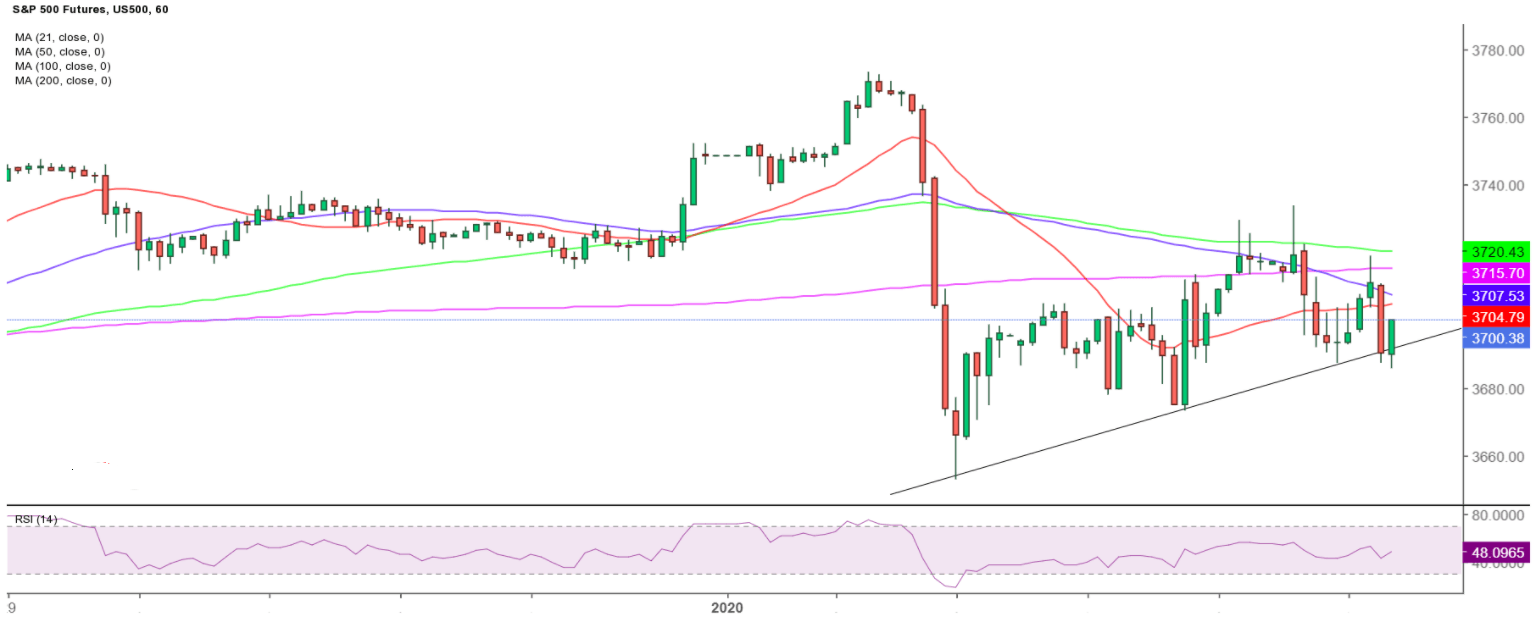

- S&P 500 futures testing the rising trendline support at 3,690.

- Death cross on the hourly chart points to further downside.

- The hourly RSI attempts recovery but not out of the woods yet.

S&P 500 futures are attempting a bounce from the critical ascending trendline support at 3,690, although the bearish bias still remains intact.

The rebound in the futures comes on the heel of the 5% rally in the 10-year Treasury yields, which have topped the 1.0% level for the first time since March 2020.

Looking at the hourly chart, the futures tied to the S&P 500 index have confirmed a death cross earlier in the Asian session.

The 50-hourly moving average (HMA) pierced through the 200-HMA from above, suggesting that there is further scope to the downside.

Therefore, the price could fall back towards Monday’s low of 3,652 on a failure to takeout strong resistance around 3,705. That level is the convergence of the 21 and 50-HMAs.

Acceptance above the latter could fuel additional upside, as the bulls target the 200-HMA at 3,715.

The hourly Relative Strength Index (RSI) has recovered from lower levels but remains well below the midline, adding credence to the downbeat mood.

Markets eagerly await the US ADP jobs data and Georgia Senate election result for fresh trading impetus.