- Wall Street’s main indexes stage a rebound on Tuesday.

- S&P 500 Technology Index is leading the rally.

- CBOE Volatility Index is down more than 6%.

After suffering heavy losses at the start of the week, major equity indexes in the US opened higher on Tueday as risk flows started to overwhelm the financial markets. Reflecting the upbeat market mood, the CBOE Volatility Index (VIX), Wall Street’s fear gauge, is down 6.3% on a daily basis.

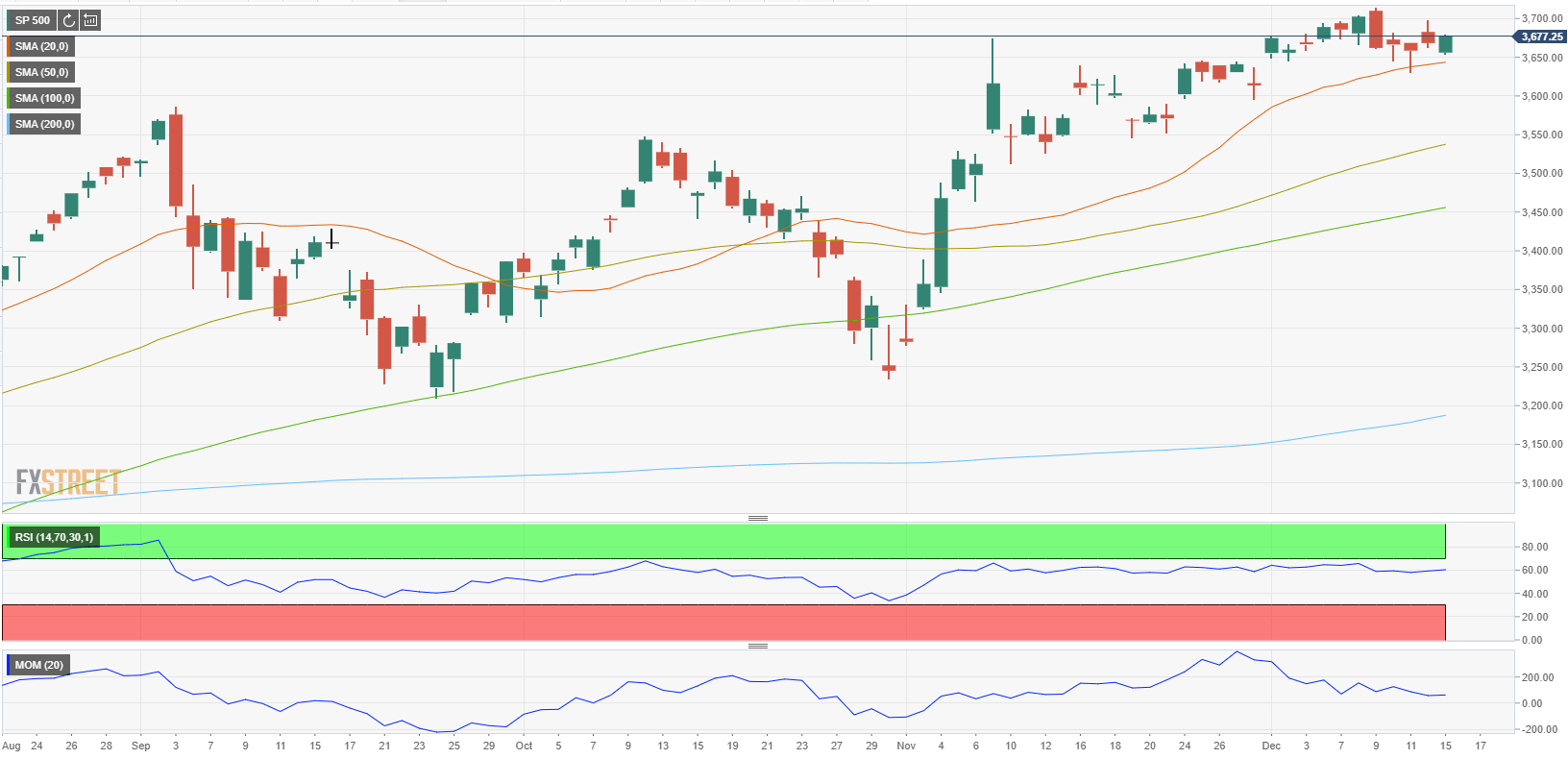

As of writing, the S&P 500 Index was up 0.72% on the day at 3,674, the Dow Jones Industrial Average was advancing 0.6% at 30,043 and the Nasdaq Composite was rising 0.78% at 12,558.

Earlier in the day, the US Food and Drug Administration (FDA) announced that they have not identified any specific safety concerns with Moderna’s COVID-19 vaccine and signalled that an emergency use authorization could come on Thursday. This development seems to have helped market sentiment improve.

Among the 11 major S&P 500 sectors, the Technology Index is up 1.12% as the top performer after the opening bell. On the other hand, the defensive Real Estate Index is posting small losses.