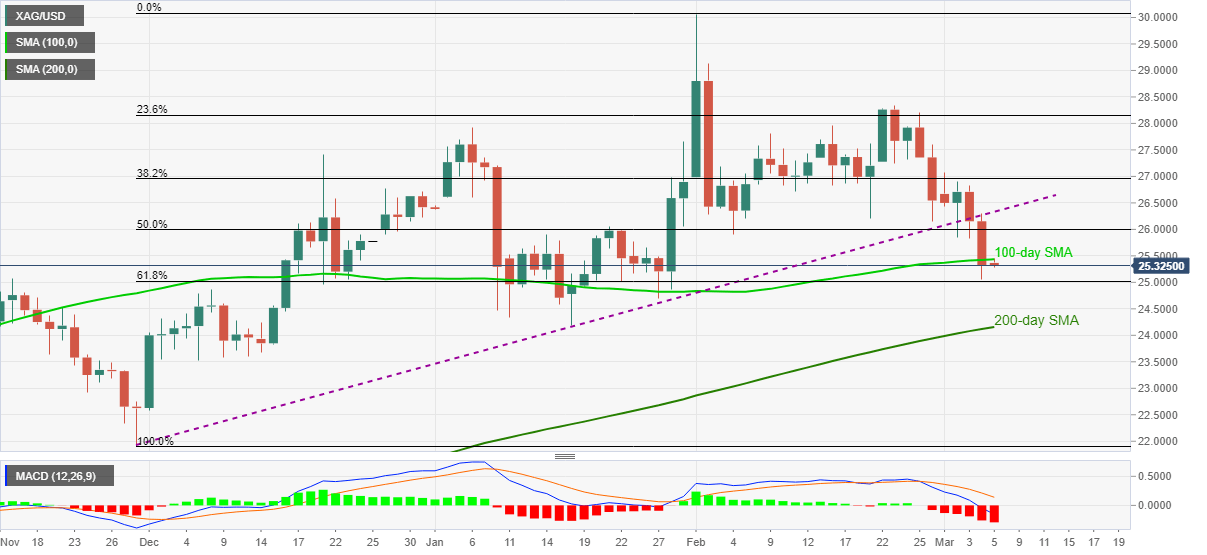

- Silver fades bounce off five-week low while staying below 100-day SMA.

- Sustained break of three-month-old support line, bearish MACD also favor sellers.

- 61.8% Fibonacci retracement level offers a breathing space during the drop to 200-day SMA.

Silver prices remain heavy near late January lows, currently down 0.23% around $25.30, during Friday’s Asian session. The white metal dropped the fresh bottom in multiple days after breaking an ascending trend line from November 30 the previous day.

The bearish bias also gains support from the metal’s failure to recover from recent lows while staying below 100-day SMA amid bearish MACD.

Hence, silver sellers are en route 200-day SMA level of $24.15. Though, 61.8% Fibonacci retracement of November 2020 to February 2021 upside, at $25.00, offers immediate support to the quote.

It’s worth mentioning that there are multiple supports around $23.60 for the commodity to break below $24.15 while targeting lows marked during late-2020 near $21.90.

Alternatively, an upside clearance of 100-day SMA, at $25.43 now, needs validation from 50% of Fibonacci retracement and previous support line, respectively around $26.00 and $26.30, before recalling the silver buyers.

Following that, $26.90, the $27.00 threshold and February 23 top near $28.33 will add to the upside filters.

Silver daily chart

Trend: Bearish