- Wall Street’s main indexes opened lower on Thursday.

- Technology shares trade deep in the negative territory.

- CBOE Volatility Index is up nearly 4% in the early trade.

After closing in the negative territory on Wednesday, major equity indexes in the US edged lower after the opening bell as the market mood remains sour amid a lack of progress in US coronavirus aid talks. Earlier in the day, House Republican Leader, Kevin McCarthy, said that they were expecting to finalise the COVID-19 relief bill next week but failed to provide a boost to sentiment.

Reflecting the risk-averse market environment, the CBOE Volatility Index (VIX), Wall Street’s fear gauge, is up nearly 4% on the day at 23.10.

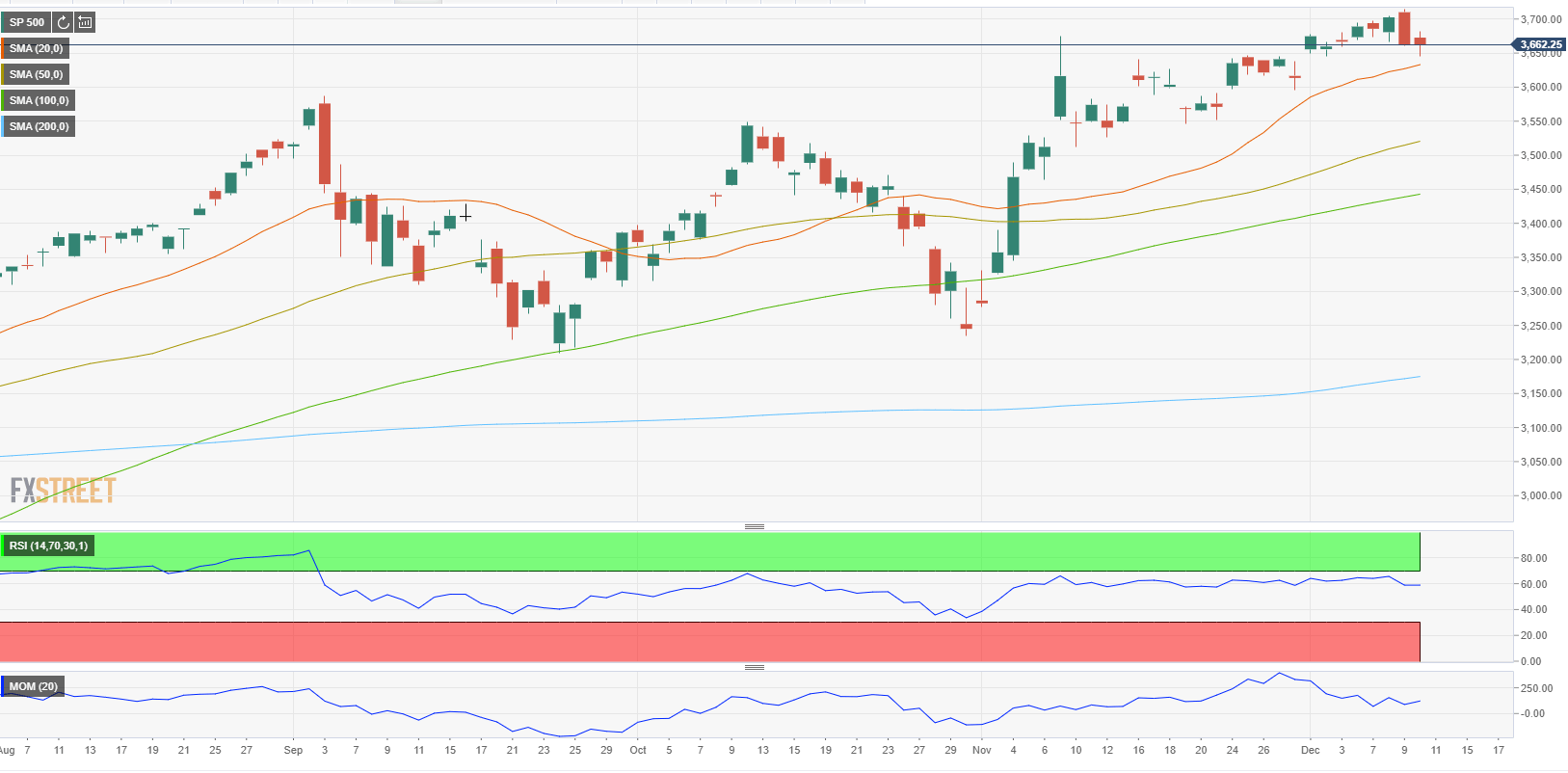

As of writing, the Dow Jones Industrial Average was down 0.52% at 29,910, the S&P 500 was losing 0.65% at 3,649 and the Nasdaq Composite was falling 0.9% at 12,257.

Among the 11 major S&P 500 sectors, the risk-sensitive Communication Services Index is down 1.5% and the Technology Index is losing 0.52%. On the other hand, the Energy Index is posting modest gains supported by rising crude oil prices.