Forbes contributor Naeem Aslam, in his latest editorial piece, noted that the bearish bets on the S&P 500 index reached a nine-year high on Friday, could be possible because “traders fail to shake off the biggest one-day surge in coronavirus cases in the US and how it has constrained the US economy’s re-opening process.”

Key quotes

“The S&P 500 futures, along with Dow Jones futures, are likely to remain sensitive to the lack of a clean re-opening of the US economy, and this particular event is going to adversely influence the recovery efforts.

Geopolitical tensions between the US and China continue to simmer in the background.

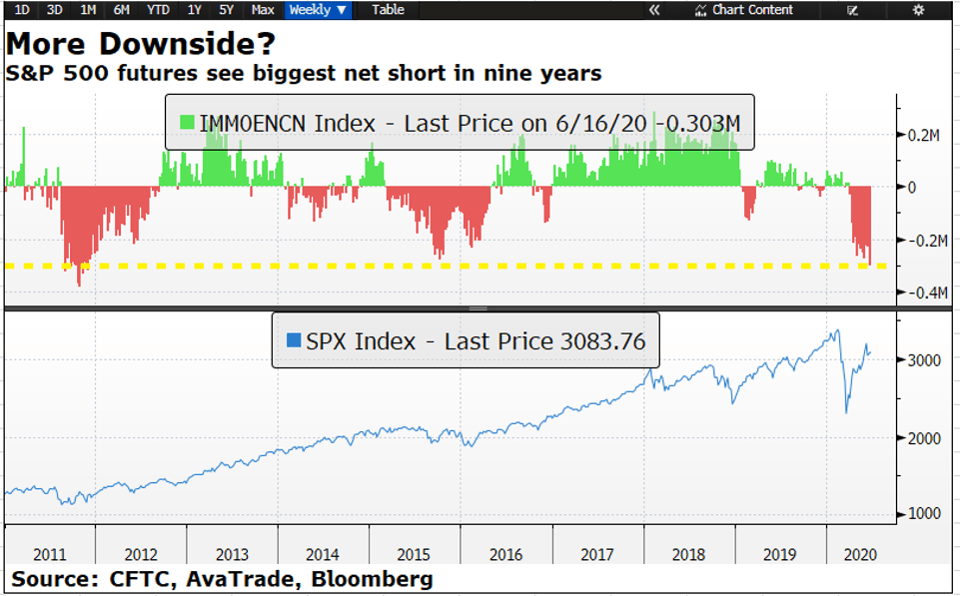

The S&P 500 chart below shows large hedge funds (net non-commercial) have increased their short positions to the highest level in nearly nine years.

This switch indicates two things: firstly, if they are right, the stock market could experience a wild and sharp move to the downside.

Finally, if the hedge funds are wrong, we could see some serious capitulation taking place. That can provide rocket fuel for the coronavirus stock market rally.

The S&P 500 index found its strength near the 50-day moving average on a daily time frame, and as long as the S&P 500 futures price stays above this average, we have strong chances for the coronavirus stock market rally to continue its upward journey.”