- Wall Street’s main indexes started the new week on strong footing.

- Energy stocks post strong gains to lead the rally.

- CBOE Volatility Index (VIX) is down more than 3%.

Major equity indexes in the US started the first day of the week in the positive territory as coronavirus vaccine rollout and heightened hopes for a US stimulus deal caused a positive shift in risk sentiment. Mirroring the upbeat market mood, the CBOE Volatility Index (VIX), Wall Street’s fear gauge, is down more than 3%.

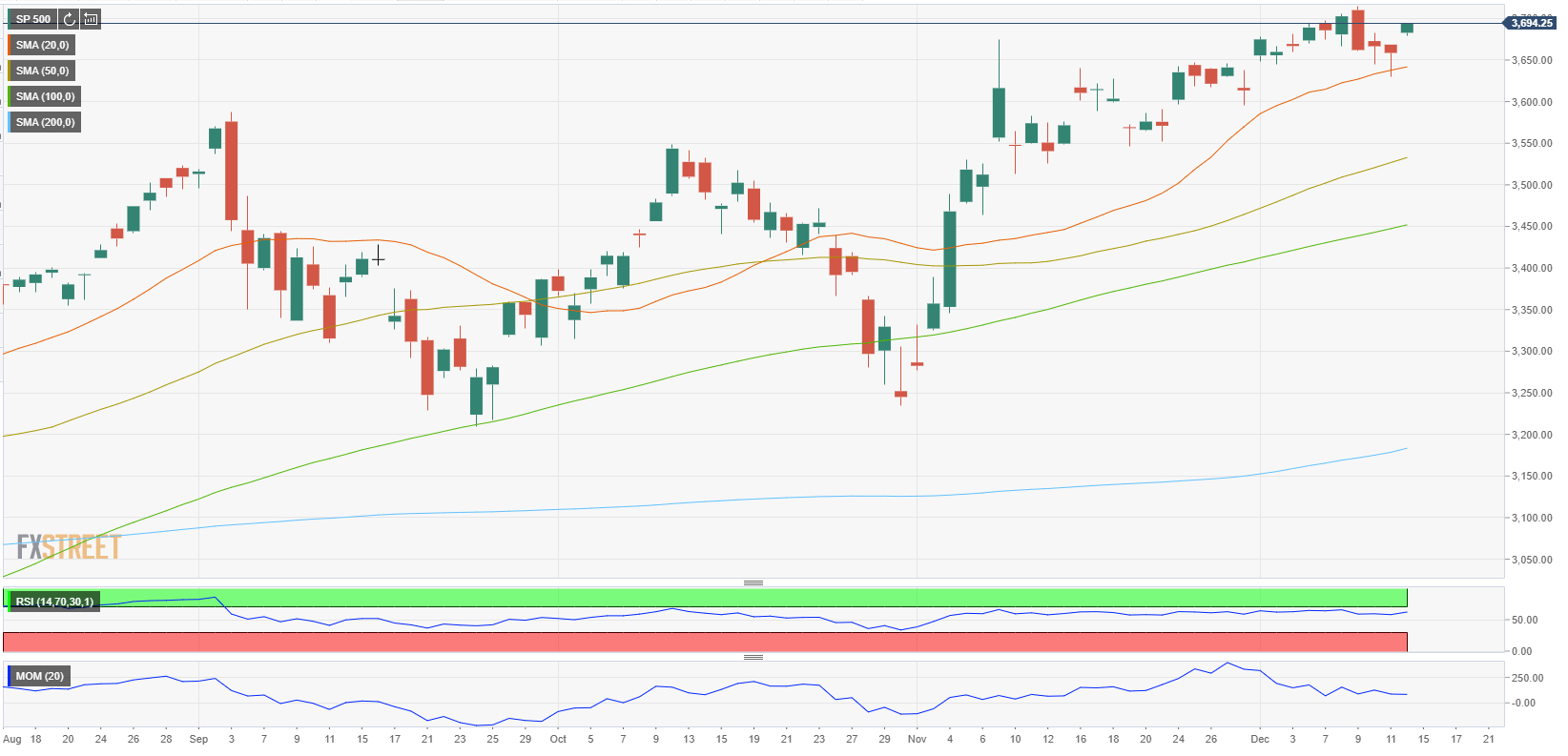

As of writing, the S&P 500 was up 0.86% on the day at 3,695, the Dow Jones Industrial Average was rising 0.76% at 30,278 and the Nasdaq Composite was gaining 1% at 12,495.

Among the 11 major S&P 500 sectors, the Energy Index was up nearly 1% after the opening bell supported by rising crude oil prices. On the other hand, the Communication Services Index is the underperformer with a gain of 0.15% on reports suggesting Apple, Amazon and Google could face fines as much as 10% of the annual revenue in the EU.