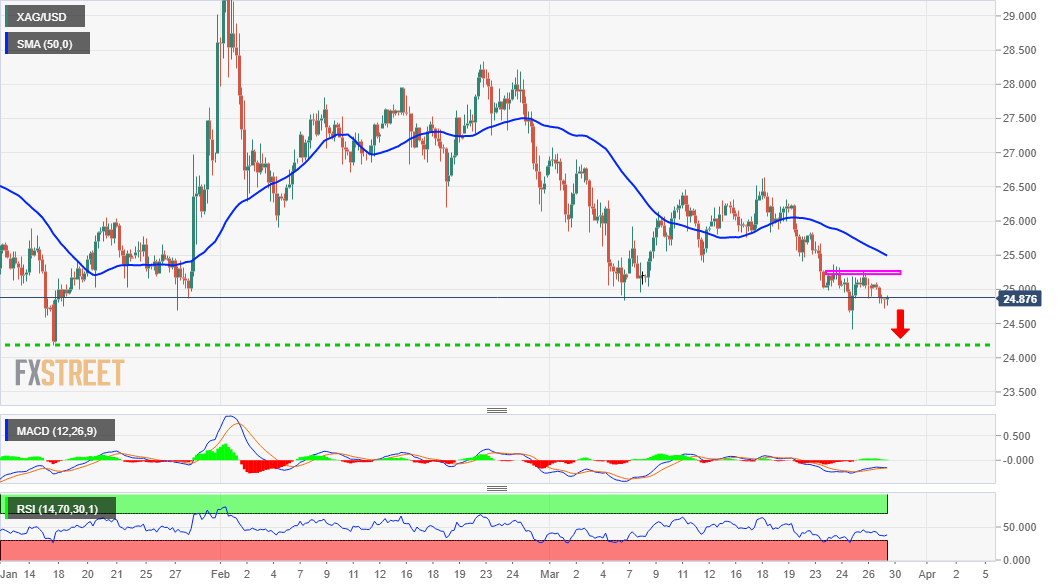

- Silver witnessed some selling on Monday and extended its slide from the $25.25-30 supply zone.

- The bias favours bearish traders and supports prospects for a decline to retest the $24.00 mark.

Silver remained under some selling pressure through the mid-European session and was last seen hovering near two-day lows, around the $24.75-80 region. The mentioned area coincides with the very important 200-day SMA, which if broken decisively should pave the way for additional losses.

Given that last week’s rebound from over two-month lows lost steam near the $25.25-30 supply zone, the bias remains titled firmly in favour of bearish traders. The outlook is reinforced by the fact that bearish technical indicators on hourly/daily charts are holding above the oversold territory.

The set-up supports prospects for a further near-term depreciating and an extension of the recent sharp pullback from the key $30.00 psychological mark. Hence, a subsequent slide below the $24.40 region, towards challenging YTD lows near the $24.00 mark, remains a distinct possibility.

Some follow-through selling should pave the way for a fall towards the next relevant support near the $23.60-55 area en-route the $23.00 mark. The downward trajectory could further get extended and drag the XAG/USD towards November 2020 daily closing lows, around the $22.60 level.

On the flip side, any attempted recovery back above the $25.00 mark is likely to meet with some fresh supply near the $25.25-30 region. A sustained move beyond might trigger a short-covering move and lift the XAG/USD beyond the $25.80 intermediate resistance, back towards the $26.00 round-figure mark.

This is followed by resistance near the $26.30-40 region, which if cleared decisively will negate any near-term negative bias. The XAG/USD might then aim back to reclaim the $27.00 mark before eventually darting towards the $27.35-40 resistance zone ahead of the $27.80-90 barrier.

XAG/USD 4-hourly chart

Technical levels to watch