- The S&P 500 crossed above the 3860 mark for the first time ever.

- Gains are being driven (again) by Tech, with Apple 3.3% higher, hence the Nasdaq is the outperformer of the major US indices.

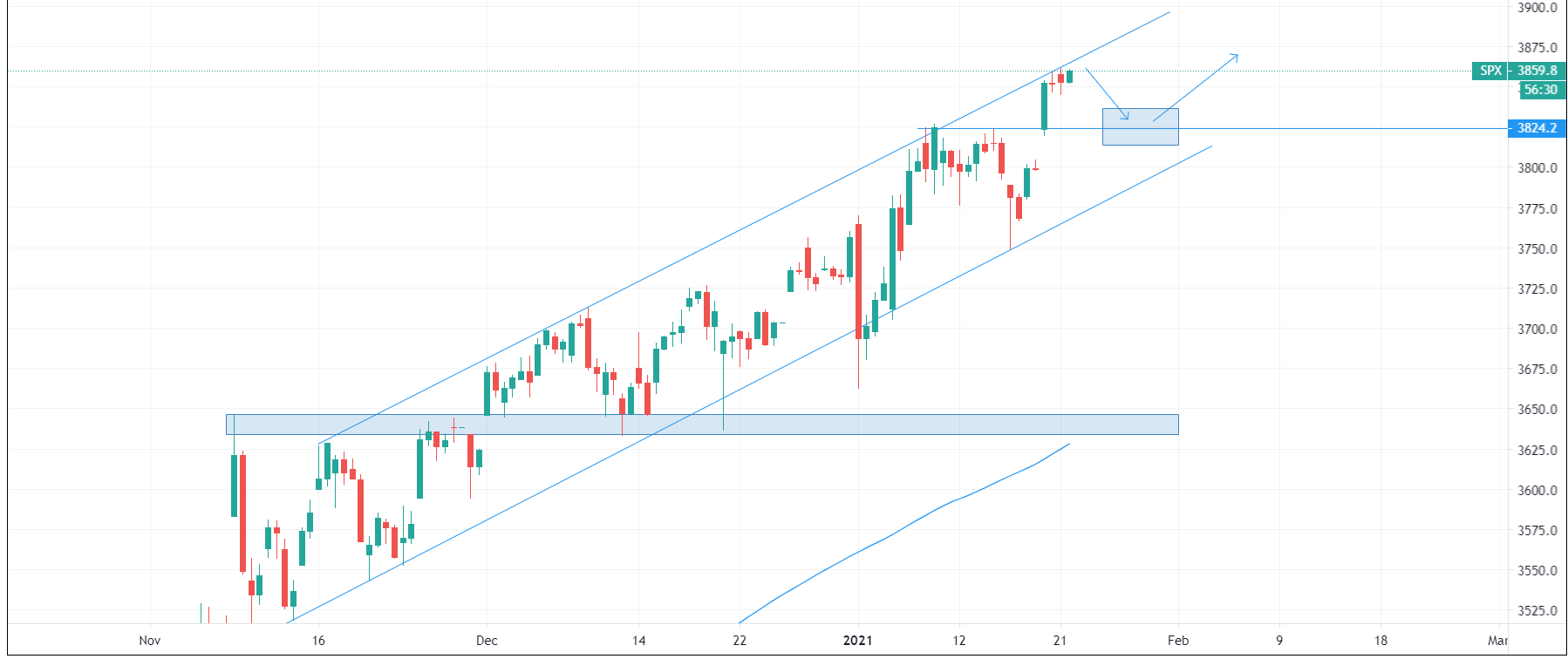

- The S&P 500 continues to advance to the upside with a trend channel that has been in play since mid-November.

Another day, another all-time high for the S&P 500, which is today crossed above the 3860 mark for the first time. Gains on the day have been modest, with the S&P 500 index up about 0.2%. Gains are being driven (again) by Tech, with Apple 3.3% higher, hence the Nasdaq is the outperformer of the major US indices, up 0.8%. The Dow is up 0.1% and the Russell 2K is up 1.2%. Energy stocks lag, amid indecisive crude oil and energy markets and as US President Joe Biden takes executive action against domestic US fossil fuel activities.

Driving the day

In terms of the macro themes driving the day; no particular catalyst has influenced the price action and market commentators will point to continued optimism around the prospect of more economic-activity boosting fiscal stimulus to come in the months ahead in the US, continued Fed accommodation, further progress regarding mass vaccinations and hopes for a strong rebound in global growth and trade conditions later in the year.

Note that some nerves still persist regarding the worsening state of the pandemic spread in Europe, the US and elsewhere. Countries are moving into tougher lockdown and given fears about the international spread of new variants, some of which are feared might be resistant to vaccine acquired immunity, are leading countries to increasingly close off borders (UK may be isolated from Europe soon). Vaccine rollouts remains a broad counterweight to these concerns, or even outright market positive; expectations are for some degree of herd immunity to have been acquired in major developed markets by Summer. However, fears that 1) new variants may be resistant to vaccine-induced immunity and 2) that the one dose strategy being pursued by some countries (notably the UK) may not be as effective as hoped present downside risk. However, vaccine makers in Oxford University (makers of the AstraZeneca vaccine) are already reportedly mobilising to tweak their vaccine to take into account new Covid-19 variations.

Meanwhile, US data appeared not to have much of an impact on broader economic sentiment; initial weekly jobless claims were not as bad as expected but still pretty ugly at 900K, Housing data showed the sector still on fire and one of the earliest indicators as to the performance of the manufacturing in January, the Philly Fed index, showed an improvement in the sector. Various analysts commented that the data combo underscores the K shaped economic recovery currently underway in the US; in other words, low wage service sector employees and the service sector more broadly is being absolutely devastated by the pandemic, while consumption shifts away from experiences and towards psychical goods, which underpins the manufacturing sector, and loose monetary policy pumps the housing market, further widening the gap between the economic haves and have nots. This dynamic ought to underscore the need for more fiscal and monetary stimulus in the eyes of the policymakers pulling the strings in the US right now.

S&P 500 maintains bullish bias

The S&P 500 continues to advance to the upside with a trend channel that has been in play since mid-November and seen prices rise more than 200 points from below 3550. Support in the 3820s will be worth watching. Should bearish sentiment prevail for a time and the index suffer a more meaningful setback, support between 3630 and 3650 will be the area to watch.

S&P 500 four hour chart