- Spot silver has recovered from Wednesday lows around $26.70 and trades comfortably back above $27.00 again.

- The precious metal has been consolidating within a bull flag and could see a breakout to the upside.

Spot silver prices tumbled on Wednesday, dropping to lows around $26.70 However, since the start of Thursday’s Asia Pacific session, silver markets have managed to regain some composure and spot prices have managed to comfortably reclaim the $27.00 level. At present, XAG/USD trades with gains of around 20 cents or 0.7% in the $27.20s.

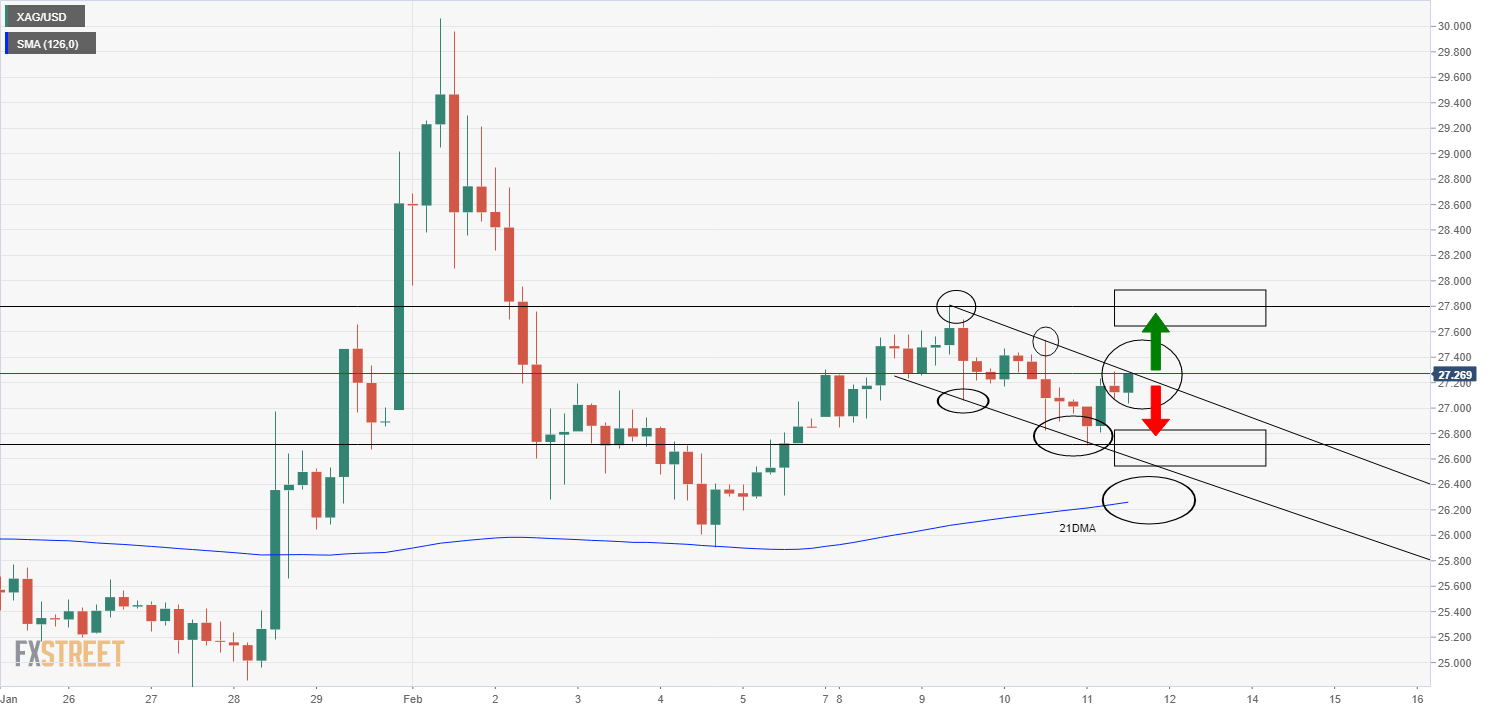

Technically speaking, XAG/USD prices have formed a bull flag in recent days. A break above this bull flag could open the door to further gains back towards highs from the start of the week around $27.80. If the bears regain momentum, they will first try to push silver back to fresh weekly lows under $26.70 ahead of a drive towards XAG/USD’s 21-day moving average at $26. 26.

Driving the session

The US dollar continues to trade with a negative bias amid a risk-friendly market tone (US and European stocks trade higher), providing a tailwind for precious metal markets. Softer than anticipated US weekly initial jobless claims numbers for the week ending on 6 February (came in at 793K versus forecasts for closer to 750K) have largely failed to dampen the broad market tone;

Markets are still expecting the US Congress to deliver another sizeable fiscal stimulus package, vaccine rollouts continue, Covid-19 infections rates are dropping and the US Federal Reserve is set to maintain its ultra-dovish monetary policy stance, as affirmed by Fed Chair Jerome Powell in his remarks to the Economic Club of New York on Wednesday.

Looking ahead, inflation expectations and real US yields are set to be crucial driving factors behind precious metal price action; the former is likely to continue to rise so long as the US Congress actually does deliver on fiscal stimulus as hopes, vaccine rollouts continue as hoped and the global economy does see accelerated growth in the second half of the year, again as hoped. Real yields will be much more dependent on Fed policy; the dovish tone from Powell’s speech last night suggests the Fed are keen to maintain highly accommodative monetary conditions, which means real yields are likely to stay low. This is a good combination for the likes of silver and gold.

If, for whatever reason markets start betting on a tightening of policy and real yields rise accordingly (and inflation expectations drop), this could be a very bad combination for precious metals and could mark the start of a more prolonger precious metals bear market.

XAG/USD four hour chart